Catching up on super after a career break

Summary: A worker on an average income with a 40-year career whose super returns 4 per cent after inflation fees and tax could expect to retire with a balance of $633,128 in today's dollars. But taking a career break means a disproportionate hit to a worker's superannuation. Assuming a worker has the capacity to make extra super contributions after returning to work, it is generally possible to catch up on the missed contributions. |

Key take-out: To catch up on super after a career break, it will take significantly more than just doubling contributions for the period missed. For example, a worker who has a four-year break would then need to double contributions for 5.5 years to catch up. |

Key beneficiaries: General investors. Category: Superannuation. |

Anyone who spends some time out of the workforce misses out not only on the super contributions from this period, but also on the resulting investment returns over time. This is particularly significant given that Australia's superannuation system is largely a defined contribution system and that the general consensus is that contributions of 9.5 per cent of income mean super is a significant contributor to retirement income but not enough to fund retirement entirely.

This week, Treasurer Scott Morrison raised the possibility of increasing contributions caps to allow parents returning to work after a break to top up their super. The question is: how much does a career break impact superannuation fund balances by retirement?

Earnings over time

The starting point is to consider how superannuation contributions vary over time – based on how income earned varies over time. Someone at age 22, as they start work, is not likely to be earning as much as someone in their 50s in the same profession.

To compile this “age earnings profile”, let's use the ABS data series of employee earnings that includes a calculation of mean income by age group to calculate the percentage of the average income that each age group earned.

The current average full-time income is $1484 (Average Weekly Ordinary Time Earnings), and this was adjusted for each age group based on their earning percentage of the full-time average income. It certainly has some quirky elements to it – for example it is interesting to see the average income drop for full-time workers in the 55 to 59 age group. Perhaps a group of high income earners retire at around this age, while lower income earners tend to have to keep working through to their age pension age in the 60s. However, for the purpose of these calculations we will use these approximations of average income over time.

Table 1: Average income for different age groups

Age | % of average income (for full time workers) | Weekly average full time income |

20–24 | 65% | $ 961 |

25–29 | 86% | $ 1,272 |

30–34 | 98% | $ 1,454 |

35–39 | 107% | $ 1,581 |

40–44 | 117% | $ 1,729 |

45–49 | 113% | $ 1,678 |

50–54 | 114% | $ 1,699 |

55–59 | 104% | $ 1,536 |

60–64 | 109% | $ 1,621 |

Superannuation contributions

The current compulsory employer contribution rate is 9.5 per cent. To assume a contributions rate I have used the 9.5 per cent rate – even though it has changed over time, and will likely change in the future. It is the best approximation of contributions that we have.

Superannuation contributions are then taxed at a rate of 15 per cent. I have assumed that a person starts working at age 22 (perhaps after completing a uni degree or apprenticeship), and has a 40-year working career.

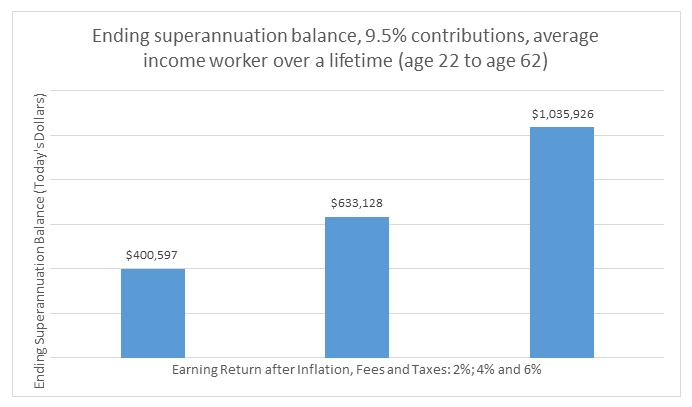

Average superannuation income based on different after inflation earning rates

The following table sets out the final superannuation balance in today's dollars of an average income earner receiving 9.5 per cent superannuation contributions over their working lifetime. The rates of return range from 2 per cent per annum after inflation, fees and tax (probably a fairly conservative return), to 6 per cent after inflation, fees and tax – a return that is certainly at the higher end of the range of likely returns. As a benchmark as to justify this range of returns, the Future Fund targets a return of 4.5 per cent per year after inflation. They have had exceeded this target over a period of time that has included the Global Financial Crisis.

