Coming to terms with Australia's stark economic reality

Reserve Bank of Australia Governor Glenn Stevens might move markets but his deputy Philip Lowe is making a name for himself addressing the long-term and pivotal issues facing the Australian economy.

In a speech last night at The Sydney Institute titled Demographics, Productivity and Innovation, Lowe addressed two of the most important challenges for policy makers in coming decades: an ageing population and subpar productivity growth.

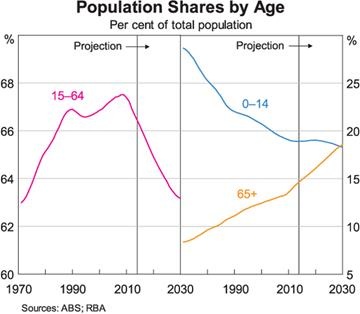

Over the past few decades, Australia has experienced favourable demographics that have helped to boost growth. Until recently, Australia had a relatively young population, flush with working-age individuals. The trend towards greater female participation in the workforce also boosted growth significantly. Lowe calls it a ‘demographic dividend’.

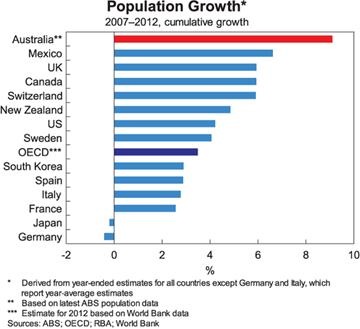

Over the past decade the economy has also been supported by particularly strong population growth, which has greatly exceeded growth in other developed countries. This has been mostly due to strong migration: Australia is among the most multicultural developed nations, second only to Switzerland.

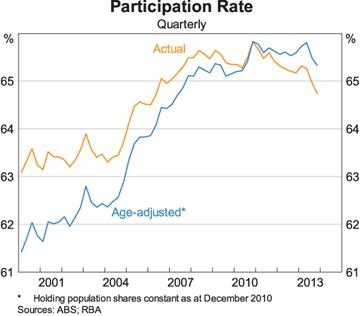

We are beginning to see the implications of these developments in the monthly labour force data. The participation rate has fallen significantly over the past 12 months and is set to fall further. The RBA estimates that around half of the decline in participation since 2010 has been due to baby boomers hitting retirement age.

This can be seen in the graph below, which makes an adjustment for the ageing population by holding the population shares constant at their level in December 2010 (just prior to the first baby boomers hitting 65 years old).

The challenge for the Australian economy should be clear. Increasingly we will be relying on a smaller share of the population to produce more goods and services. This will only be compounded by the expected decline in the terms of trade, which has for many years boosted income growth.

The reality is that the unprecedented period of economic prosperity for Australia is now over and our economy will be far more susceptible to the economic volatility (including recessions) that we have come to regard as problems for other, less successful, economies.

Any analysts failing to appreciate Australia’s demographic shift are fundamentally misreading the Australian economy and by extension are too optimistic about our prospects.

Strong population growth may help to offset these unfavourable demographics to some extent, but it will be a tough slog. Migration cannot hope to solve the problem, merely stall it temporarily. The likelihood is that trend real GDP growth will slow and GDP per capita could stagnate as we rely on an increasingly small share of the population to generate growth.

But all is not lost. There remains one simple -- though admittedly difficult to achieve -- way of addressing this: faster productivity growth.

That brings us to the second part of Lowe’s speech.

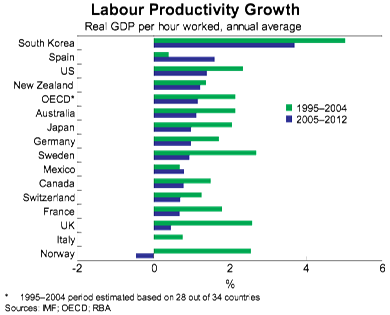

Australian productivity growth slowed significantly over the past decade, rising at a much slower pace than during the 1990s. A similar experience was felt across a range of developed countries.

There are many reasons why this shift may have taken place, though there are no clear answers. One line of thinking is that it is due to the global financial crisis and the resulting lack of investment spending.

A second potential reason is that the first three quarters of the 20th century was a golden period for productivity growth, as developed countries took full advantage of transformational inventions involving electricity and the internal combustion engine.

Professor Robert Gordon suggests that although there have been many breakthroughs since then, they pale in significant compared with earlier innovations. Effectively, it is an argument that there are diminishing returns to innovation.

A third possibility pushed by Nobel Laureate Edmund Phelps is that the changed role of government has stifled the desire and incentives for innovation. According to this view, there are plenty of great innovations to be made but we just don’t have the appropriate incentives to seek them out.

Lowe doesn’t pretend to have all the answers – nobody really does – but it is clear that innovation and investment sit at the core of productivity growth. But that requires risk-taking. Following the global financial crisis, it is perhaps not surprising that risk-taking isn’t high on people’s agendas.

An ageing population has certain implications for risk-taking and innovation. Research indicates that although older workers are often more productive, younger workers are more likely to be entrepreneurial or innovative. Younger works are more likely to utilise new technologies and are also less risk averse than older workers. On the basis of the available research, an ageing population is likely to result in less risk-taking and fewer new business ventures.

But at the same time, an increasingly smaller share of the population in the workforce will push businesses to look for labour-saving techniques. Pressure on government budgets could also promote change and drive greater efficiency. As Lowe admits, there are no definitive answers and everything is necessarily speculative.

Lowe’s speech may not move markets but in many ways it is more important than a speech on house prices or exchange rates. Australia faces some big structural challenges arising from unfavourable demographic trends. While those challenges may not be as dire as those faced by other developed countries, they will fundamentally change the very nature of the Australian economy.

Without a significant improvement in productivity growth, Australia’s trend growth rate will slow and our standards of living will stagnate. An ageing population will put pressure on our tax system and health expenditures (Henry and the tax experts are wasting their breath; March 12) and there will be a reliance on a declining share of our population to generate growth. With the possible exception of climate change, this is the preeminent economic challenge for Australian governments and we should begin addressing it straight away.