Closing the door on the GFC

One of the ironies of the economic crisis that began in late 2007 is that the best acronym for it -- the “GFC” for “global financial crisis” -- was coined in the one country that suffered the least from it, Australia. The year 2014 is the seventh of the “GFC” (the panic began on August 9, 2007, when BNP Paribas shut down three of its subprime-based funds), but at last the majority of economic reports are of sustained if anaemic growth, rather than of bank failures and recession. Australia’s reported growth rate for 2013 of 2.8 per cent follows the UK reporting 1.9 per cent and the US 2.4 per cent; even the EU, where several countries are still mired in outright Depressions, recorded an overall growth rate of 0.1 per cent for 2013.

These are hardly sterling growth rates, but the fact that they are all positive is causing a noticeable change of mood in economic commentary -- and a shift in public expectations as well. Is it enough to call the GFC/Great Recession/North Atlantic Financial Crisis over?

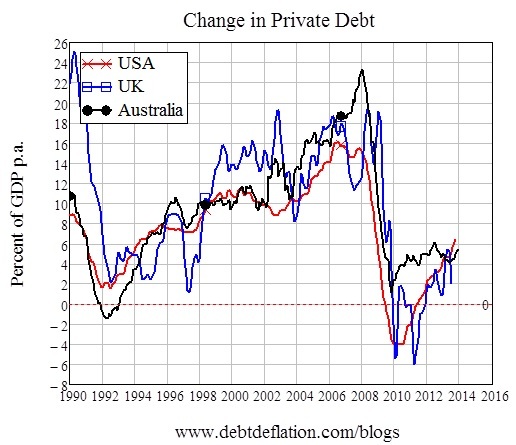

It isn’t. But I’m willing to do so on an entirely different measure: the rate of change of private debt is now strongly positive. The period of private sector deleveraging that caused the crisis appears to be over. Debt is now not merely growing, but growing faster than GDP -- see figure 1.

Figure 1: Deleveraging is over -- for the time being

With sustained positive growth in credit comes a tendency to positive economic news as well, and out of that a tendency to take on more credit too -- after all, that’s what gave us the previous boom, isn’t it?

So the news is likely to continue improving, and at some stage in the future, “the GFC” will be the preceding crisis, not the one we will be in.

So have we learnt enough out of what was universally acknowledged as the greatest economic crisis since the Great Depression to avoid another one in the future? Not on your Nellie. As Bill White (the research director for the Bank of International Settlements, and the only official to warn of the GFC before it happened) said recently, central banks and Treasuries don’t know what they are doing, and are making it up as they go along. They didn’t see this crisis coming, and now that it’s ending they’re not sure why it has ended either: they’re just happy that it has.

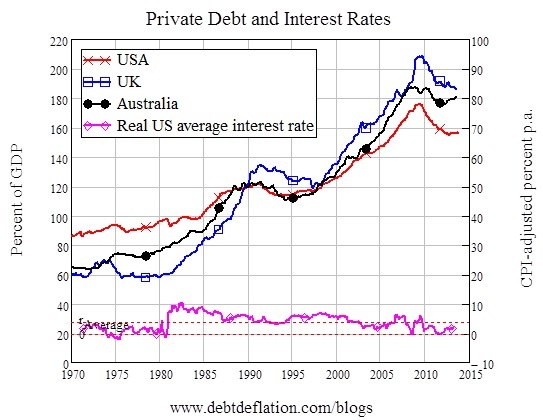

This wouldn’t be a problem if the cause of the crisis was merely cyclical: private debt rose for a while, then it fell, now it’s rising again, so what’s the big deal? The Big Deal is the secular trend: it’s now rising again from previously unprecedented levels -- and this can’t all be blamed simply on real interest rates being too low. As figure 2 shows, real interest rates were as low as they are now from 1970-1980, when overall private debt didn’t grow all that much. Instead, the substantial growth in debt occurred from the early 1980s till 1990, and then again from 1995 till 2009, when for the most part real interest rates were above their average level for the last half-century.

Figure 2: A secular trend to rising debt

Yet still central banks hope they can “fine tune” the economy using the interest rate alone, and with US unemployment levels now within cooee of the level at which Ben Bernanke said monetary policy could return to “normal”, the Federal Reserve may start to increase rates in late 2014.

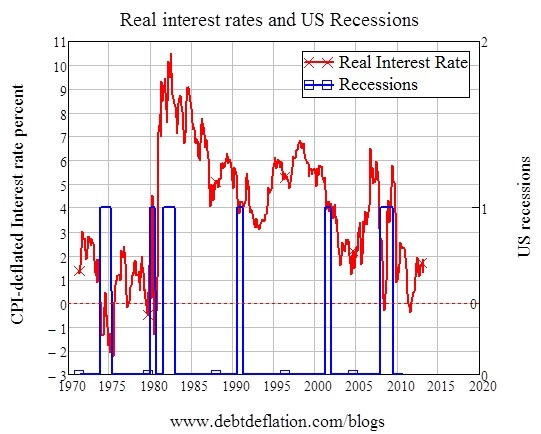

Figure 3: Just 0.2 per cent to go and it's below Bernanke's target

This belief that getting the interest rate right is all that it takes to keep the economy out of recession is the product of economic models, not of economic experience. As I explained a few weeks ago, the models that still dominate how central banks and treasuries think -- despite their failure to anticipate the GFC -- ignore banks, debt and money, and have just the level of capacity utilisation, the inflation rate and the official interest rate as their core variables.

But when you look at the data, there isn’t much of a relationship between the interest rate and recessions (see figure 4). For instance, there was a “double-whammy” recession in the early 1980s when the real (after inflation) rate of interest was over 7 per cent; but there was also one in 1975 when the real interest rate was actually negative.

Figure 4: No apparent relationship between real interest rates and recessions

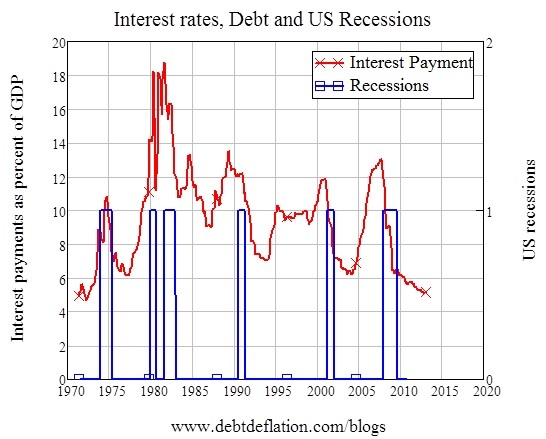

But in fact there is a much clearer relationship when you include one factor that these models ignore: the level of private debt. If you look not at interest rates alone, but interest payments as a percentage of GDP, then the US economy seems prone to fall into a recession whenever this level stays above 10 per cent for a sustained period. The anomalous 1975 recession in terms of interest rates alone -- conventional theory would have the economy booming with negative real interest rates -- makes much more sense when debt is factored in, since the debt service level then actually cracked 10 per cent of GDP (see figure 5).

Figure 5: Recessions soon after the interest rate burden exceeds 10 per cent of GDP

But hey, let’s not let empirical data get in the way of a good theory! Despite the fact that the GFC vindicated the Minskian approach to economics that Bill White and I share, the economics profession (and its foot soldiers inside central banks and treasuries) has hung onto its treasured models in which the economy can be quickly nudged back towards equilibrium with some fine-tuning of interest rates by the central bank.

So this crisis has proved the old adage that history teaches that we learn nothing from history.

Steve Keen is author of Debunking Economics and the blog Debtwatch and developer of the Minsky software program.