Boarding the ETFs boom

| Summary: Exchange-traded funds are gaining popularity among Australian equities investors, with net inflows more than doubling in 2013. New funds are in the wings for 2014, including more offshore ETFs, but investors should be aware of the tax consequences of some international funds. |

| Key take-out: "Smart beta" ETFs, which invest in indices using methodologies to target specific investment themes, are attracting more investor interest and will continue to emerge in the Australian market. |

| Key beneficiaries: General investors. Category: Shares. |

Exchange-traded funds (ETFs) continued their growth in 2013, fuelled by a number of factors.

One of the major ones was the steady improvement in the health and returns from key investment markets here and abroad. With these trends set to continue in 2014, understanding the opportunities, benefits and risks around ETFs will be a handy tool for investors.

The range and style of ETFs available now to Australian investors combine the traditional benefits of ETFs (low cost, transparent investment rules, tax efficiency and liquidity) with some newer investment themes (like high dividend portfolios), allowing investors to tilt their portfolios to suit their specific needs.

What's on offer

The Australian ETF industry now manages over $10 billion of assets from a range of global and Australian specialist providers (a full list of ETF issuers is available at www.asx.com.au ). This represents an increase of 55% in 2013, with rising valuations as well as net inflows accounting for this rapid growth. Net inflows into Australian ETFs increased by 180% in 2013, a massive outperformance compared to the modest 18% net inflow increase into traditional retail managed funds in the same period.

Short-term traders also increased their usage of Australian ETFs, with turnover up by 33% in 2013. Over 97% of the new inflows into Australian ETFs were garnered by three ETF issuers: iShares, Vanguard and BetaShares. Table 1 shows the most popular Australian ETFs in 2013.

Table 1: Top 10 ETFs by FUM in 2013 |

||

|

ASX code |

ETF |

$FUM |

|

STW |

State Street SPDRS ASX 200 |

2.2bn |

|

IVV |

I Shares S&P 500 |

1bn |

|

IOO |

I Shares Global 100 |

550m |

|

VAS |

Vanguard Australian Shares |

500m |

|

GOLD |

ETF Securities Gold |

441m |

|

SLF |

SPDRS LPT |

385m |

|

SFY |

SPDRS ASX 50 |

365m |

|

VHY |

Vanguard High Yield |

322m |

|

AAA |

BetaShares High Interest Cash |

314m |

|

IEM |

I Shares Emerging Markets |

309m |

Why so successful?

Australian investors (at least the "savvier" types who are up to speed with the nuances of this still relatively new form of investment product) have started to click to the use of ETFs to "access" their desired investment market/s - with over $1 billion flowing into the ETFs available in Australia that give exposure to US equities.

That's the simplest way to use ETFs, stemming from their core usage as a low-cost way to access the "beta" from a specific market or asset class. As the US economy continues its resurgence, there's no doubt ETF investors will continue to increase their exposure to US equities, including via ETFs. Similar patterns were seen last year as the Japanese equity market rallied, and may be expected to arise as the European economies come off their lows.

What's the catch?

One of the lesser-known quirks in the Australian ETF market stems from the large number of ETFs available on the ASX, but which in turn are also listed on overseas exchanges, which bring with them the need to comply with foreign tax and securities laws. Using a process pioneered by global companies like BHP, (whose Australian listed shares were then made available in the US through the listing of "depositary receipts" over them on the New York Stock Exchange), ETF issuers like iShares make their US listed ETFs available in Australia using the depositary receipt mechanism. This means that Australian buyers of these ETFs need to prepare and lodge US federal tax forms (and failure to do so means that US taxes are deducted from ETF distributions).

It's possible to overcome this compliance burden by only using ETFs listed on the ASX - which most large ETF players use as their issuance platform. State Street, for example, routinely lists its Australian ETFs on the ASX (even through it is US headquartered).

What's missing from ASX?

That's a hint of what is likely to be offered in 2014 - more Australian listed ETFs providing access to international markets. In parallel to the increase in availability of these simple "access" style ETFs, it's also likely that the new style of "smart beta" ETFs will continue to emerge in the Australian market.

I spoke about this last July in my article, Smart Beta ... you better know about it! Smart beta is easily defined as an ETF which invests in an index that is designed using quantitative-based methodologies to provide access to specific investment themes.

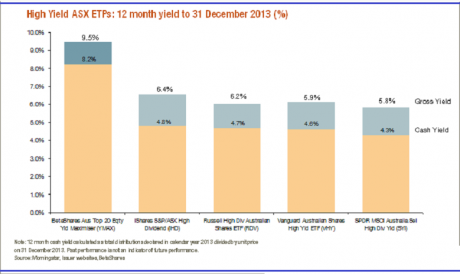

Unlike the "market capitalisation" method, which compiles indices based on the size and share price of the company, smart beta designs indices to set up specific rules around what to invest in. These smart beta ETFs are already available and popular on the ASX, with a range of equity income ETFs available. Table 2 shows the returns and profile of the most popular of these smart beta ETFs.

What might we expect next?

New issuers like Market Vectors have entered the Australian market and seem likely to offer ETFs with access to different markets and/or different styles than previously available. As other international equity markets start to recover, it's likely that new ETFs will be made available over them. Continuing the Australian investors' love affair with income, newer forms of smart beta ETFs with different mechanisms for producing income are likely to follow.

Are all ETFs more or less the same?

Yes, and no! The Australian Securities and Investment Commission uses strict rules to regulate the ETF market, To obtain the label "ETF", the investment must use the "managed investment scheme" format (with independent asset custodians and clearly defined investment rules).

Investors should note with caution that products can be labelled "Exchange Traded Products" - and look very much like an ETF - and yet can use derivatives and exotic technology that would not be possible under the ETF rules. Check also to be sure that the ETF you are interested to use is actually listed on the ASX (and unless you're comfortable, steer clear of US listed ETFs and the compliance complexity they create).

ETF's will continue to grow in popularity, style and the range of themes they make available. Given their lower cost and simplicity, it's little wonder these products continue to be popular.

Tony Rumble is the founder of the ASX-listed products course LPAC Online, a provider of investment training to financial services professionals. He provides asset consulting and financial product services but does not receive any benefit in relation to the product reviewed. Twitter: @TonyRumble.

* This article is part of the "It's Time" series in Eureka Report focussing on new opportunities for investors in 2014. Click here to see the entire series.