Carr's Call: The trouble with the bubble call

| Summary: Forecasts of a decline in bank earnings per share are failing to account for a rebound in credit growth, with interest rates and lending levels at record lows. If anything, bank lending levels are set to grow. |

| Key take-out: In the absence of any clear catalyst for deterioration, bank EPS growth is likely to accelerate from here. |

| Key beneficiaries: General investors. Category: Growth. |

I realise you’ve already read a variety of opinions on UBS’s bank bubble call last week, including arguments for and against.

John Abernethy wrote a great piece as to why banks weren’t a bubble in his May 3 missive, Bursting the bank price bubble theory. Roger Montgomery continues the theme today with his comment Banks not cheap, but no hold-up imminent, while Ian Verrender wrote a separate article on Monday, Five reasons to hang onto the banks.

I’m not seeking to replicate what they said, but given the big banks are 27% of the market and a decent proportion of everyone’s portfolio, I do have something to add to what you have already read. But I’ll be brief.

The key point I’d like to add in support of why banks are not a bubble is that you simply can’t call a bubble at the bottom of the credit cycle. It’s not credible.

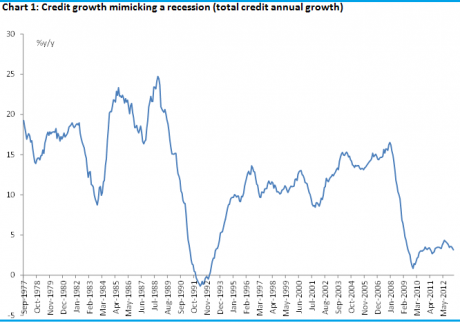

It’d be different if credit growth was pumping out double-digit growth rates like in the heyday of the 1980s, at cruising speeds of 25% or so. But we’re not. You can see from the chart below that total system credit growth is recessionary. It’s the lowest since the recession of the 1990s and, at an annual pace of 3.2%, is four-times lower than the average over the last four or so decades (12%).

Luckily recessions don’t last forever and credit growth, as you can see, is not a constant variable. It would be unreasonable to assume that this low growth will last forever, or even for two more years, for reasons I’ll go into below. At this point we just need to know that when an analyst says that the banks are a bubble or even just expensive, they are implicitly assuming an ever-lasting credit recession.

Consider that the consensus earnings per share forecast for the big four banks is 5.5% on average over the next two years (this year and next). That’s about the average since 2005 if you include the GFC slump. If, like me, you think the GFC was an outlier, then EPS growth has been closer to 11% since 2005. So a 5.5% growth rate is very low – and lower than the 7% average of the last two-years even.

I could appreciate that EPS growth might deteriorate if there was some catalyst – if there were structural forces or policy influences at play that were dampening credit growth. But there isn’t. So the fact that the consensus expects EPS growth to decelerate compared to the last two years, when that period was one of the worst credit recessions this country has seen, isn’t something I see as reasonable. It’s an explicit forecast that the economy will deteriorate from here, not improve, which flies in the face of what we are seeing here and globally. And it flies in the face of policy settings as well – lending rates are at record lows.

In the absence of any clear catalyst for deterioration, I think instead that EPS growth will accelerate from here. This is especially if you consider that costs to income for the four major as a whole is still around the average – i.e. no evidence of substantial cost cutting. But even if we assume a continuation of the comparatively low EPS growth that we’ve seen over the last two years, then even on that basis, banks are not rich.

Take one of the big banks, Commonwealth Bank for illustrative purposes. It’s currently travelling on a forward price-earnings ratio of 14.3 for 2014, with EPS growth of 5.8% for that year. That’s a little above the actual price-earnings recorded over the last decade (13.7), but not onerous. As discussed, 5.8% EPS growth is on the low side. If you take CBA’s average EPS growth over the last two years of about 9%, then the forward price-earnings ratio slips to 13.6, which is fair value compared to actual price-earnings over the last decade. At this point, recall John Abernethy’s piece on why you should actually expect a premium – the hunt for yield etc. So 13.6 is too low, it’s cheap.

The prospects for banks really come down to credit growth from here, and there are two reasons why credit growth won’t remain in recession.

Banks are in no way handicapped in providing more credit should the demand arise.

- Loans to deposits are low and currently sit around 1.1 times deposits compared to the average of 1.25 and the high in 2007 of 1.4 times deposits.

- The banks enjoy the best credit ratings of any banks anywhere, have no problem funding on the wholesale markets, and are doing so at ever cheaper rates.

Similarly, there are simply no constraints on the demand side. The myth of heavily indebted Australian households has been well and truly smashed. Two-thirds don’t have a mortgage or much in the way of meaningful debt, and of the 30% or so who do have a mortgage, the average debt outstanding is $200,000 and RBA estimates suggest 50% are ahead on their repayments – 20% by one year or more.

More to the point, and after yesterday’s decision to cut interest rates to record lows, the capacity to service debt is the best it has been on record.