Carat fans brace for the tapering stick

The outlook for gold in the immediate doesn’t look shiny. Yields on the 10-year Treasury note are rising as taper talk once again has financial markets in its grip. Add to this a stable-to-strengthening US dollar and declining equity-risk premium, and the gold price is facing a battle.

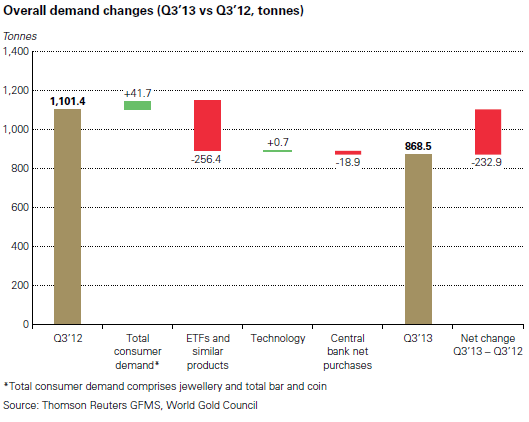

Overnight the gold spot price settled at $US1,242.95 per ounce, down from a high of $US1,419 as recently as August. Even as 684 tonnes of gold were liquidated from physically-backed gold exchange traded funds from January through to August, the gold price managed to rise. Liquidation has since continued at a steady pace, further compounding the woes of the precious metal.

The rally in gold during August was largely driven by concerns over the Federal Reserve tapering in September and the increased volatility this generated in emerging markets. There was also geopolitical risk in the Middle East.

Rationale for the mass exit from gold ETFs is due to investors, primarily from western markets, selling off holdings in preparation for tapering. The graph below shows demand for gold declined in the September quarter compared with the previous comparable period. The notable aspect is the red bar indicating the quantity leaving ETFs.

India, along with China, has long been a net buyer of gold, primarily for jewellery. However, since the Indian government has implemented measures to curb gold imports, it has significantly altered the Indian gold market and consequently demand for the precious metal.

Despite government restrictions, demand for gold within India still remains resilient, reflected by local price premiums to international gold prices. At the moment this demand is being served by gold coming into India through unofficial channels, according to the World Gold Council.

There is certainly merit in holding gold as an investment if inflation is a concern. At the moment inflationary pressures in the western world are non-existent and probably will be for some time. However, it could very well be a different story in a post-taper world.