Calm before a deathly debt storm

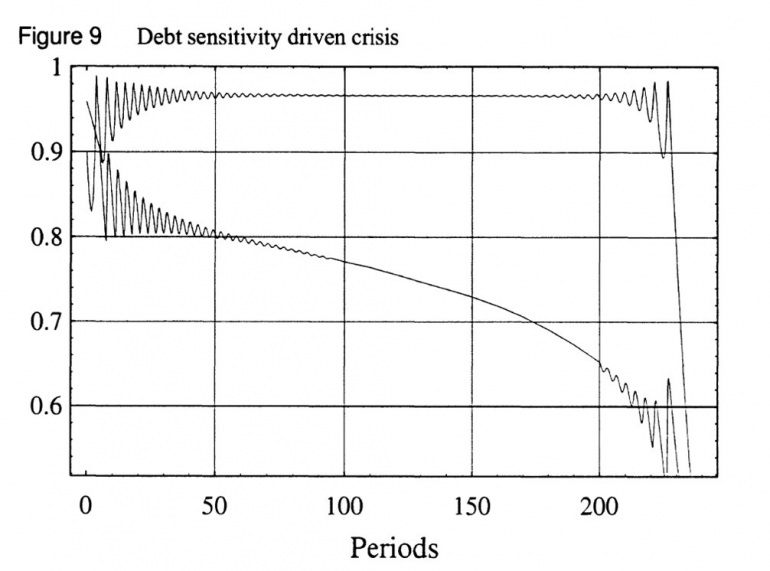

In 1992, I built a model of Minsky’s ‘Financial Instability Hypothesis’ that simulated the debt-induced breakdown he argued could happen in a capitalist economy. But it also had an unexpected feature: the breakdown was preceded by a period of apparent stability. Initial volatility gave way to a period of tranquillity, which was then followed by increasing volatility and finally a breakdown (see Figure 1: the two variables are the employment rate and the wage share of GDP):

Figure 1: Volatility gives way to tranquillity, only to be followed by breakdown (Figure 9 in Keen 1995)

This wasn’t a prediction from Minsky’s verbal model of financial instability, it was an unexpected outcome of a mathematical model. But the phenomenon of decreasing volatility leading to breakdown was so peculiar that I highlighted it in the paper I wrote about the model (which was published in 1995):

“From the perspective of economic theory and policy, this vision of a capitalist economy with finance requires us to go beyond that habit of mind which Keynes described so well, the excessive reliance on the (stable) recent past as a guide to the future. The chaotic dynamics explored in this paper should warn us against accepting a period of relative tranquillity in a capitalist economy as anything other than a lull before the storm.”

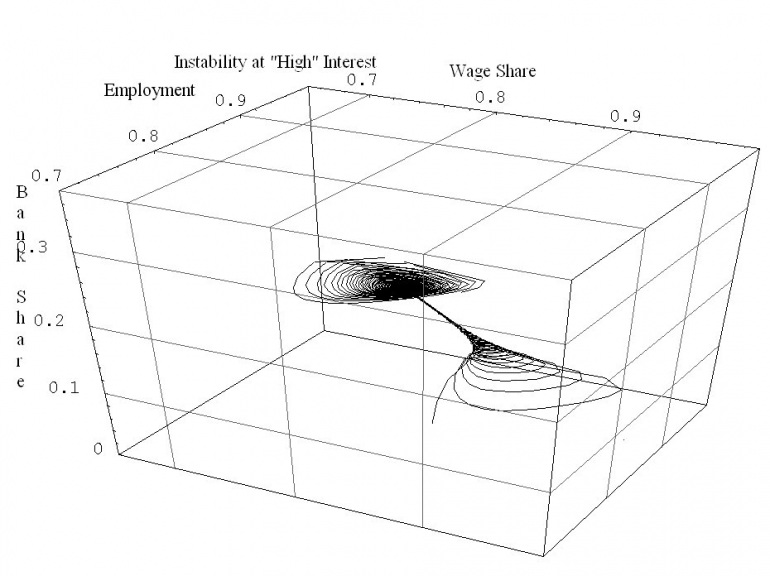

The driving factor in this model -- and one that is omitted in all mainstream neoclassical economic models -- was the ratio of private debt to GDP. This third dimension gave some perspective on the dynamics behind this process -- it showed the economy being sucked into a vortex of rising debt -- but the phenomenon of apparently rising tranquillity followed by a breakdown still remained mysterious.

