Can Australia avoid a confidence death spiral?

| Summary: Persistently low confidence is the real problem with the Australian economy and its effects can be incredibly destructive...but there is hope. |

| Key take-out: Australia is staring down a confidence death spiral, but a lift in building approvals could be the push needed to curb our obsession with a downturn. |

| Key beneficiaries: General investors. Category: Economics and strategy. |

“…Much depends on ‘confidence’ – that intangible thing that is hard to measure and very hard to increase. We are talking here about confidence that the future will be characterised by growth, that there will be customers for products, that innovations are worth a try, and so on. That confidence seems pretty subdued right now.” Glenn Stevens, governor Reserve Bank of Australia (July 3, 2013)

No one should fool themselves into thinking that there is too much wrong with this economy outside of low confidence. Much of the RBA governor’s speech this week dealt with that issue – such is its importance – and he noted the effects of it – ‘unusually low non-mining and dwelling investment’. Indeed the sharp decline in consumer spending since the middle of last year is probably the best place you can see, first hand, just what the RBA governor is talking about. How destructive it is.

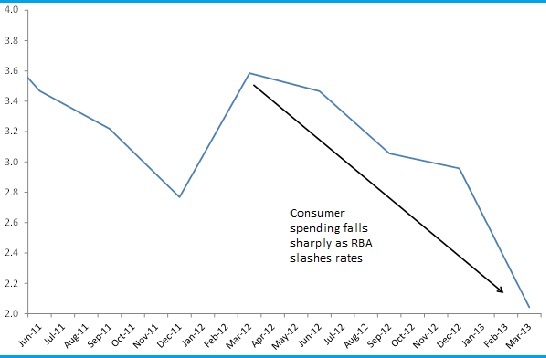

Chart 1: Australian consumer spending drops!

Up until about the middle of last year, consumer spending was growing at a solid clip, supported by low unemployment, decent income growth, record wealth and very low interest rates. Consumer confidence wasn’t all that high, and had in fact declined after the market began pricing in an RBA easing cycle – but at that point this hadn’t impacted spending. The change came when the RBA slashed rates by 75bp over two meetings in the second quarter and backed it up again with another 50bp in the fourth quarter. You can see from the chart that spending dropped even further from there and currently sits well below average, despite the extraordinary support from spending fundamentals I mentioned above. People were visibly spooked that the RBA felt the need to cut rates so aggressively when there was seemingly little wrong with the economy.

Still, others suggest consumer spending slowed under the weight of high debt and that it was this that restrained spending. Yet this can’t be right. Debt levels, contrary to popular opinion, are actually very low for the majority of Australians (two-thirds have little-to-no debt). It’s only a small proportion of households that hold very large amounts of debt, thereby distorting the national average. And in any case, it doesn’t explain the strong rates of spending growth that we saw in the two years to June 2012, nor the high rates of saving – why ‘save’ when you could pay off your mortgage.

More recently, the monthly retail spending numbers, while generally not a good guide to overall consumer spending, suggest that consumers have actually cut back on spending even further over the last three months – with spending falling on average by 0.2% per month. Contrast this with the US, where consumer spending is undergoing a resurgence despite a much higher unemployment rate, and mortgage rates are not too much lower than here.

Confidence is bad, and getting worse it seems. And this is a direct threat to my medium-term optimism – one of the key, real risks. Adding insult to injury, Moody’s reckons that the recent decline in the Australian dollar is a negative credit event for retailers, given the slump will make goods more expensive – in particular petrol. As I’ve noted before, the falling dollar actually makes us poorer! It lowers our income and unfortunately consumer spending accounts for two -thirds of the economy.

So with there being no ‘lever’, in Governor Stevens’ own words, that policy makers can use to lift confidence, what, if anything, can? Because at the moment we’re headed for a confidence death spiral – with all the real economic implications that brings.

With the current state of play as we know it now, I actually think much rests on another economic release we saw this week: building approvals. They actually fell for the month of May – which is the latest number – about 1% or so, but prior to that there actually had been signs of a pretty decent pick-up.

