Bond investors can keep calm and carry on

Fixed income markets have been unsettled since May, when hints by the Federal Reserve of an eventual reduction in quantitative easing triggered an abrupt rise in rates. Although the Fed ultimately decided not to alter their QE program in September – and more importantly, indicated that it will maintain its near-zero policy rate until at least 2016 – confidence in bonds has yet to be fully restored. Many are left wondering what to make of a period where fixed income returns were generally negative.

This has been particularly true of individual investors, many of whom are exiting bond markets and “waiting it out” in cash. In the process, however, they’re also forgoing an asset class that may have helped them meet such essential long-term objectives as capital preservation, income, steady returns and portfolio diversification. These benefits will be more desirable than ever as Baby Boomers move from asset accumulation toward managing a sustainable income stream in retirement.

At the heart of these decisions lies a simple question: What’s going to happen to bonds – particularly the core, quality-oriented securities that anchor many portfolios – when rates rise? Fortunately, past experience can provide valuable insight.

Bigger building blocks

Most investors are familiar with the bond “seesaw” showing the inverse relationship between bond prices and yields. While the two are obviously interdependent, the reality for investors is more nuanced.

In fact, despite the potential for short-term discomfort, rising rates should be welcomed by long-term investors, particularly in this era of historically low yields. This is due to the fact that interest income is the primary driver of bond returns, and the ability to reinvest into a gradually rising rate environment can actually increase returns, helping to build wealth over time. In other words, by reinvesting the income and proceeds of your maturing bonds in securities that pay a higher coupon, you are increasing the income you receive, and your future growth potential. (It should be noted that this benefit doesn’t extend to equities. Rising rates increase corporate borrowing costs, putting pressure on both profits and the stock price.)

This leads to the mathematical truth that if you are a long-term investor, you should be hoping for rates to rise gradually from the current low rates, as your long-term returns will likely be higher, not lower.

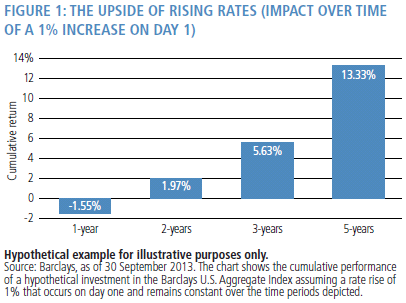

An increase in a bond portfolio’s income also helps offset the other end of the seesaw, price declines. This rebalancing is often achieved quite quickly, as Figure 1 shows: Assuming a rate rise of 1 per cent, a negative return in year one can turn positive by year two, and over time could provide a boost to returns.

The worst-case is not so bad

The summer’s volatility came as a shock to many bond investors, particularly those new to fixed income markets who perhaps assumed that bond prices never go down. With memories of the financial crisis still fresh, selling begat selling, leading to a 3.67% decline in the Barclays U.S. Aggregate Index from May 1st to August 31st, before rebounding in September.

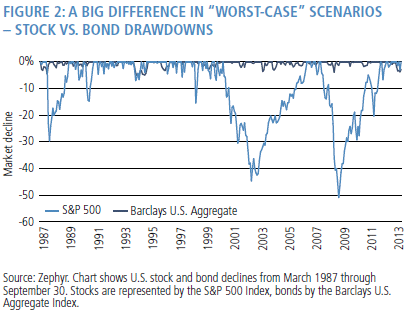

Yet even at their most turbulent, bond prices are nowhere near as “bubbly” as stock prices – neither on the upside nor the downside. As a result, core bond declines have typically been much less severe and quicker to recover, as Figure 2 shows. Consider these “worst-case” scenarios: The sharpest calendar-year price drop for bonds was 3%, in 1994. Meanwhile, stocks, as we well recall, had their worst year in 2008, sinking 38% – a significant decline in wealth that can be difficult to recover for those close to retirement. Bonds’ relative steadiness is one of the primary reasons investors have relied on fixed income to anchor their portfolios.

Cash “safety” has a price

Clients concerned about bond volatility may be tempted to abandon the market until prices stabilise. Indeed, from May through August some $US43 billion left US taxable bond funds (Strategic Insight), and moved largely to cash and money markets. While the positive nominal return from these assets may be reassuring, it’s also important to recognise that there are trade-offs.

Nominal yields on cash-equivalent instruments are negligible – 3-month Treasury bills returned around 0.05% in late October – a level unlikely to improve as long as the Fed maintains its target rate at zero (likely until 2016). Furthermore, real returns are negative even at today’s paltry inflation rates: over the past decade, an investment in three-month Treasury bills provided an annualised real return of –0.77% as of September 30. That’s a steep price to pay for perceived safety.

Moving farther out on the yield curve, to high quality short- and intermediate-term bonds, may entail some additional risk. But over time, the positive effect of compounded real total return can be significant, and possibly the difference between meeting your financial targets or falling short.

“Carry” on, beyond duration

Finally, where are we in terms of interest rates? Rates have already begun to normalise from the summer turbulence, and as I mentioned earlier, the Fed has indicated that it will not begin raising its policy rate until 2016, which should certainly provide stability to the front part of the yield curve. Thus, to the extent that rates rise, Pimco believes it will be slow and gradual – an ideal environment for long-term investors.

At the same time, yields have little room to fall further, meaning that duration, or interest rate risk, will no longer be the dominant driver of bond returns. Today’s “market of bonds” is undergoing a sea change, one in which investors will need to de-emphasize duration and tap into other sources of value to boost their portfolios’ return potential. These diverse forms of yield, or “carry” – which include premiums earned from credit quality, yield curve roll down and currency exposure, among other risk factors – will be increasingly important tools for fixed income managers as they nimbly work to adapt to and profit from today’s evolving rate environment.

Jon Short is a managing director, head of wealth management at Pimco's New York office.

This article originally appeared on Barrons.com on 4 November 2013. Reproduced with permission.