China's credit-binge hangover is a big headache for Australia

With the share market booming, it's easy to envisage that the good times have returned and so here we go again. When such sentiments abound, we all need to remind ourselves that what happens to Australia largely depends on what happens to China.

And if you are a global investment manager, particularly one managing emerging market bonds, you watch China very carefully because it affects so many of your market places. That's why I was pleased to catch up with Paul McNamara this week, the investment director of GAM's emerging markets bonds and foreign exchange operation. Globally GAM manages about $135 billion.

McNamara is a hero in London because he exited Russian securities before they went belly up. McNamara points that after the global financial crisis China sent credit growth through the roof and with that growth came massive fixed-asset investment, a strong recovery in GDP and massive demand for commodities. Those emerging countries that were major commodity exporters, countries such as Brazil, Russia, South Africa and, to some extent, Indonesia, boomed. And, although we are not an emerging economy, no country boomed more than Australia.

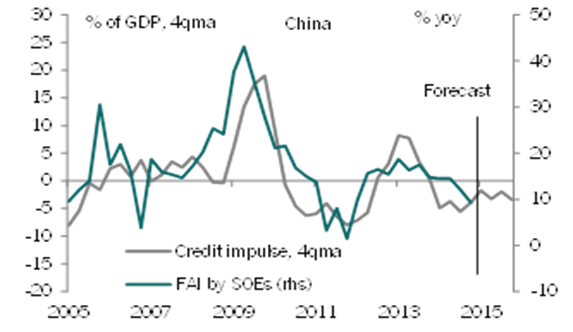

However, as you can see in the graph below, China has been winding back its credit growth severely. The graph reflects McNamara's view that while there is only a small amount to fall, credit growth and therefore commodity demand will stay down for an extended period.

McNamara adds a caveat. If China does find it necessary to give its economy another massive stimulus via higher credit growth, then he will be wrong in the short term and mineral resource demand will rise, but further stimulus in China will almost certainly end in a nasty crash. The current gradual process will enable China to manage its transformation.

The emerging countries that will do well in this environment are those that missed out on the China commodity boom but have made major steps to expand in areas like services and manufacturing.

On top of that list is India but Poland, which is not saddled with the euro, is also doing well trading with Europe. Ukraine could also have been a strong performer but for the civil war. A third winner is Mexico. Turkey is brilliantly placed but has got itself mixed up with the Islamic State movement and could face a hard time.

McNamara says weak credit growth in China will curb demand for key commodities such as iron ore and copper for many years – and that this is a long-term change in global trade. The second graph (below) shows how China's fixed-asset investment is holding steady at a lower level and is not recovering.

This means prices may stay low for an extended period which, in turn, means so does Australian tax revenue. Accordingly, Australian prosperity has a cap on it unless other industries like education, tourism and health rise and Chinese developers keep building dwellings in Melbourne and Sydney to take up the slack (Melbourne and Sydney property developers face very different problems, February 4).