China rebound echoes round the world

| Summary: The latest economic data from China shows an economy still on the rise. And jobs figures out of the UK, Germany and the US also demonstrate that global conditions are on the improve. That’s good news for Australian investors, who can expect the ride the upswing in global industrial production. |

| Key take-out: With growth is at its strongest in over a decade, investors should expect a boost across our stockmarket, particularly mining and materials stocks. |

| Key beneficiaries: General investors. Category: Economics and Investment Strategy. |

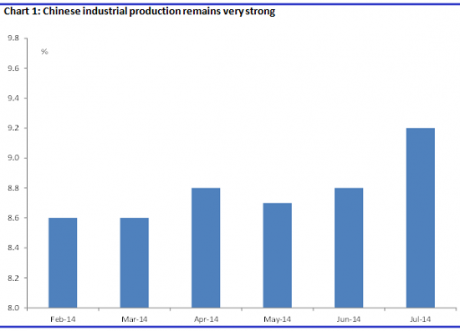

Markets were taken aback by last week’s stronger-than-expected Chinese economic data – especially the lift in industrial production that we saw in June, to an annual rate of 9.2% from growth of 8.8% the month prior.

It’s not that a lift of 0.4% in annual terms is a marked increase or anything. It’s a reasonably minor upgrade. The importance of the number was much more subtle and, well, much more important. It led, along with the other data out, to a reasonably decent upgrade in expectations for the Chinese economy.

Increasingly, investors are giving up on the idea that China is headed for a marked downturn. Of course, the economy has slowed, but this is by intent. Double-digit growth rates were simply not sustainable for the government, without risking social cohesion. The government has succeeded in this and so we are left with an economy that is still growing at a very strong growth rate, in line with government policy. It is a command and control economy.

In any case, that uptick in industrial production is arguably a more important indicator for the stockmarket than other indicators like Gross Domestic Product etc. That’s because it gives a purer read on those sectors which matter for growth and on which the services sector relies – manufacturing, construction and utilities, for the consumer and industrial markets. If industrial production is on the up, it’s showing that demand for construction, manufacturing etc. is accelerating. The recovery is real and broad-based.

Of particular importance, investors should note that the rebound in Chinese industrial production is occurring at a time when the global IP cycle itself is turning. Chart 2 below shows the average industrial production growth of the major economies, and it shows production is in a major upswing. Indeed, we are witnessing the strongest rebound in industrial production in about 14 years. That’s excluding the post GFC spike in 2009-10, which really was just a catch-up from the credit-induced production slump of the two-years prior.

Investment implications

One of the major implications of this data for investors is that the global economy is doing much better than is widely perceived. It’s not looking all that fragile and weak, which is the common perception. By the by, this is why we are seeing such strong rates of jobs growth. In the UK, employment growth is at its strongest in about 40-years. The unemployment rate is at post-GFC lows. In Germany, the unemployment rate is at its lowest since reunification and, of course, jobs growth in the US is exceptionally strong. The unemployment rate is falling. This in turn creates a positive feedback loop. Jobs growth, or less job uncertainty, creates income, is great for confidence, which then feeds back into industrial demand. We are on a stable footing here.

In a broader context, all of this has very positive ramifications for the global earnings cycle generally and issues of valuation. Up front, we simply should not be concerned about stocks looking rich. More specifically for Australia, a global industrial production upswing is great for our market —especially our mining and material stocks. If you had to summarise Australia succinctly, we are a global growth play. This is well known.

Now, fair to say that some of our big miners may have already had a solid rally over the last month or so. RIO is up 12% since mid-June, although it’s still well away from its peak of over $70 reached in February. Similarly, BHP is up 11% and is nearing its 2014 peak, which also happens to be the top of the trading range we’ve seen over the last three years. Having said that, our large miners haven’t really been involved in this bull-equity run. That’s not to say investors haven’t made money; a value investing strategy has worked wonders in this space. But by and large they haven’t performed as well as other domestic sectors – some of our banking and retail stocks – or even global equities.

The strong rebound in the global industrial production cycle, and the fact that Chinese industrial production has held up into very strong growth rates, suggests that this lack of affection may have quite weak foundations. The truth is, the global industrial cycle is what drives the mining cycle – the demand for steel and steel related raw products –iron ore and coking coal etc.

Growth in industrial demand is very strong, as noted above. Certainly we have seen an aggressive supply response and, as a result, much of the supply/demand analytics that we see in the market invariably assumes either balance or some commodity glut. Note, however, that this view is underpinned by an expectation for ongoing weak industrial demand. As noted above, we’re simply not seeing this – growth is at its strongest in over a decade.