Table 2: Ending superannuation balances for an average worker

Assumed earning rate after inflation, fees and tax | Ending superannuation balance of average income earner (working age 22 to 62) in today's dollars |

2% | $400,597 |

4% | $633,128 |

6% | $1,035,926 |

The impact of a career break

Let's allow for two impacts of a career break.

The first is simple – no superannuation contributions will be received over the period that someone is not working.

The second result of a career break is a delay in the increase in income that happens over a person's career. This will be accounted for in the calculations by keeping income increases in sequential order after the career break – rather than jumping ahead based on age.

For the calculations, I have assumed that the career break comes at age 30. I will look at the impact on superannuation of 2, 4, 8 and 16 years away from work using the 4 per cent after tax and inflation earnings rate.

Table 3: Impact of a career break on ending superannuation balances

Ending superannuation balance * | Percentage decrease in years worked | Percentage decrease in ending super balance | |

No career break | $633,128 | ||

2 year career break | $584,679 | 5% | 7.7% |

4 year career break | $540,242 | 10% | 14.7% |

8 year career break | $461,834 | 20% | 27.1% |

16 year career break | $332,980 | 40% | 47.4% |

* Assumes an earnings rate of 4 per cent per annum after fees, tax and inflation.

Extra contributions to catch up

The next question is: What level of extra contributions following a career break will help restore the superannuation balance to where it would have been without a break?

It is assumed that the person returning to work has the capacity to double their superannuation contributions, with the following table setting out how long they will have to double their contributions to put their ending superannuation balance on par with where they would have been if they had not had time away from work.

Table 4: Number of years of double contributions after career break to get to same ending balance as if there were no break

Years of career break (from age 30) | Years of double superannuation contributions to make ending super balance equivalent to no career break |

2 Years | 2.5 Years |

4 Years | 5.5 Years |

8 Years | 12 Years |

The 16-year example does not work for the scenario given, because even if the person doubles their superannuation contributions for their remaining working life, they still end up well behind.

After a 16-year working break, the worker needs to triple their superannuation contributions for the rest of their working career (17 years) to end up in the same financial position as if they had not had a career break.

Conclusion

It is probably a fair summary of superannuation that it won't quite be enough to fund someone's retirement by itself: This situation becomes more of a problem if someone takes a period of time away from employment and contributions.

It is generally possible to catch up on these missed contributions, although it will take significantly more than just doubling missed superannuation contributions for the period of employment missed.

Scott Francis is a personal finance commentator, and previously worked as an independent financial adviser. The comments published are not financial product recommendations and may not represent the views of Eureka Report. To the extent that it contains general advice it has been prepared without taking into account your objectives, financial situation or needs. Before acting on it you should consider its appropriateness, having regard to your objectives, financial situation and needs.

Frequently Asked Questions about this Article…

Taking a career break can significantly impact your superannuation balance because you miss out on both the contributions and the investment returns during that period. This can lead to a substantial decrease in your retirement savings.

Yes, it is generally possible to catch up on your superannuation after a career break. However, it requires more than just doubling your contributions for the period you missed. For example, a four-year break would require doubling contributions for 5.5 years to catch up.

A two-year career break can result in a 7.7% decrease in your ending superannuation balance, assuming a 4% earnings rate after inflation, fees, and tax.

To make up for a four-year career break, you would need to double your superannuation contributions for 5.5 years to restore your balance to where it would have been without the break.

An eight-year career break can lead to a 27.1% decrease in your superannuation balance. To catch up, you would need to double your contributions for 12 years.

Recovering from a 16-year career break is challenging. Even doubling your contributions for the rest of your working life may not be enough. You would need to triple your contributions for the remaining 17 years to match the balance you would have had without a break.

Superannuation contributions vary over time based on income changes. Typically, income increases with age, which means contributions also increase. A career break can delay these income increases, impacting your overall super balance.

The current compulsory employer contribution rate is 9.5% of your income, and these contributions are taxed at a rate of 15%. These rates can change over time, affecting your superannuation savings.