Construction upswing builds our mining boom

| Subject: Global construction is on the rise, with China continuing to lead the way. At the same time, Europe and the United States are filling their own construction gaps. That’s all good news for Australia, with our vast mineral resources supplying the world with most of the key ingredients for the construction upswing – especially for steel production. |

| Key take-out: What’s good for steel production is good for iron ore, coal producers and other miners. This should support Australia’s terms of trade and ensure the mining boom is far from over. |

| Key beneficiaries: General investors. Category: Economy. |

In my April article The fine line in iron’s decline, I outlined the reasons why I wasn’t a fan of all the pessimism on China, iron ore prices and our resource stocks more generally.

At its worst, many analysts were talking iron ore prices of around $USUS80 to $USUS100 now, although for their part the large miners were thinking something more around $US130.

There was also an expectation that China was set for a hard landing, whether from a burst credit bubble bust or something equally disastrous. Fast forward six months and iron ore sits comfortably above $US130. Moreover, far from having a hard landing, China’s growth actually accelerated in the third quarter.

Again though, many analysts can’t quite bring themselves to accept recent events, and while I think the constant pessimism on China is unreasonable, it’s not unreasonable to question how much momentum there really is.

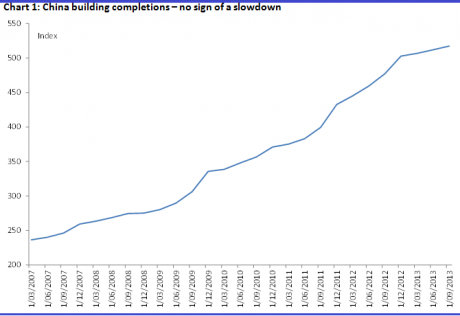

For me, I think there is a fair bit of momentum both now and in the months to come, and there is one very important – and quite simple – reason for that: The global construction cycle has turned and momentum is building. Take a look at chart 1 below.

It shows building completions in China growing at a fairly consistent pace over time. Indeed, for the September quarter, data from Bloomberg shows completions at their strongest in nearly two years. Now we know the rebuttal to this – ghost cities and an overinvestment in construction. There is a bubble and it will burst. I reject this idea, given still very low rates of urbanisation in China. It doesn’t make sense. What does make sense to me is the explanation for these apparent ghost cities. It’s a centrally planned economy. An area gets targeted for urbanising, a city gets built and the people move over time. This is a country that relocated several million people to build the Three Gorges dam.

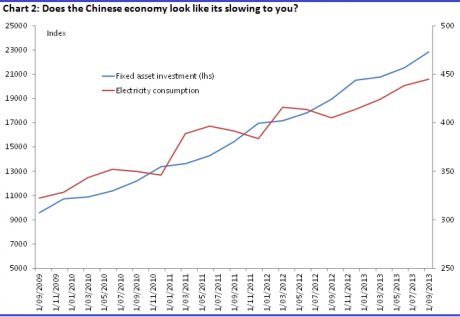

Moreover, everything I look at is consistent with a strong economy with plenty of momentum – regardless of whether the economy as a whole is growing at 7.5% or 8.5% – or 9%. It makes no significant difference. But take a look at the charts below. It shows electricity consumption and fixed asset investment and it shows no loss of momentum at all. Indeed growth is comparatively consistent here.

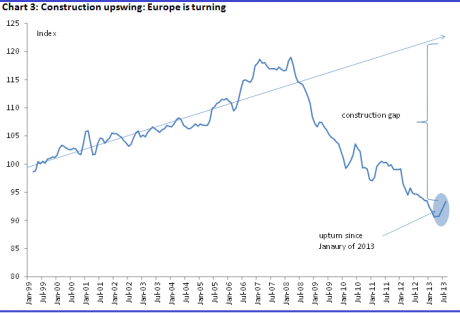

In any case, this isn’t just about China. And, as many of you have probably already noted, the charts above don’t show a turnaround or a lift in momentum but just consistent, ongoing solid growth. Then again, that’s all they were meant to show. The turnaround, the lift, is to be found elsewhere – most notably in Europe and the US. Truly, this rebound is global, although each region is at a different phase.

The European’s, for instance, have obviously been in a recession and construction was hit hard as a result. Construction there actually collapsed to its lowest levels since at least 1997 – that’s as far back as my data set goes. That’s quite a significant collapse just there. But that in itself is a reason to look for a turnaround. Why? Because this weak level of construction output is neither normal, nor a correction to normality from some construction binge.

Note the significant construction gap this recession has caused. The European statistics agency notes that prior to the GFC, construction output was a relatively steady beast. There was a surge in housing construction in maybe Spain and other countries (Ireland and the UK), but overall, growth including engineering and non-residential building was quite stable. That means the turnaround we’re seeing now has some way to run before it even gets close to ‘normal’ activity levels.

The pick-up in construction activity over the last six months is really just the beginning. Note also that the current trajectory is quite steep. There’s no guarantee that will be maintained, but equally there is no reason to think it won’t, given it’s coming off such a low base. Moreover, the cost of capital, the cost of financing any project, is dirt cheap.

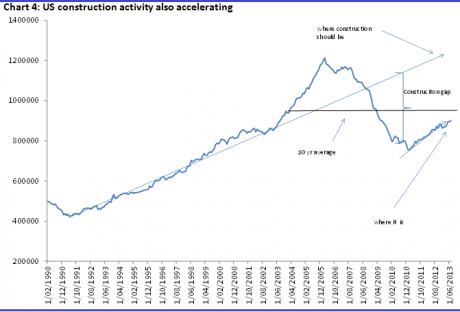

The recovery in the US itself is a little more advanced, as you can see in Chart 4 below. Yet, note that it too is below what it should be. There is a construction gap. Another way of thinking about it is to look at the average level of construction over the last 10 years or so, shown in the black line.

This line takes into account construction over the boom and the ensuing slump. What it shows is that for the last decade momentum has been much weaker than what it was over the previous 10 years. Which, of course, is why we have a gap.

When you combine the continued strong rate of construction growth in China and the rest of the emerging world (50% of the global economy) through the ongoing process of urbanisation, and the rebound in construction activity in Europe and the US, then it is clear the outlook for global construction is excellent. In fact, the rebound could be quite vigorous, considering exceptionally low interest rates and calls for governments around the world to investment in infrastructure. The rhetoric is that they will. Either way, the data suggests we are only at the beginning and that the upswing has a very long way to run indeed.

Bringing it all home

The thing about the construction sector is that it uses a lot of steel. According to the World Steel Association, 51% of global steel production is used this way. It should be noted at this point that another 12% is used in car production, and I’d point to Ford’s latest earnings reports and optimism about car production, not only in the US but also Europe. Steel demand, in contrast to expectations for a slowing, is actually growing. With the global construction cycle only just turning, and a very positive outlook for car production – which has expanded at a rapid clip in China and the US already – global steel demand will remain strong and will likely pick up further from this point.

The benefit for Australia is that China is by far the world’s largest producer of steel. In fact, China’s steel production is about the same as the next 22 major steel producers, and it accounts for 46% of global production. It should be also be noted that it consumes about 45% of global steel as well, which is why I started off with a look at the health of Chinese construction output.

Naturally, what’s good for steel production is good for iron ore and coking coal producers, copper etc. – our miners. In turn, this should support Australia’s terms of trade and ensure that the mining boom is far from over – expanding the wealth of the country.

You can understand why Rio and BHP both announced plans this week to expand their operations.