Climate fights in 5 big states

Americans are today heading to the polls to cast their ballot for candidates running in the country's mid-term election. The outcome, some pundits say, could be a brutal blow for Democrats, who are battling to control the Senate. The results may also have ripple effects for renewable energy in several states.

As Bloomberg New Energy Finance points out in its Analyst Reaction: US REC market cheat sheet: are RECs above the ballot?, there are several states of particular interest: Florida, Pennsylvania, Massachusetts, California and New York.

For instance, in Florida, former Governor Charlie Crist (D) is in a tight gubernatorial race against incumbent Rick Scott (R). Crist, who in the past supported developing a Renewable Portfolio Standard for Florida, has made improving the solar industry one of his touchstone campaign pledges. In Pennsylvania's gubernatorial race, candidate Tom Wolf (D), who is leading in polls over Tom Corbett (R), has pledged to bring Pennsylvania into the Regional Greenhouse Gas Initiative (a cap-and-trade scheme with Northeast and Mid-Atlantic states).

At the national level, legislation to extend the federal Production Tax Credit for wind generation is expected to become serious after the elections, when the ‘lame duck' session begins, according to Bloomberg New Energy Finance. A bill introduced in the House in September – HR 5559, entitled ‘Bridge to a Clean Energy Future Act of 2014' – would extend the PTC, but the act is sure to be watered down as it filters through committees.

Looking forward, it remains unclear whether the EPA's Clean Power Plan will incentivise states to start or strengthen Renewable Portfolio Standards. At the very least, however, it does appear that renewables will play an important role in reducing states' "adjusted" emissions rates.

(Bloomberg New Energy Finance is offering a post-election webinar on November 5. Contact Noemi Glickman at nglickman@bloomberg.net for more details.)

Last week, on the opposite side of the world, the first main component of Australian Prime Minister Tony Abbott government's Direct Action Plan – the Emissions Reduction Fund – cleared its critical hurdle in the Australian Senate. Bloomberg New Energy Finance's Analyst Reaction: Australia's flawed Emissions Reduction Fund passes the Senate details the modifications to the scheme, their likely effect and our expectations for the policy in operation.

The plan would offer a reward to those that voluntarily cut carbon emissions. The 31-29 vote in Australia's Senate was a victory for Abbott. The bill to enact the Direct Action plan will now return to the House of Representatives, where Abbott has the needed votes, and which appears certain to agree to the Senate's amendments.

The passage of the controversial ERF through the Senate was secured after a deal was struck between the government, the Palmer United Party and independent Senator Nick Xenophon. The changes negotiated by the PUP and Senator Xenophon address some shortcomings in the ERF, which is essentially a government-funded reverse auction procurement mechanism. Yet the fundamental flaws which will hamper the policy in operation remain.

For instance, the government's budget is unlikely to be sufficient and, among other things, Bloomberg New Energy Finance finds that the procurement mechanism encourages participants' bids to deviate from the fundamental cost of the abatement activity.

Finally, in Brazil last week, solar-power developers including Solatio Energia and Rio Energy won contracts to deliver 1048MW of capacity in the country's first energy auction with a specific category for photovoltaic projects.

Solar developers agreed to sell electricity at an average price of $US87 a megawatt-hour ($A99), after starting at a maximum price of $US104. In Brazil's energy auctions, the government sets a ceiling price and developers bid down the price at which they are willing to sell power. The lowest bids win contracts.

Wind is usually the big winner in Brazil's power tender auctions, as Bloomberg New Energy Finance noted in last month's Analyst Reaction: Brazil solar preps for a big November debut. The government's carve-out for solar in this round opened the gates for competition among solar developers. Time will tell if the prices they offered support viable projects. They put Brazil on a trend toward the cheapest solar contract prices without subsidies in the world.

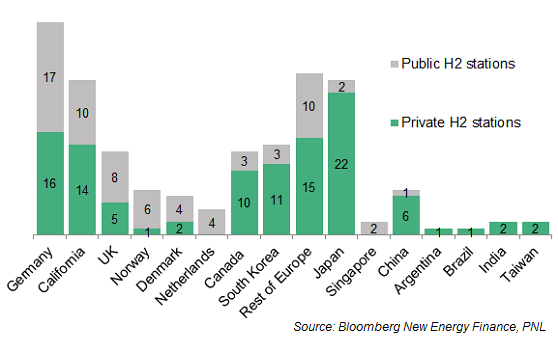

Graph of the week: There are only 80 public hydrogen refueling stations in the world.

Originally published by Bloomberg New Energy Finance. Reproduced with permission.