Can the RBA defuse a mining time bomb?

Low interest rates continue to support the non-mining sector but there remains considerable uncertainty surrounding the timing of the mining investment collapse and the non-mining sector picking up. Get the timing right, and it will be smooth sailing ahead; get it wrong and we could be in for an almighty mess.

The Reserve Bank of Australia released its Statement on Monetary Policy today, which showed that the outlook for the Australian economy is largely unchanged since the February SMP.

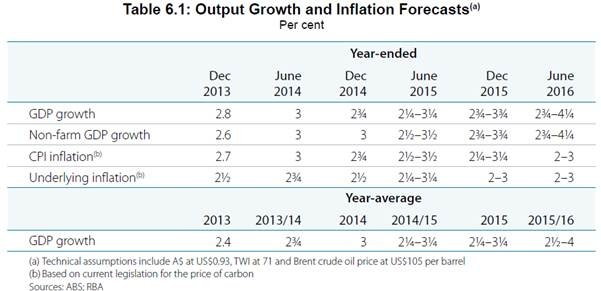

The economy has been a little stronger than the RBA expected during the first half of 2014 but it expect the economy to be a touch weaker further out owing to a higher exchange rate assumption. The RBA has subtracted around 0.25 percentage points from year-ended growth in June 2015 and June 2016 but over that horizon the revisions are inconsequential.

An important technical point for understanding RBA forecasts is the assumptions it makes. For example, it assumes that the cash rate and exchange rate will be unchanged over the outlook. The first stops the RBA from potentially misleading the market; the second is necessary since exchange rates are incredibly volatile and difficult to forecast.

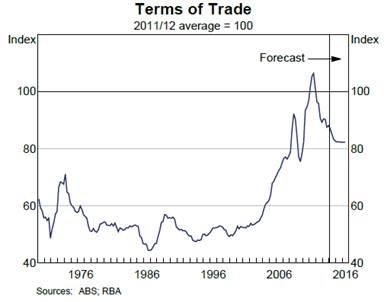

I see some downside risk for the dollar coming in the form of lower iron ore prices. As more iron ore projects shift from the investment to the production stage, the pick-up in global supply should drive prices lower. A softening of Chinese demand could also achieve the same outcome.

Since the Australian dollar is largely a commodities currency, tracking developments in our terms-of-trade closely, a fall in commodity prices will bring the dollar down. The RBA expects the terms-of-trade to decline over the forecast horizon, consistent with my view, though it is not clear how this squares away with its assumption that the exchange rate is unchanged.

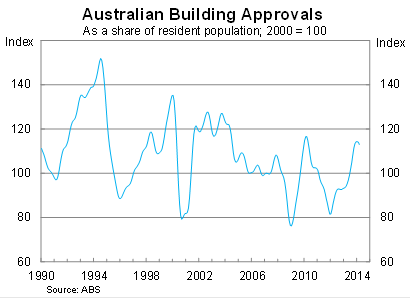

The RBA said that the pick-up in dwelling investment is under way and that “recent information suggests that the upswing this year is likely to be a little larger than was forecast three months ago”. However, I recently questioned whether the boost would be that large since the recent boom in building approvals pales in comparison with previous booms (A house bet that may not pay off for the bank, May 5).

The RBA is optimistic about building approvals, but recent data suggests that they may have hit their peak. On a trend basis, approvals fell in both February and March, and approvals for high-density living have come off significantly. If that is the peak for approvals, then the construction boom is likely to be short and sweet.

The RBA noted that house price growth has moderated in recent months and that auction clearance rates have also declined from recent highs. Loan approvals remain strong but momentum has slowed. Nevertheless, investor activity remains elevated and in my opinion is tracking at an unsustainable pace that could have significant repercussions for growth (A day of reckoning for the house market, May 7).

Business investment is set to decline further over the next couple of years as more mining projects are completed and few new projects commence. Survey measures for investment intentions indicate that mining investment will fall sharply next year, while non-mining investment will only rise modestly.

The biggest concern for the RBA is the timing and size of the mining investment collapse. It is resigned to the fact that the collapse will be large. I’ve stated that it could punch a hole in GDP of around 3 to 4 percentage points, but it don’t know precisely when it will begin or how sharp the deterioration will be.

The RBA says that “there is significant uncertainty as to whether the timing of stronger activity in some parts of the economy will coincide with weaker activity in other parts”. If it gets the timing right, then growth will proceed at trend pace or a touch below. Get the timing wrong, however, and the economy could be a bit of a mess.

The challenge for the RBA will receive a further blow next Tuesday when the federal government releases its budget for the 2013/14 financial year. The RBA forecasts were prepared based on the most recent updates by state and federal governments. So these forecasts do not incorporate many of the spending cuts or tax changes proposed by the Coalition in recent weeks.

The RBA has stated that they intend on leaving rates unchanged for some time and that position makes sense given the considerable uncertainty surrounding the economy. Although employment has picked up and retail spending has been solid, a rate rise now -- which slowed the non-mining sector -- could prove devastating for an economic transition that couldn’t be less certain.