Chill out: The US economy is fine

Recent economic data in the US has hinted at a flagging recovery, with January numbers on house prices, jobs growth, home building, consumer confidence and retail sales all falling short of expectations. But take a closer look and it’s not nearly as worrying as it appears at first glance.

The weather, a rarely mentioned impact on an economy outside of when things go awry, has arguably been at its most menacing in three decades in some of America’s biggest markets.

For many economists and analysts this has been a simple reason to look beyond the latest economic indicators, but the true extent of the weather factor has been largely overlooked in preference for ambiguous assumptions that predict $50 billion will be shaved from the US economy.

Back in 2011 the federally funded National Center for Atmospheric Research (NCAR) went a step further, publishing an in-depth study showing that weather variability over the course of the year could impact GDP to the tune of 3.4 per cent, with no sector or state immune. This amounts to a potential risk of over $500 billion per annum.

Recent history backs up the research, with the worst winters this century for residents in the major midwest and northeast cities -- Chicago, Washington DC and New York City (three of the biggest four contributors to the nation’s GDP) -- highlighting that miserable weather takes a toll.

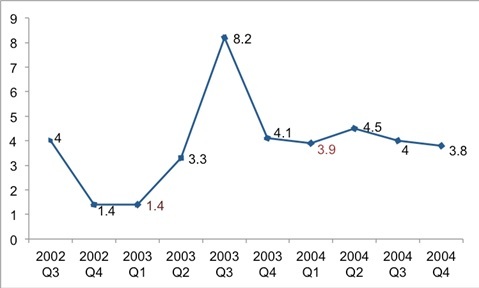

The chart below indicates that the challenging winter months of 2003 and 2004 checked what was otherwise a surging economy.

The first quarter of 2003 was clearly the laggard in a remarkable year of growth, while the first quarter of 2004 had a weak corresponding number to top, making it arguably the worst quarter of the year.

US GDP - quarterly growth from Q3 2002 to Q4 2004

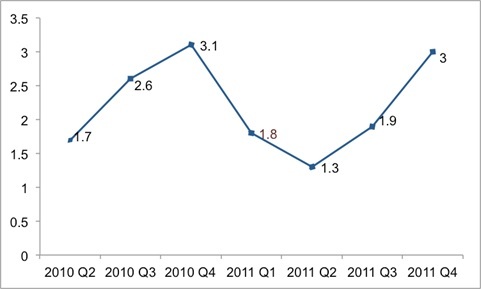

In 2011, a long, harsh winter stalled the economic recovery, which had just begun to pick up steam in 2010.

US GDP - quarterly growth from Q2 2010 to Q4 2011

The impact of this year’s chill may even be more pronounced than in the three years alluded to above as the 2014 winter has been more extreme, particularly compared to the prior year.

In New York City, the nation’s largest city and most important economically, there has been five times as much snow, five more days where the high was below -5 degrees Celsius and twice as many days below freezing (0 degrees), compared to last year.

In Chicago, residents have confronted a staggering 24 days so far this year where the temperature failed to get beyond -5 degrees. Last year, there were eight such days. In all, 70 per cent of days have been colder this year, while there has been a tripling of snowfall.

And in Washington, there has been more than double the amount of days below freezing and 10 times as much snow.

It has all led to a record 75,000 flight cancellations nationwide, dampening productivity as some workers are left stranded and unable either to return from holidays or get to business meetings and conferences.

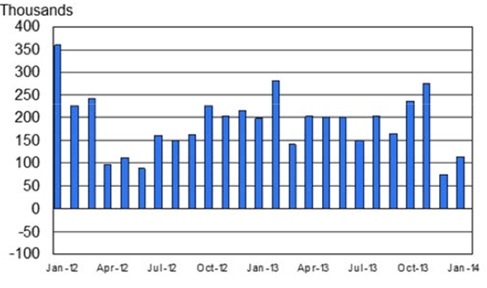

Meanwhile, construction has been put on the backburner -- the hardest hit midwest region witnessed a slump in home building of over 60 per cent last month -- factories have been forced to slow production, and retailers and restaurateurs have seen foot traffic wane. All of which has stymied job creation, with jobs growth in the past two months the lowest the nation has seen since mid-2012.

Source: US Bureau of Labor Statistics

The positive is that if you look beyond what will almost certainly be a disappointing growth read in the first quarter -- which Goldman Sachs optimistically predicts to be down 0.5 per cent compared to where it would be with average weather, recent history suggests that markedly stronger expansion is only a quarter or two away.

The problem for policymakers is the flow-on effect will take months to sort out and serve to interrupt what is currently a steady QE exit trajectory.

Given the lag in data releases we may have to wait until May to develop a clear picture on the US economy. In the meantime the US central bank’s Federal Open Market Committee will have two more meetings to discuss its taper of economic stimulus.

Can they look through the weather impact and trust their judgment on the underlying strength of the economy? Or will the data be too disappointing for a cautious Fed to ignore? After last night’s testimony from Fed chair Janet Yellen, the jury remains out.

Daniel Palmer is Business Spectator's North America correspondent @Danielbpalmer