Busting the bust myth

PORTFOLIO POINT: The prospects for strong growth inside and outside of the mining sector are signals that the economy will bounce back strongly in the medium term.

Take that! Lots of talk about it, but let’s face it folks there’s still no signs of the impending mining investment bust.

We got confirmation of that last week from three separate sources, all of which firm up my view that the mining boom isn’t about to peak. Two key takes. Firstly, it looks like investment will make another very strong contribution to GDP this year. Secondly, expectations are that investment will be strong next year as well.

The estimates of economists will vary according to what adjustment factor (provided by the ABS) they used, but using the five-year average, Thursday’s capital expenditure survey shows that mining companies expect to lift investment a further 19% next year after a 75% increase last year. Sure, that is down from an estimate of 33% in the June quarter, and some people have made a big deal about that being the largest downgrade on record. For me that’s a meaningless observation when you are still talking about an increase of nearly 20% to a new record. It completely misses the big picture.

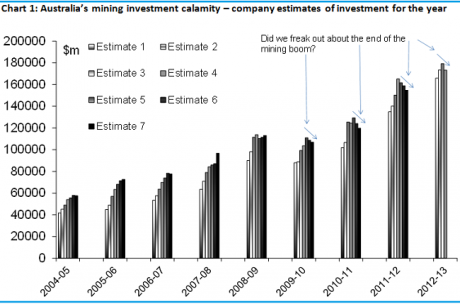

In any case, as you can see from the chart, downgrades to investment intentions are normal as we come into the year end. So from estimate 1 to about estimate 4 or 5, companies basically lift their expectations of how much they can investment in the year. Come to year-end and it’s not unusual for that to be downgraded due to weather, costs, whatever. That doesn’t mean the boom is about to end.

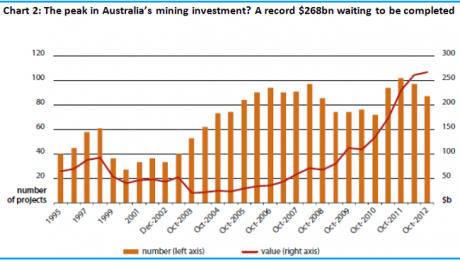

Added to that is the fact that there is, according to estimates last week, still $268 billion in committed investment projects – an upgrade from previous estimates and over three-times the amount of mining investment completed over the last year. That was itself a record. Have a look at chart 2 (from the Bureau of Resource Economics) as a reminder.

Notice how the number of projects fluctuates, but each fluctuation on the downside doesn’t mean the boom has ended. For instance, were we talking about the end of the boom in 2012-11? No. Also, don’t forget there’s another couple of hundred billion at the less advanced stage in addition to the above. As I discussed in my note of November 12 Heading into a 2013 boom, we’re not near a peak.

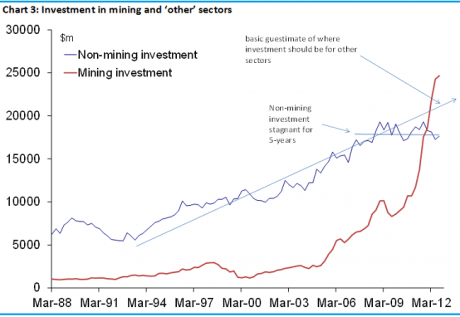

Anyway that wasn’t the most exciting aspect of the data in my opinion. Have a look at chart 3.

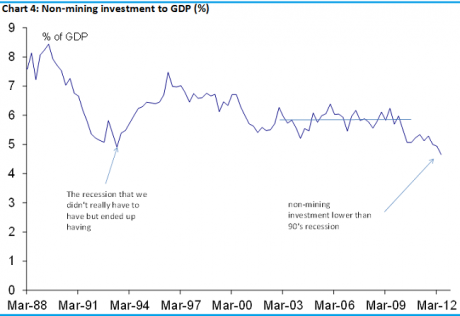

It’s not the sharp rise in mining investment that I want to draw you attention to, although it is impressive. It’s the lack of any action in the non-mining space, that 90% of the Australian economy that’s doing nothing in the way of planning for future growth. The chart shows that for the last five years investment has flat-lined – done nothing. Over that same period the economy is 30% bigger (these are all nominal figures). So, in relative terms, you are looking at a fall of around 30%. In fact, chart 2 shows that investment as a proportion of GDP is lower than the recession that we didn’t really have to have in the 1990s.

What’s driving it? A collapse in investment in equipment, plant and machinery. Some may say that companies simply don’t have the cash – there is a non-mining recession after all – but this isn’t true. Consumers are still the biggest contributor to economic growth by far, and the fact is that over that five-year period we’ve seen a 20% lift in non-mining revenues and a 15% lift in profits. These growth rates are lower than the pre-GFC, credit-fuelled boom years, but still not so bad as to justify such a slump in investment.

In truth, I suspect this may have something to do with why the Aussie sharemarket was, and is, underperforming global peers rather than the Australian dollar. How can investors be expected to have faith in prospects if companies aren’t willing to invest in their own future?

Now the good news is that this isn’t a situation that can last forever – over time, lazy or fearful boards/executives get weeded out. Investors want people with vision, boards who plan for growth, not those who destroy shareholder value. We’ve already seen a bit of action on this front over the last year, and my prediction is that this process will accelerate in 2013. That’s especially the case given the European crisis has calmed somewhat and is unlikely to flare up to the extent we’ve seen.

That being the case, the prospects for growth are huge. You can see that after the previous low in the 90s recession, when non-mining investment went on to spike to over 70% over the next couple of years. If investment to GDP only reaches the 2005 peak, then that’s still a 50% lift in non-mining investment from today’s level.

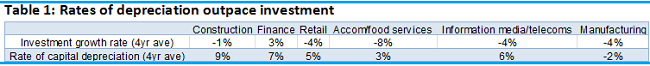

Indeed, it could be that we are witnessing the lift now. It’s too early to say for sure, and I don’t want to overstate it, but there was a sizeable upgrade in investment intentions outside of mining and manufacturing this quarter (still about 80% of the economy) of about 17%. The fact is, rates of depreciation have been far in excess of investment rates for many industries over the last few years (just take a look at table 1 below), and this isn’t sustainable.

Now this is all terribly important because, and as I discussed in my note Heading into a 2013 boom, there isn’t a lot standing in the way of an extraordinarily strong year next year.

Now maybe I’m going to be out on my timing, but on paper at least the planets are all aligned. We’ve got solid consumer spending, the mining boom, ample scope for a sharp and much-needed pick-up in housing construction and, as I’ve highlighted today, non-mining investment is lower now than during the 90s recession, which provides plenty of scope for a turnaround here also.

You simply will not, and cannot, get a better fundamental picture than that. It’s all good, and the only thing that can stop it in my opinion is stupidity, or an absence of leadership to be more polite. Unfortunately there is no shortage of that.