Figure 2: A rising vortex of debt. (Figure 8 in Keen 1995)

The pattern certainly didn’t fit the data from the decades leading up to 1992, which had been of rising volatility in unemployment -- though inflation had been beaten out of the economy by Volcker’s sky-high interest rates in the early 1980s. When I developed the model, US unemployment was still rising -- though more slowly than in previous recessions -- and there was no guarantee that it wouldn’t peak at a higher level than in 1983 (see Figure 3).

Figure 3: Rising volatility in the recent past circa 1992

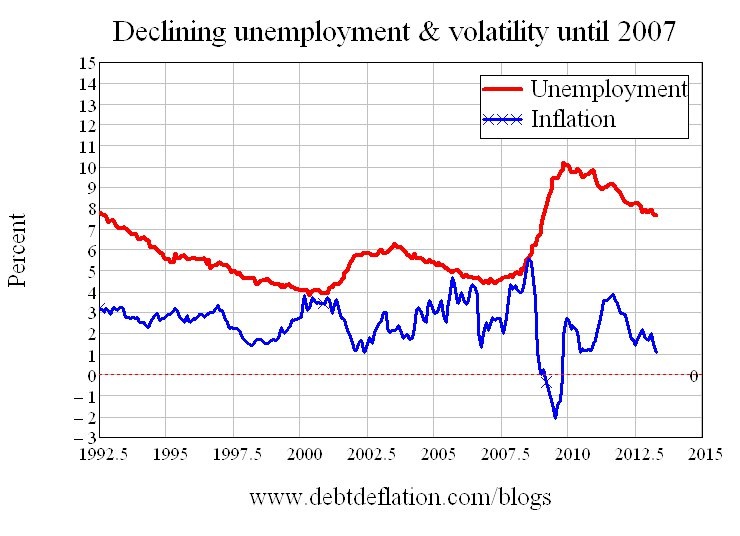

As it happened however, mid-1992 was the peak for unemployment in a recession that the US National Bureau of Economic Research later said ended in March 1991, and from then on the pattern seemed to be one of decreasing volatility -- until the economic crisis began in 2007 (see Figure 4).

Figure 4: 'The Great Moderation'

Conventional economists like Ben Bernanke saw this as a wonderful thing, and not only eulogised what they termed ‘The Great Moderation’, but even took credit for it -- arguing that it was due to better management of monetary policy.

In 2004, Bernanke said: “The low-inflation era of the past two decades has seen not only significant improvements in economic growth and productivity but also a marked reduction in economic volatility, both in the United States and abroad, a phenomenon that has been dubbed "the Great Moderation." Recessions have become less frequent and milder, and quarter-to-quarter volatility in output and employment has declined significantly as well.

“The sources of the Great Moderation remain somewhat controversial, but as I have argued elsewhere, there is evidence for the view that improved control of inflation has contributed in important measure to this welcome change in the economy.”

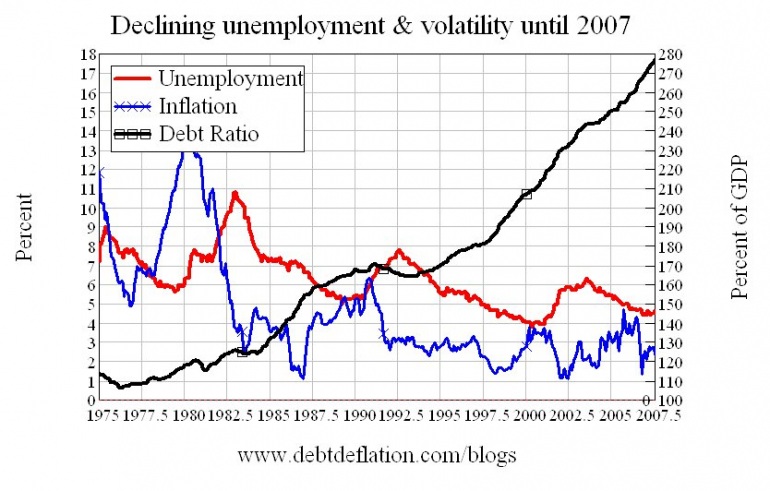

My Minskian perspective made me rather less sanguine about this period, especially when in late 2005 I added the debt to GDP data to this picture -- and saw a fair to middling replica of my Minsky model staring back at me (see Figure 5; it didn't look quite that bad in 2005, because I didn't then have financial sector debt data -- which added a whopping 100 per cent of GDP more debt to the mix. But the trends in the data were still ominous enough to make me expect that a debt-deflationary crisis was imminent, both in the US and Australia -- the only two countries for which I then had data).