This matters a lot. For consumers, one of the biggest dead-weights on confidence is job security. So far the media have put in a great effort to scare everyone by reporting any and every job loss, while at the same time ignoring any job increases. And there must be job increases because the statistician reports that there have been 124,000 jobs created over the last year. Still, and notwithstanding the sharp lift in employment, most economists look for an increase in the unemployment rate to 6% or above, although I’d note that the unemployment rate was already expected to be 6% or so at the end of last year.

This is where building approvals are critical. The construction industry itself is one of the biggest employers in the country – over 10% of the workforce. One million people. Now, much is often made of the mining investment boom, but the fact is that only a very small percentage of people in the construction industry are employed to build mines and gas platforms etc., about 7%, which means that 93% are employed for residential and non-residential building. In terms of actual construction residential is the biggest employer. Another way of thinking about it is that only 0.7% of the workforce is employed to build mines and gas platforms etc.

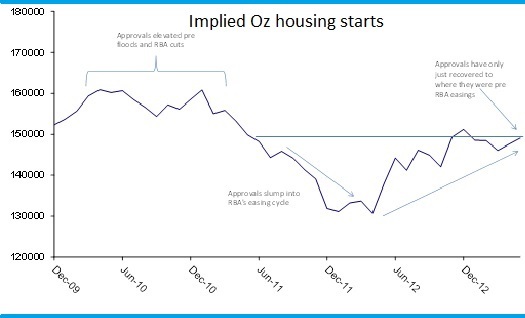

Now take a look at chart 2. While approvals may have fallen in the latest month, adding to this sense of impending doom, the recent uptick more broadly suggests that housing starts are set to pick up quite sharply (assuming 95% or so of approvals translate into starts). At the moment the number of starts will probably be around the 150,000 figure. That’s well down from the peak in 2002 (near 200,000), but it’s off the GFC low of 108,000 – and a good way above the recent low in 2012 of just over 120,000.

Chart 2: Implied housing starts - Australia

This is an incredibly positive signal given how labour intensive the industry is, not to mention the positive boost to employers in associated industries – manufacturing construction services etc. I appreciate that economists are increasingly pessimistic on the employment outlook. But the reality is, if you see a solid lift in housing starts, as suggested by recent approvals numbers, this will do much lift the labour market, especially as workers switch from engineering construction work to more residential stuff – they’ll be easily absorbed.

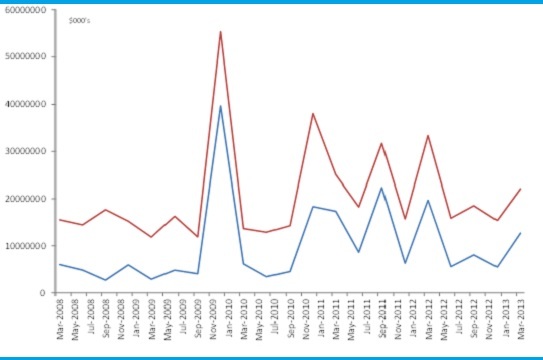

In any case, there may not even be a pool of labour to absorb from the end of the mining boom. Chart 3 shows the amount of work commenced in the first quarter in the engineering construction space – most of which is gas etc.

Chart 3: Engineering construction commencements

You can see from the chart that work commenced actually increased for the quarter, despite all the talk about an end of the mining boom. It’s very volatile though and you can see once again there was this sharp drop off in activity in the second half of last year. Confidence certainly took a beating last year.

So can we avoid a confidence death spiral? I think we can but we are at a critical juncture. I showed on Wednesday that international investors are very bearish Australia and this is a very recent development. They’re not going to be interested in our market until the Australian dollar stabilises, wherever that is – we don’t know what target exchange rate industry and policy makers will be satisfied with. Similarly most of the country is obsessed with a downturn here – it is the market psychology already. This doesn’t bode well. However, if building approvals can continue to rise, despite all the headwinds faced in terms of confidence, I think this might just be the jolt required to break this country out of its own psychological malaise.