Coming to terms with Australia's negative income shock

Real wages stagnated in the September quarter and household balance sheets remain under pressure. With the unemployment rate at a 12-year high and the Australian dollar much weaker against our major trading partners, the household sector is unlikely to be the source of growth that we have grown accustomed to.

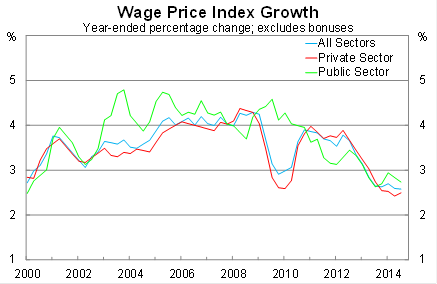

Australian nominal wages, excluding bonuses, rose by 0.6 per cent in the September quarter, meeting market expectations, to be 2.6 per cent higher over the year. Wage growth remains at its slowest pace in around 16 years (the measure only goes back to 1998).

Private sector wages ticked up slightly in the September quarter but remain noticeably below their crisis-related slump. Public sector wage growth continues to moderate and is likely to drop below private sector wage growth by the December quarter.

A distinguishing feature of this wage slowdown has been the moderation of public sector wages, which simply didn't happen through the global financial crisis. Some will be quick to blame the current federal government, but the slowdown pre-dates them and is also present at the state level.

If anything, moves by the Coalition to ease the public payroll have simply built on the work of the previous Labor government, which saw real government expenditure decline in both the 2010-11 and 2012-13 financial years.

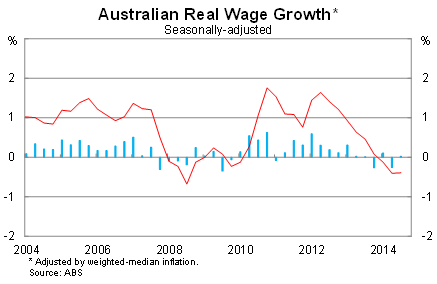

Real wages -- that is wages adjusted for annual inflation -- were unchanged in the September quarter, to be 0.4 per cent lower over the year. By this measure, Australian living standards have declined over the past year.

Further compounding the household sectors problems has been the sharp decline in the Australian dollar. The dollar has declined by 8.5 per cent against the US dollar since the end of June and almost 4.5 per cent against the trade weighted index.

Australia needs a lower dollar for a variety of reasons. Trade-exposed sectors need to improve their competitiveness and a lower dollar will shift spending towards domestic rather than foreign operating businesses.

But it also reduces the purchasing power of Australian households, who are either faced with the higher cost of imports or substituting towards more expensive domestic alternatives. In the long-term, the household sector may benefit as stronger domestic production feeds through to incomes and employment but in the short-term the adjustment could be quite severe.

The ongoing weakness in wage growth has some important implications for the Australian economy. The consumption implications are obvious and don't need to be restated but the data also highlights the increasing spare capacity across the Australian economy.

When new jobs have been available, there has been no shortage of available candidates willing to take the position. Excess supply of workers puts prospective employees in a poor bargaining position, resulting in softer wage outcomes.

Last quarter, I made the observation that since our last recession, wage growth has become more sensitive to the business cycle while unemployment has become less sensitive. This suggests that our next recession may play out very differently to the early 1990s episode, with a more modest spike in the unemployment rate but much weaker wage growth.

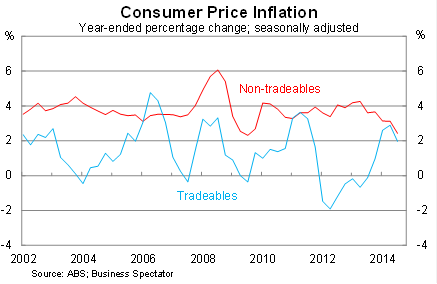

Finally, it indicates that domestic wage pressures may ease further in the near-term. Wage growth accounts for around 40 per cent of the cost of non-tradeable goods (and 25 per cent of the cost of tradeable goods). Non-tradeable goods account for around 60 per cent of the consumption basket used to calculate the quarterly inflation figures.

Soft wage growth will continue to weigh on the household sector over the next couple of years. That's how long -- at least -- that it will take for the sharp fall in our terms of trade to flow completely through the system.

Australia enjoyed the fruits of a terms-of-trade boom but now we are in the midst of a negative income shock. Those receiving promotions or who are able to shift workplaces will do just fine but for the rest it will be a hard slog.