Figure 5: A debt spiral with declining unemployment and inflation

That was what motivated me to go public with warnings of an imminent economic crisis -- especially since the dominant neoclassical sect in economics was blithely advising politicians the world over that the economic outlook was excellent. My all-time favourite on this front remains the OECD’s Economic Outlook, which was also published (in preliminary form) in May 2007. In an editorial titled Achieving Further Rebalancing, its chief economist reassured readers that the OECD’s neoclassical economic models foresaw a tranquil future:

“In its Economic Outlook last Autumn, the OECD took the view that the US slowdown was not heralding a period of worldwide economic weakness, unlike, for instance, in 2001,” it said. “Rather, a “smooth” rebalancing was to be expected, with Europe taking over the baton from the United States in driving OECD growth.

“Recent developments have broadly confirmed this prognosis. Indeed, the current economic situation is in many ways better than what we have experienced in years. Against that background, we have stuck to the rebalancing scenario. Our central forecast remains indeed quite benign: a soft landing in the United States, a strong and sustained recovery in Europe, a solid trajectory in Japan and buoyant activity in China and India. In line with recent trends, sustained growth in OECD economies would be underpinned by strong job creation and falling unemployment.”

There’s been some revisionist debate on Twitter (see Figure 6) & the blogosphere of late on whether or not I and other non-neoclassical economists (such as Wynne Godley, Michael Hudson and Ann Pettifor) did actually warn of the crisis before it happened, so here’s what I had to say about the future economic outlook in May 2007: (about 18 months after I began making warnings):

“So how do I justify the stance of a Cassandra? Because things can’t continue as normal, when normal involves an unsustainable trend in debt. At some point, there has to be a break -- though timing when that break will occur is next to impossible, especially so when it depends in part on individual decisions to borrow…

“At some point, the debt to GDP ratio must stabilise -- and on past trends, it won’t stop simply at stabilising. When that inevitable reversal of the unsustainable occurs, we will have a recession.”

Figure 6: Twitter wars

I also ramped up the effort to overcome the many deficiencies in that 1992 model -- especially the fact that it could generate a debt crisis, but not a debt-deflation, because it had no pricing equation in it.

Making that extension properly also required going beyond a model with debt but not money (which is similar in that sense to the DSGE model in Eggertsson and Krugman 2010) to a strictly monetary model. Once I had that, I had the dilemma of developing an equation for how prices are set.

If I were neoclassical, I would have shoved in a ‘marginal cost equals price’ (freshwater school) or ‘marginal cost equals marginal revenue’ (saltwater school) assumption here -- both of which are empirically and logically false. As a post Keynesian, I could have shoved in a mark-up pricing equation, but that felt like a fudge: I preferred to try deriving the pricing equation from model itself.

Here I found myself in a bind. The one way I could do that was to argue that the price level would adjust under the pressure from the flow of monetary demand on one side, and the pressure of physical supply on the other. This isn’t the same as neoclassical supply and demand -- which wrongly assumes that the ‘supply curve’ is given by (marginal) costs and the ‘demand curve’ by (marginal) revenue, and it imagines that prices are set in either a timeless equilibrium (freshwater school) or a friction-delayed convergence to ‘marginal cost equals marginal revenue’ (saltwater school).

But having spent four decades railing against neoclassical thinking, it felt like a defeat to start from ‘let’s assume prices adjust to supply and demand’. I was reminded of Karl Marx’s observation about David Ricardo on this point, when he argued that Ricardo’s “labour theory of value” relied upon the price of labour being driven down by Malthus’s ‘Iron Law of Wages’ so that in equilibrium, labour received a subsistence wage.

Marx, who had his own solution to this dilemma, enjoyed pointing out Ricardo’s problem:

“But why? By what law is the value of labour determined in this way? Ricardo has in fact no answer, other than … the law of supply and demand … He determines value here, in one of the basic propositions of the whole system, by demand and supply -- as Say notes with malicious pleasure."

Great. But I grit my teeth and gave it a go. And I got the surprise that I’ll detail in the next post in this series.

This is the fourth article in a series titled Is capitalism inherently unstable? See earlier articles here, here and here.

Steve Keen is author of Debunking Economics and the blog Debtwatch and developer of the Minsky software program.