Can retail head-off the ageing squeeze?

Summary: Understanding the influence of Australia's changing demographics is essential to understanding the performance of the business sector. |

Key take-out: Retailers need to be aware of this challenge and take steps to mitigate the risks or diversify. |

Key beneficiaries: General investors. Category: Shares, retail sector. |

An ageing population creates a unique challenge for Australia's retail sector. Older Australians spend significantly less than younger households, according to research from the Reserve Bank of Australia, with a higher share of that spending allocated towards essential services rather than retail goods. It represents a significant threat to retail stocks over the next couple of decades.

Understanding Australia's demographics and the influence of those demographics is essential to understanding not only the Australian economy but also the performance of our business sector. Strong population growth, for example, creates a ready and growing market for goods and services, while rising female participation in the workforce boosts household incomes.

An ageing population is perhaps the most interesting demographic factor affecting the Australian and global economies. Our personal preferences and spending habits change as we age. So too does our tolerance for risk.

For decades Australia benefited from favourable demographics: Strong population growth and rising female participation in the workforce being two prime examples. The economic influence of the ‘baby boomers', who were at their most productive throughout the 1980s and 1990s, also had a strong influence on Australia's economic success.

This has changed over the past decade as the first ‘baby boomers' have entered retirement and the boost from rising female participation has diminished somewhat. Even population growth isn't what it was at the peak of the mining investment boom.

The share of the Australian population aged between 15 and 64 years old – the so-called working age population – is set to decline significantly over the next 15 years to a level not seen since the early 1970s. By 2030 it is estimated that Australia will have more people aged over 65 years old than children under the age of 15.

This presents a set of challenges for the Australian economy that will influence economic outcomes and investment behaviour over the next couple of decades. If the experience overseas is any indication – with the likes of Japan and Germany further along in this process – then we can expect slower economic growth and greater difficulty balancing the budget.

Retail sector

Corporations will rise and fall on the back of the shift in consumer preferences. It should come as little surprise that our income and spending patterns differ as we get older. Older households, for example, tend to earn and spend less than the average person. They also tend to save less as they run down their superannuation income or rely on the aged pension.

The graph below, obtained via research from the RBA back in 2014, shows how spending and income differs according to age group. Household disposable income and spending peaks when the primary income earner is between the ages of 45 and 54 years old.

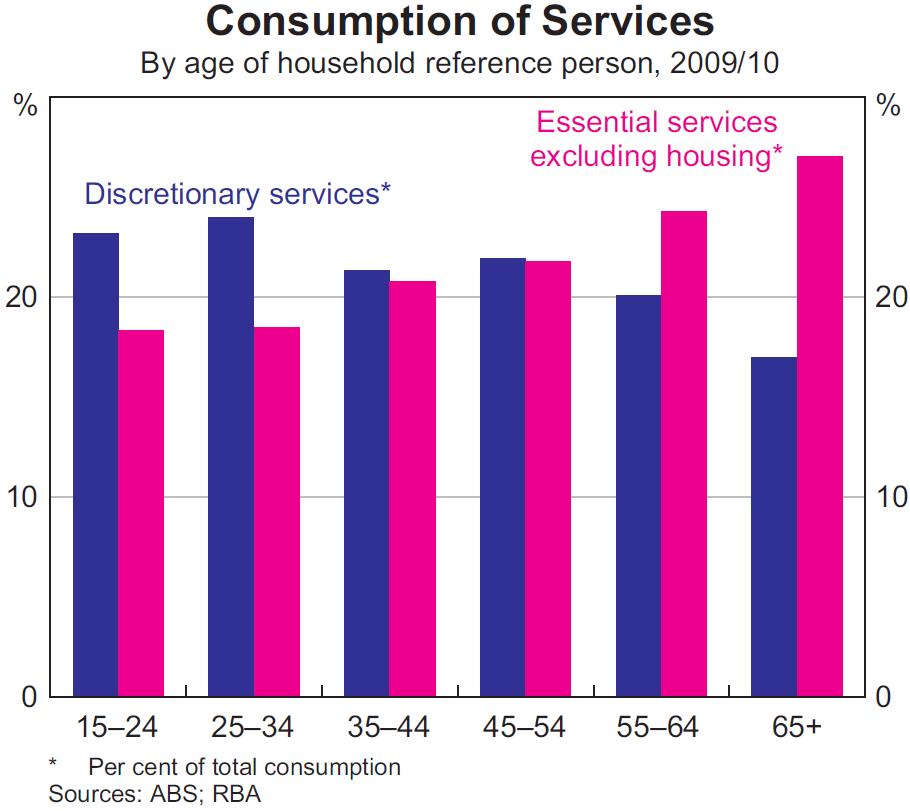

Older households spend a lot less on durable goods than younger households. Older households have already accumulated these goods and as household budgets tighten they may become reluctant to upgrade or replace unless it is truly necessary.

