Commodity slump: Not bad news for everyone

Summary: The falling oil price is likely to weigh on LNG profits, while iron ore is likely to stay in a bear market for some time, meaning tax revenue from resources is set to fall. But a rise in US interest rates will push the Australian dollar lower and cushion the blow of the fall in mining revenue. Salaries are increasing at a lower rate as companies look harder at productivity. |

Key take out: Companies that will do well in this environment are those that begin to devote more time to strategic long-term growth decisions. |

Key beneficiaries: General Investors. Category: Economics and investment strategy. |

The combination of APEC and the G20 plus the China Free Trade Agreement means that there is an enormous amount of material at everyone's desk about what is ahead for Australia and the world.

But I suspect that the agendas of the politicians will obscure the likely emergence of what is one of the most fundamental changes Australia has experienced for many decades.

For example, at the start of APEC, China announced a new gas deal with Russia which means that Russian gas goes into China at much lower prices than earlier deals and effectively that will cut Australia out of new LNG projects based on Chinese demand given we are a very high cost producer.

And if oil prices stay at current levels then existing LNG projects will be a lot less profitable than their promoters ever envisaged. At the same time China is lowering its costs of iron ore production and clearly wants to stay in the game ensuring the current situation of overproduction will extend into a long-term affair.

Unless there is a major boom in the US that rekindles China's exports then we are looking at a long extended bear market in iron ore particularly as China is reorientating its economy from infrastructure and exports to a much more consumer market. They also want to reduce pollution.

These developments add up to a curbing of steel growth. The clear balance of probability is that not only is the mining investment boom over but taxation revenue we have enjoyed from mining, which has driven Australia's big spending, will be reduced.

On the other hand US interest rates are beginning to rise so we are set for further falls in the Australian dollar, which will make the effect of the reduction in mining revenue much less painful. It will enable lower cost miners to produce profits and pay taxation albeit both at a reduced rate.

Conversely the fall in the Australian dollar will expose Australia's version of the so-called Dutch Disease where the Netherlands in the middle of the 1960s and 1970s oil boom allowed their manufacturing and other industries to be destroyed so when the boom was over they suffered badly.

That would certainly be Australia's fate but for one other development. China is going to open up a much bigger agricultural market with Australia and they are pouring money into Sydney and Melbourne property and maintaining our economic momentum by building apartments – even though these units may remain empty for long periods.

At the same time they are keeping prices in the dwelling market high by constant buying of existing houses. This secondary development has an element of danger because many of those houses were supposed to be sold once the Chinese students have left the country. It would seem that many have not been sold so if the government cracks down there will be a lot of extra houses on the market.

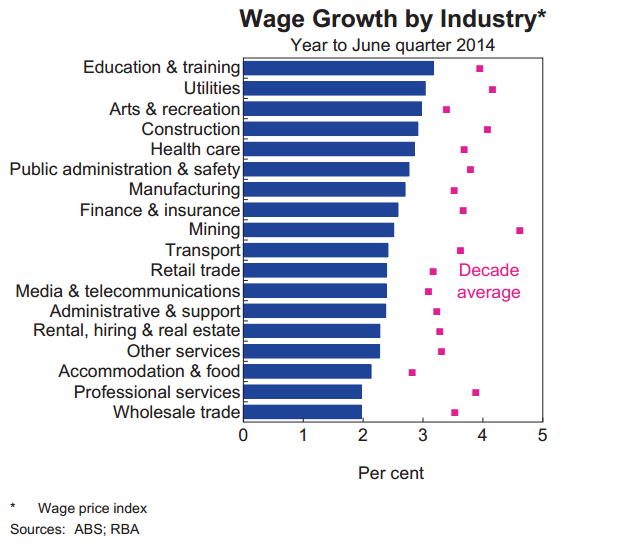

The collapse of the mining boom is causing Australian companies over a wide area to look much harder at their productivity and costs and they are shedding labour. Thanks to Harrison Polites at Business Spectator I came across this graph of salary increases in the year ending June 30, 2014.

As you can see, salary rises are well below last year and for many areas are employees are only averaging around 2%. And that masks even deeper reductions in recent months.

The government is only offering 1.5% to the defence forces on the basis that everyone else in government employment will get much less. This fall in the rate of salary increases is causing many Australians to keep a tight watch on discretionary expenditure, although there are clear signs in recent months they are prepared to spend more particularly as their house prices are performing well and they are helped by the elimination of carbon tax and lower petrol prices.

The end of the carbon tax also helped trigger a big rise in business conditions, according to the monthly NAB business survey. But confidence remains low.

Given our resource orientation, it is hard to imagine the Australian share market showing substantial increases in this sort of environment. We seem to be passing to a new environment where the winners will be enterprises and countries that can take advantage of the lower priced commodities. Of these beneficiaries the most significant is the US but China and Japan are also significant beneficiaries. Countries like Brazil and Russia are not winners and Australia also falls into that basket. There is an increasing recognition that technology and the ability to gain the most from databases will be important drivers of success. The US markets with companies like Google, Facebook and Apple have a great advantage. Indeed one of the basic weaknesses in our market is the shortage of high technology stocks. In addition there is only one manufacturer in the top 20 companies – CSL.

The companies that do well in this environment will be those that begin to devote more of their time to significant strategic decisions. Those that are simply sitting on their pile and paying dividends – which is what institutions want – could find themselves in a difficult space. They won't go broke but they will find returns below what they have been used to achieving.

Among those companies will be the commodity producers unless the fall in the Australian dollar is very steep. The banks will also need to watch out.

What could make this depressing scenario wrong? Firstly trade minister Andrew Robb has a vision to develop the north. If he got this off the ground it would provide Australia with the equivalent of another “mining boom”. The China Free Trade Agreement is the first step in his plan.

Alternatively if the United States recovery gathers much more momentum and boosts Chinese exports and therefore demand for commodities we could see a turnaround that would make the current difficult situation seem simply a memory.

While the US is making progress it never seems to gather the momentum it has in previous decades when there was a downturn. That means it doesn't drive China as it did in previous years.

Even more worrying is the increasing inequality of income which unless reversed will cause voters to elect people at the extreme of the right or the left. Australian companies can no longer sit back and enjoy the “lucky country” – they need to take strategic long-term growth decisions.