Coalition budget reform needs more than tough talk

With every passing week, it becomes increasingly obvious that the Federal Government will need to raise taxes if they hope to meet their budget goals and create a long-term sustainable budget. But are they willing to make a necessary but politically unpopular decision?

Just last week, former Australian Treasury secretary Ken Henry admitted frustration at the lack of progress on tax reform since he led a wide-reaching review of the Australian tax system in 2010. Former Liberal leader John Hewson said that Australia needs an independent commission to analyse and deliver tax reform.

In a speech last night, current (but soon to be outgoing) Australian Treasury secretary Martin Parkinson said: ‘There’s a growing gap between what the community expects from government and what government can sustainably provide.’

It is a sentiment shared by many Australians. But the solution to the divergence between public expectations and government capabilities is not as clear cut as the Coalition would like us to believe.

The discussion on government debt has been largely misleading. Both politicians and the media are too preoccupied with short-term budget fluctuations rather than the long-term structural issues that may actually lead to a genuine budget crisis.

The Coalition has tied its wagon to spending cuts, but they are unlikely to address the two most urgent areas in need of spending reform: health care and the aged pension. Instead, they are set to focus on less urgent (but politically easier) areas such as discretionary spending and non-elderly welfare expenditure.

This may improve the near-term budget outlook, but will do nothing to address the long-term structural issues. That requires reform to health care, aged services and pension and widespread tax reform.

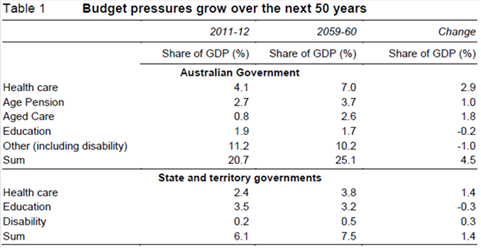

The Productivity Commission made it abundantly clear that healthcare and aged care services are the two danger areas for the budget over the next 50 years. They estimate that an ageing population will increase health and aged care expenditure by around 7 percentage points of GDP by 2059/60. It will also narrow the tax base and reduce tax revenue.

Naturally these costs will vastly dwarf any notional spending cuts the Coalition recommends in the May budget. Tax reform is inevitable, but the question is when. Is the current Coalition willing to make genuinely tough decisions? Are they willing to make the right decisions?

Parkinson’s comments are concerning on that front, particularly for those hoping for sensible and reasonable reforms to the tax system and spending. Speaking on Treasury employment Parkinson said: “We are currently shrinking from more than 1,000 people by shedding about one in three positions. We have already shed about 15 per cent of staff, so we are half way there.”

I cannot be the only person who finds it disturbing that the government will be making decisions based on recommendations by an increasingly under-resourced Treasury department, particularly at a time when budget reform is the centre of the Coalition’s platform.

It comes only weeks after the revelation that the Australian Bureau of Statistics will need to cut between 70 and 100 jobs to address their widening budget black hole. The quality of some statistics produced will inevitably become compromised and, by extension, so too will the decisions made on those statistics -- including those by the RBA, Treasury and governments across the country.

It paints a pretty bleak picture of government decision- making, particularly at a time when it has rarely been more important. This has only been emphasised by widespread criticism of Prime Minister Tony Abbott’s decision to sack Parkinson, which flies in the face of recommendations by former prime minister John Howard, former treasurer Peter Costello and Parkinson’s predecessor Ken Henry.

Tax reform is both inevitable and necessary, but the Coalition hasn’t worked that out yet. Instead of focusing on the long-term structural budget issues, they are preoccupied with mostly meaningless short-term fluctuations. Unless they address tax reform and health and aged-care expenditure, it is safe to say that they are not really serious about budget reform.