Older households also spend more on essential services, such as health and aged care services. Younger households spend a lot more on discretionary services such as travel, accommodation and eating out at restaurants.

Strong growth in health and aged care services will put further pressure on federal and state budgets. Recent years have shown how difficult it is to not only cut expenditure but to make cuts to areas that voters deem essential. Few services are more essential than health and aged care services.

We also cannot forget the important link between household spending and GST revenue. The federal budget is under assault from a variety of angles and fixing the problem will require strong leadership and ambitious reform.

If I was an investor focused on retail stocks I'd be asking whether retailers are aware of this challenge and whether they have taken steps to mitigate these risks or diversify their brand. Many retailers have been, for example, slow to react to or acknowledge the threat of online shopping. Could that happen once again?

Online sales and exports will be no refuge for Australian retailers since most developed economies are suffering a same – if not greater – problem. Increasing exposure to developing markets such as China and India may be an option for Australian retailers as the middle-class in both those countries expands.

The graph below, obtained via a speech given by RBA deputy governor Philip Lowe, compares the working age population across a variety of developed countries. The challenge is greatest in Japan and South Korea, followed by Western Europe, most notably Germany, and then Australia and the United States. This is very much a global challenge and retail stocks will be affected across the board.

This phenomenon could be offset to some extent by the fact that the income of older households has grown more quickly over the past two decades than the average household. The ‘baby boomers' are asset rich and many have the capacity to maintain their spending habits into retirement. History suggests, though, that they will become more cautious as their enter retirement.

Productivity and risk-taking

The influence of an ageing population can be offset by several factors. One is higher levels of migration, which is the path that successive federal governments have chosen to address the issue. Increasing our intake of working-age individuals can help to flatten out our age profile but it is only a stop-gap measure.

The only real solution to an ageing population is stronger productivity growth. Making better use of our resources is the one sustainable path towards greater living standards and a healthy and vibrant corporate sector.

Australia's productivity performance over the past decade has been poor but not inconsistent with the experience of most developed economies. There is a great deal of debate as to why this has occurred. The global financial crisis and resulting sovereign debt crisis is certainly one possibility.

An ageing population has important implications for how a society thinks and acts on risk and innovation. We know, for example, that entrepreneurs are more likely to be in their 30s or 40s. Younger workers also tend to take up newer technologies at a faster rate than older workers. Older workers tend to become more risk-averse when it comes to investment decisions as they approach retirement.

According to the RBA's deputy governor Philip Lowe, “this higher risk aversion of older citizens means that as the population ages, access to capital for more risky firms, especially start-ups with little business history, is likely to be more restricted and more expensive.”

In addition Lowe notes that “if ageing societies become inherently more risk averse and less supportive of innovation … then we are likely to face a greater challenge than we have to date in generating productivity growth.”

This may be offset to some extent by the fact that an older workforce, on average, creates an incentive for businesses to find and implement labour-saving techniques. So far though, this doesn't seem to have had much effect on productivity of workplace technology.

It's also worth noting that Australia's relatively good demographics – that is, the fact that our demographics are not as bad as other developed economies – could be viewed as an opportunity. If an ageing population hits productivity growth then surely it will hit other economies more forcefully than it does here. In theory, that could support the competitiveness of those Australian firms who compete in global markets.

How this translates into market performance is a little unclear. It clearly puts pressure on stocks that operate in the retail space and I'd expect the relative performance of those stocks to be worse than they have been in the past.

But we also know that markets are highly distorted at the moment; relying less on fundamentals and more on monetary policy and expectations surrounding monetary policy.

As such, the observation that retail stocks face structural headwinds is perhaps not as actionable as it would have been in a pre-crisis economy. Nevertheless, if the influence of monetary policy on global stock markets begins to diminish then investors should be aware of the influence of an ageing population on the performance of Australian and global equities.