Chinese gun for ASX listings

| Summary: After a very long winter, the climate for ASX stockmarket floats is finally improving. And it seems Chinese companies wanting a presence on the Australian market are a big part of the renewed activity, and there are expectations a record number of new Chinese IPOs will list on the ASX over the next six- to 12 months. |

| Key take-out: As well as the attraction of an ASX listing for companies, which carries a prestige value, China is also making a conscious effort to encourage and incentivise its local enterprises to list overseas as a way to attract direct foreign investment. |

| Key beneficiaries: General investors. Category: Shares. |

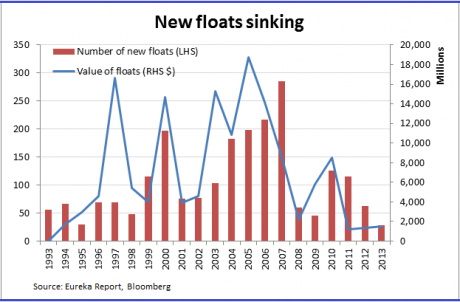

The public float market is slowly coming back to life after coming through one of the toughest periods on record, with the number of new stocks to debut on the local exchange this year the smallest in at least two decades.

The potential rebound could not come soon enough as there have only been 28 initial public offers (IPOs) on the ASX in 2013, raising a total of $1.5 billion compared with the 10-year average of $8 billion.

The recovery in risk appetite, which has seen many of the most speculative small cap plays doubling in value over the past two months, has prompted private companies with public life ambitions to come out of hiding over the past few weeks to drum up support from brokers and investors.

The interesting thing about this potential recovery in the IPO market is that it seems to have been kick-started by Chinese companies gunning for a listing on the ASX despite controversy around their behaviour (more on this later).

What’s more, experts are tipping this trend to pick up in pace over the coming months – leaving local investors grappling with the question of whether to buy into foreign companies listing on our bourse.

Pitcher Partners director, Matthew Pringle, expects to see a record number of new Chinese IPOs on the ASX over the next six- to 12 months as his accounting firm, which also specialises in IPOs, is actively engaging with a number of Chinese companies looking to list here.

“A lot of it has to do with ‘face’. They perceive a lot of [prestige] from being a listed company,” says Pringle.

The director of Novus Capital, Nicholas Kapes, has also noted an increase in listing enquiries from Chinese companies. The broker is managing the upcoming floats of online payment company 99 Wuxian (NNW), which is scheduled to hit the boards on October 8, and men’s fashion retailer Sunbridge Group (SBB), which will debut on October 22.

“These companies are contacting me – I am not going to China looking for companies to float,” says Kapes. “And from what I have seen so far, yes I am expecting a lot more Chinese companies to list here.”

Pull and push factors

The upbeat outlook for Chinese ASX floats is not only driven by “pull” factors (i.e. the attraction of an ASX listing), but also “push” factors. Pringle points out that it is getting hard and prohibitively expensive for Chinese companies to list on the Singapore and Hong Kong exchanges, which are more natural homes for these stocks, and that is forcing Chinese companies to venture further afield.

Another big “push” factor is the long queuing time to list in China, which can stretch for two years or more. Bloomberg reported that there is a backlog of around 800 companies trying to list in China.

China is also making a conscious effort to encourage and incentivise its local enterprises to list overseas as a way to attract direct foreign investment. There is a lot more room to grow too, as there have only been around 10 Chinese companies doing an IPO here in the last four years.

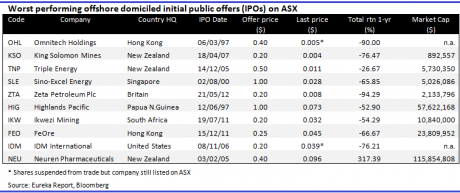

But selling an offshore IPO in Australia is an uphill battle; in many instances, it’s a case of buyer-beware, as our market is littered with examples of offshore companies going bad.

It makes for dismal reading, but more than three quarters of ASX stocks with a market cap of under $300 million that are domiciled outside of Australia are trading 71% below their IPO price on average.

The ASX had to defend its decision to allow such floats after the Australian Securities & Investment Commission noted that a third of such companies did not meet their continuous disclosure obligations.

Recent notable failures include ASX-listed Chinese finance company, Zheng He Global Capital, which collapsed last year after $20 million went missing from its bank account in China. Another example is technology company Nexbis, which was privatised at a painful discount after it struggled to collect on large Chinese and Malaysian contracts.

Let’s not forget marine engineering firm Miclyn Express Offshore (MIO). The two biggest shareholders in the Bermuda-registered and Singapore-headquartered company are being accused by some analysts of trying to privatise the company by stealth without paying an appropriate premium to minority investors. Miclyn Express is not subject to Australian corporate law that prevents a single investor from taking a greater than 20% stake without making a formal takeover bid.

I have previously written about how IPOs generally underperform the broader market on the whole in the first few months of listing. I suspect the underperformance is even more extreme for offshore companies on the ASX.

There are some notable success stories in this space, such as Asian property online company iProperty Group (IPP) and Chinese software developer TTG Mobile Coupon Services (TUP), but these positive examples are few and far between.

Homework required

The general lack of transparency and the illiquid nature of these investments are key reasons why investors need to really do their homework before applying for shares.

I believe foreign companies listing here should be treated as “guilty until proven innocent”, and that probably sums up the reason why most professional small cap investors steer clear of such IPOs.

However, the chief investment officer for Celeste Funds Management, Frank Villante, believes it would be a mistake to disregard them totally.

“It doesn’t really matter to me where the company comes from; it’s more a question of what the business is and whether the numbers make sense,” he says.

Ensuring that foreign ASX-IPOs are priced at a very attractive discount to Australian domiciled peers is only one of the boxes that needs to be checked.

The other important thing is to look at who is standing behind the company, and you can start by looking at who is on the board.

“You probably would want majority Australian independent non-executive directors at a bare minimum, and an independent non-exec chairman who is Australian-based ,” said the portfolio manager from OC Funds Management, Rob Frost.

The other thing to look for is the accountants, lawyers and brokers working on the deal. Having proven and recognised advisors is a good sign, as they should ensure the company looking to list will meet the local governance standards that are expected of them.

Cultural differences

Cultural differences can often make governance the biggest obstacle to a successful listing. For instance, the way business is conducted in China is very different to how it is done in Australia. An advisor, who didn’t wish to be named, told Eureka Report that Chinese company executives are often surprised that handing money under the table is a big no-no in Australia.

There is also often a problem with related-party transactions. In many Asian countries, business is done based on relationships, and the concept of “arms-length” transactions is seen as alien. The good news is that the cultural divide is closing.

Villante also thinks investors should look to see if the company in question has a verifiable track record in running the business, and for the reason why it wants to list in Australia. Floating here because of “face” or “prestige” is not enough of a good reason, in his book.

Perhaps the biggest advantage of looking at an offshore company’s float is the diversification benefit it can bring. It is more challenging for Australian-based companies, particularly the smaller ones, to benefit from overseas trends.

On the other hand, floats like Sunbridge Group and 99 Wuxian give investors direct exposure to the tectonic transformation of China’s economy from exports to consumerism.