Challenges for a recovering market

Summary: The world's debt load has grown since the GFC and eventually needs to be pared back, although debt repayment is deflationary because it requires increased savings at the expense of consumption. Another deflationary force is the ageing population as retirees tend to be thrifty. The build-up of liquidity after QE programs is an inflationary threat that could disrupt markets after deflation has run its course. |

Key take-out: Considering the major structural problems in the world economy, disinflation has the upper hand to date, but the coin can quickly flip. |

Key beneficiaries: General investors. Category: Shares. |

The latest global market correction was just 13.2 per cent between May and Sept 2015. The previous crash was 22.3 per cent between April and Sept 2011 and the one before that was 58.5 per cent between October 2007 and March 2009 (which defined the global financial crisis or GFC).

Source: MarketTiming.com.au

The worst seems over for now, but structural problems still persist for the bull market that started in March 2009.

The world economy faces two fundamental threats – continuing disinflation turning into actual deflation (as has happened with fuel and mineral prices) followed by an outbreak of inflation that escalates into hyperinflation (as Milton Friedman predicted for loose monetary policy).

Deflation or hyperinflation is the nightmare of central banks.

The main disinflationary forces at work in the world today are debt and demographics.

Debt

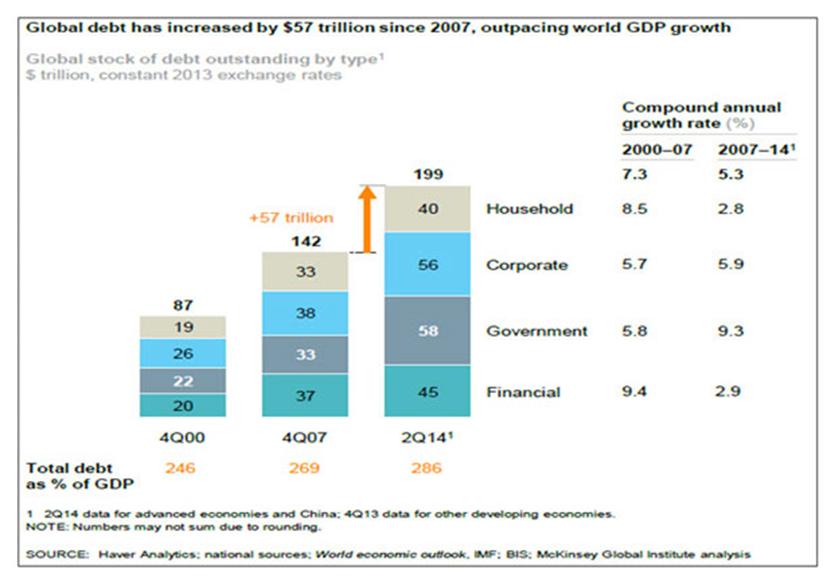

The world's huge debt load has surprisingly grown by 40 per cent since it precipitated the global financial crisis in late 2007.

Central banks intervened to stop another Great Depression by printing money to force down interest rates so as to stimulate consumer demand.

But their action instead fuelled investor demand for bonds, property and shares creating a new debt-fuelled asset price bubble. Eventually this mountain of debt needs to be pared back. But deleveraging (debt repayment) is deflationary because it requires increased savings at the expense of consumption and investment.

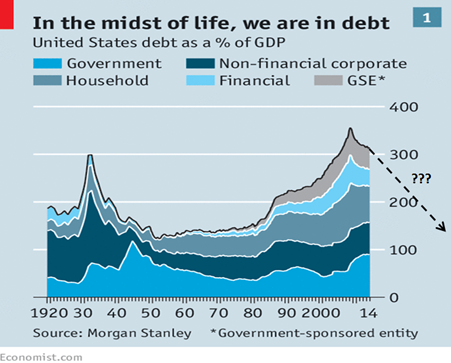

America is slowly reducing its total debt/GDP ratio but it has a long way to go. If it follows the same path as it did between 1932 and 1952 it won't be until 2027 that credit expansion starts fuelling growth again. Tightening the borrowing belt is austerity by stealth.

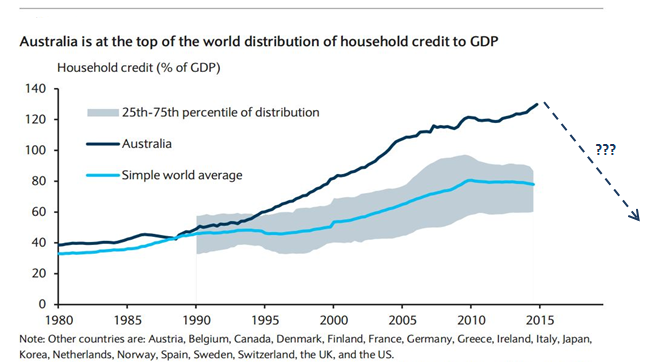

In Australia, government and corporate debt ratios are modest by international standards, but our household debt to GDP is the highest in the world. When Australian consumers start paying down debt their spending will contract. That's deflationary.

Source: Australian Bureau of Statistics, Bloomberg, Bank for International Settlements, International Monetary Fund, Reserve Bank of Australia, Barclays Research, MarketTiming.com.au

Demographics

The other deflationary force is demographics or more specifically the ageing of the population, especially in developed countries (with low immigration rates).

