Busting myths on the system costs of renewables

This is a response piece to an article published on Climate Spectator yesterday.

Bloomberg’s recent study showing that wind power is now cheaper than coal has sparked a flurry of interest, including criticisms that the analysis doesn’t include the “system effects” of integrating variable renewables such as wind and solar.

A recent report by the OECD and the Nuclear Energy Agency suggests that these system costs could be substantial, as much as an order of magnitude higher than for dispatchable technologies. Is there any substance to this claim?

Let’s explore the four components they outline in their report:

Back-up costs (adequacy)

This argument claims that since wind and solar PV do not provide “firm” capacity to the system, additional “back-up” generation will be required to ensure reliability, and that wind and solar generators should pay an additional premium to cover this cost. However, in trying to quantify this cost they’ve asked the wrong question. Instead, we should identify exactly what each technology provides to the system and reward them for that (and that alone) appropriately. Penalties should only be applied when a generator has actually caused a problem, rather than simply failed to provide a benefit.

Wind and solar PV provide large quantities of energy, but they provide much less capacity to contribute to system reliability. Dispatchable generators, by contrast, provide firm capacity as well as energy. Capacity and energy can thus be thought of as different market services, with each rewarded depending upon the supply and demand in each market.

This framework is obvious in markets that have a capacity market, which explicitly rewards dispatchable generators for the capacity they provide. Similarly, in the NEM the wholesale spot price is allowed to rise to the extreme market price cap of $12,900/MWh. This provides a very generous reward to those generators that are capable of supplying at that time (i.e. providing firm capacity).

If there is a lack of firm capacity in the system this hasn’t been caused by the renewables, it’s simply indicating that insufficient dispatchable generation has been installed. You fix this problem by ensuring an adequate price signal to reward firm capacity, not by penalising renewables.

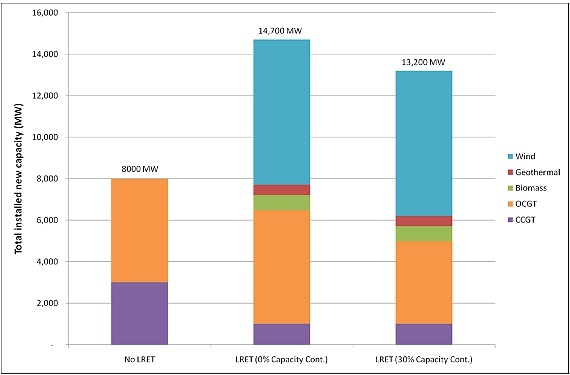

It’s also worth pointing out that renewables are actually likely to decrease the generation cost of the remaining system. Modelling indicates that investment in renewables allows the installation of more Open Cycle Gas Turbines (OCGTs) and less Combined Cycle Gas Turbines, as illustrated in Figure 1.

OCGTs have a significantly lower capital cost, and also run less frequently, reducing gas usage. This results in significant savings for the remaining system, amounting to around $5/MWh of wind generation.

Figure 1- Installed new capacity in the NEM (2020)

Source: ROAM Consulting report to the Clean Energy Council, “The true costs and benefits of the enhanced RET”, 25 May 2010.

It is also worth noting that investment in any kind of new capacity presupposes that you have insufficient installed capacity to begin with. With peak demand going down, the NEM is actually oversupplied with capacity at the moment. This makes the idea of ascribing the cost of any kind of “back-up” generation to renewables particularly inappropriate.

Finally, the authors claim that system adequacy will be threatened by renewables driving the wholesale market price to very low levels, sending dispatchable generators out of business. As discussed in this previous Climate Spectator article, this is unlikely to be a problem for the NEM, so long as we are prepared to increase the market price cap appropriately such that dispatchable generators are suitably rewarded for their availability.

So, we can conclude that this aspect of the “system management costs” calculated by the OECD/Nuclear Energy Agency report is “mythbusted”.

Balancing costs

Balancing costs relates to the management of variability, ensuring that supply matches demand within each dispatch interval. In the NEM this is managed through the Frequency Control Ancillary Service (FCAS) market for “Regulation”.

Regulation costs will depend upon the penetration level of variable renewables. At low penetration levels the variability of renewables will be less than the variability of demand, and can therefore be managed with the existing system at no (or minimal) additional cost. As the quantity of wind and solar PV increases, the total variability will eventually exceed the variability of the demand, at which point additional regulation services will be required.

At moderate levels this is likely to be available from the power system at a reasonably low cost. As the penetration of wind and solar PV escalates, the cost of procuring additional regulation services will grow.

However, in the NEM regulation costs are low. The NEM features an excellent market for FCAS (one of the best in the world) which provides these services competitively and at low cost.

Most importantly, in the NEM, wind farms and solar generators already pay for regulation costs. Regulation costs in each dispatch interval are borne by the generators and demands that cause frequency disturbances. This includes wind and solar PV generators.

At the moment the cost of procuring regulation from the market is very low. However, in future, wind and solar PV generators may choose to minimise their variability to minimise these costs (when they become significant enough to justify this action). Thus, the market should already act to appropriately incentivise the right behaviour.

We should also acknowledge that large thermal units also have system management costs of this kind attached. Large contingency reserves must be maintained on the system at all times so that the system can recover from the sudden loss of a large unit. Six separate FCAS markets are managed in the NEM solely for this purpose.

In conclusion, we find that the balancing costs ascribed by the OECD study could be ballpark correct, but most importantly they are already paid for by the wind and solar PV generators. Therefore these costs are already internalised in their decision making.

Grid connection

Grid connection costs will vary from project to project, but it is incorrect to assume that renewable resources are necessarily remote from the existing grid. Many wind sites are likely to exist in reasonable proximity to the grid, and solar PV even more so.

Importantly, in the NEM, generators already pay for their network connection, so again, this is already internalised in their decision making. Developers can decide to forgo the best quality wind and opt for a slightly lower quality resource that is in close proximity to the grid, minimising connection costs. They are already taking this into consideration.

Grid reinforcement and extension

Significant grid reinforcement and expansion is going to be required in the NEM any scenario if demand returns to a growth trajectory (which AEMO is projecting). Modelling has shown that yes, significant grid investment is required with growth in renewables. But it’s also required if we invest in other types of generation to meet growing and changing demand. The cost difference between the scenarios is less than the uncertainty in the modelling.

In the OECD/Nuclear Energy Agency study, no grid reinforcement costs are attributed to dispatchable technologies “owing to the consideration that those power plants can be located in proximity to load centres”. However this is clearly not the case. Coal-fired generators are typically located next to the coal mines that supply them, which has resulted in transmission highways to rural areas such as the south-west of Queensland, the Latrobe Valley and the Hunter Valley. Similarly, nuclear power, were it ever developed in Australia, could be expected to face significant “NIMBY” pressure to locate remotely from populated areas.

So we can conclude that the OECD/Nuclear Energy Agency study is attempting to create a problem where none exists. The current market design already includes all of these factors. If, and when, these integration costs become significant, the market will take them into account and respond appropriately. For now, we can relax.

Dr Jenny Riesz is AECOM senior consultant in Energy Strategic Advisory. The views expressed above are her own not those of AECOM.