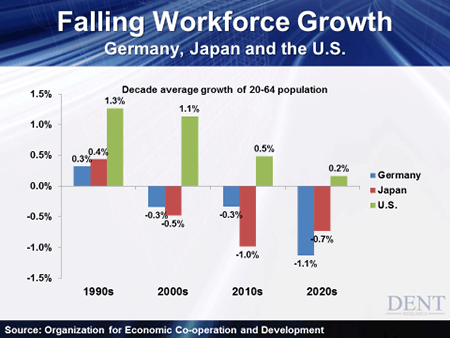

The retirement of baby boomers (those born between 1946 and 1964) is causing a slowdown of the growth of the core workforce (those aged between 20 and 64) as the next chart shows. Fortunately Australia's high immigration rate means its workforce diminution is slower than other advanced economies.

An older population is constraining consumption because retirees tend to be thrifty. They also prefer static income securities over innovative growth assets.

Liquidity

This brings us to the main inflationary threat that could disrupt markets after deflation has run its course: the huge build-up of global liquidity resulting from central banks pursuing quantitative easing (QE) in response to the GFC.

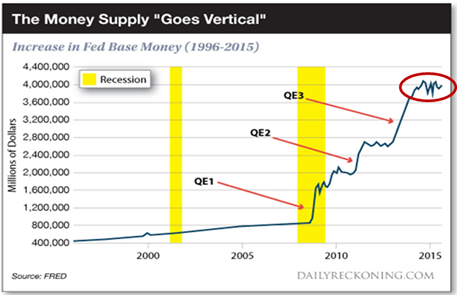

While the US Federal Reserve stopped printing money last October, it did not begin withdrawing money from circulation by selling government and other bonds it bought after the GFC. See chart below.

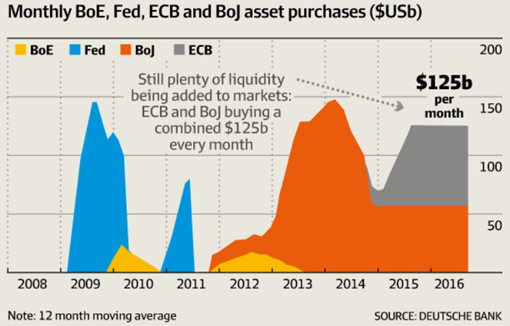

Furthermore Japan and Europe have taken up the printing presses where the Federal Reserve left off with the result that global money supply continues to have additional large injections of liquidity. See next chart.

Competitive devaluations

James Rickards, in his latest bestseller, The Big Drop, argues that once the US dollar stops escalating, the American public will lose confidence in paper money and bonds and instead turn to gold and tangible assets such as property and shares to safeguard against competitive currency devaluations igniting inflation. Citizens elsewhere will do the same.

Source: James Dale Davidson, The Age of Deception, 2015

If that happens central banks may hold off reining in excess liquidity for fear of risking another 1930s-style depression. Also governments with unsustainable debt obligations might welcome higher prices since it would reduce the relative size of their borrowings (expressed in fixed dollars) as a share of GDP (expressed in inflating dollars).

Private savers (holding cash and bonds) would lose out to both investors (holding gold, property and shares) and governments (that could repay debt with a debased currency as happened in Germany in 1923).

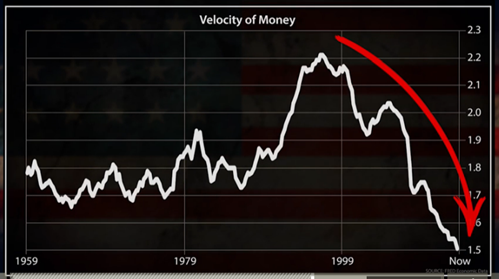

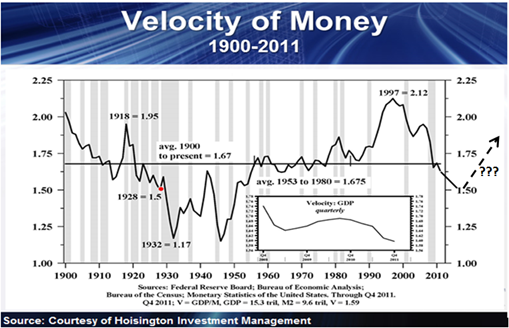

The reason that the biggest money printing splurge in history has so far not triggered hyperinflation is that the velocity of circulation of money has collapsed. In other words each unit of currency (e.g. a dollar) no longer changes hands as fast as it used to do. That can be seen in the next chart for the USA.

Source: James Dale Davidson, The Age of Deception, 2015

On Rickards' reckoning this trend will eventually reverse as it did after World War II, but this time around there won't be a baby boom generation to lift production, just cashed-up retirees and anxious consumers bidding up prices.

Conclusion

So there you have it: a Cook's tour of the major structural problems stalking the world. To date disinflation has the upper hand, but as history shows the coin can quickly flip.

The contrary view is that we have entered a new age of low inflation and low interest rates, which history shows always favours growth. The information age is still in its infancy and promises to unleash new products and services that will drive the next advancement in living standards. Also revolutionary breakthroughs in tackling climate change and pollution will spawn new energy and transport industries.

As a Market Timer I'm agnostic about the future. It could boom, but it could also bust. Bull or bear I don't care, because as a trend-follower I react to the market's actual moves in order to stay on the right side of it.

Percy Allan is Editor of MarketTiming.com.au. For a free three week trial of its newsletter and trend-trading strategies for listed ETF funds see www.markettiming.com.au.