Billionaire Alex Waislitz's TOP stocks

Summary: Listed investment company Thorney Opportunities showcased three of its holdings at its recent AGM. Poppy grower TPI Enterprises pointed to strong growth in the narcotics industry. For superannuation fund business Diversa, all eyes will be on the team's ability to cross-sell services that attract higher fees to existing clients. TOP hopes Australian Renewable Fuels will finally live up to its potential. |

Key take out: The holdings of small cap managers like TOP can provide a great source of investment ideas that are regularly not covered by the larger institutions. |

Key beneficiaries: General Investors. Category: LICs. |

It was standing room only at the Thorney Opportunities AGM on Tuesday November 24. 2015 has been a good year for the young LIC, known as TOP. The net tangible assets increased by 23 per cent net of fees for the year putting daylight between TOP and the benchmark of the Small All Ords index.

More pleasingly for investors the market started to acknowledge this performance towards the back end of FY15 and increasingly so into the first quarter of FY16. Judging by the number of people at the AGM that trend may continue as hopefully it will be the performance that attracts more eyeballs rather than the names of the directors attached to the LIC.

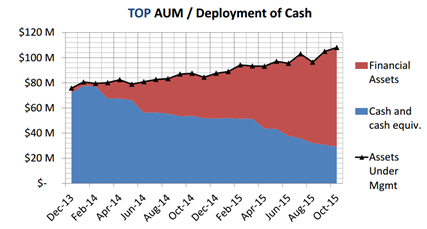

TOP is a growth story. The management fees from TOP are there to pay chairman Alex Waislitz and co to deploy capital into the best investment ideas they believe they can help add value to. From this slide used in the presentation we can see they have been doing exactly that.

With the share price closing the gap to NTA it would seem investors' confidence in the team's ability to pick opportunities is growing. It just needed time. I can see a time in the future where TOP will trade at a premium to NTA with investors willing to pay above and beyond for the growth story in an economy that commentators continue to talk down as a new low growth environment. Of course that relies on continued performance.

TOP is more than just a story about Waislitz. It is a story about the underlying businesses, many of which are not covered by the broader brokers. Remember that WAM Research chief investment officer Chris Stott says his fund looks for stocks that have little to no broker coverage (see Geoff Wilson's mid-cap play, August 3). “We like to be the first one at the party, not the last,” Stott said at the time.

A quick Bloomberg scan shows none of stocks held by TOP are covered by the larger institutions. The reason for this? The size. Why use resources on a stock if it only has a market cap of a few hundred million? A large institution can't get all of its clients into it. Institutions need to research stocks that are big, liquid and can generate brokerage across their whole book.

TOP invited the managing directors of three of its holdings to present at the AGM so investors in TOP could get better insight into them. I believe TOP was also trying to get the word out there more about these under covered stocks. Looking into the holdings of small cap managers like TOP can provide a great source of growth-focused investment ideas.

TPI Enterprises (TPE)

Sitting in the room, I got the sense that TPE chief executive Jarrod Ritchie's presentation was the most impactful of the three, even though it was last and the shortest. And so it should be: The stock has rallied over the last few weeks with some good announcements, rising above its listing price.

The grower of poppies and manufacturer of narcotic raw material is well positioned in a growing space. Ritchie commented: “We've seen enormous growth in this industry just servicing first world countries.” The next big growth story for the industry is in the developing world. There is a huge concern by the UN about the lack of supply for developing countries. The demand per capita is growing at a factor of three hundred.

TPE has a competitive advantage by way of capital costs with one facility that can produce 100t of narcotic raw material for $20 million compared to competitors with a cost of $100m-120m. One of the main reasons for this is the water-based process TPE uses compared to organic solvents widely used in the industry. They can extract the material at 50 per cent the cost of their competitors.

The completion of the Victorian site has allowed TPE to produce an additional 100t in an industry that consumes 1000t annually. TPE is one of only eight producers in the world in an industry that as you could imagine is highly regulated by the UN and federal and state governments.

The presentation was very light on with numbers and an outlook but the story certainly got the attention of those in the room. It already has TOP's attention with the LIC owning 6 per cent of the company.

Diversa Limited (DVA)

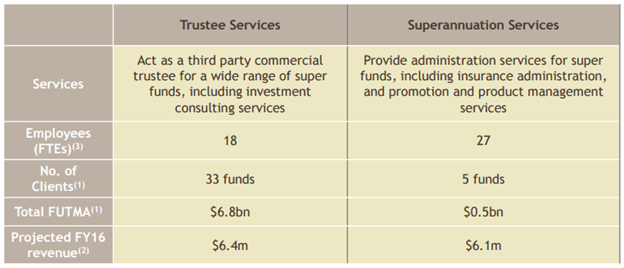

Vincent Parrott, the chief executive of superannuation fund business Diversa Limited was on hand to spruik his wares as well. In a highly competitive industry Diversa provides trustee and administrative services to superannuation funds and offers a vertically integrated service of insurances and investment management as well.

The trustee services are the wide end of the funnel for Diversa and hence why the group made the key acquisition in FY15 of The Trust Company's superannuation services division. The more management are able to grow this section of the business the more clients they will have to cross sell into the other services, transitioning 0.1 per cent pa-fee clients towards 1 per cent pa.

Diversa has moved into a profitable position now with management reaffirming guidance of FY16 revenue between $12.5m-$13.5m and EBITDA of $2m-$2.5m. The outlook for Diversa's growth is the team's ability to convert clients into the business' other services. This table from the presentation shows the potential impact of moving more clients to their investment management services. Some $0.5 billion of funds under management generates the same revenue for the business as $6.8bn of funds on the trustee services side.

A key area of concern would be the effect of losing any of those clients on the superannuation services side.

Australian Renewable Fuels Limited (ARW)

Andrew White, chief executive of Australian Renewable Fuels Limited, was the first company to present at the AGM and had arguably the toughest 2015 and least glowing outlook for FY16. Australia's largest maker of biodiesel makes up only 1 per cent of the TOP portfolio.

Subsidised imported products had a dramatic effect on ARW in FY15 in a year which saw their Picton and Largs Bay making losses but not sliding back further, a board restructure and cost cutting in personnel, admin and consulting.

Now with a stable excise policy in place that the industry participants can afford, and as of July 1 imported biodiesel paying a 40 per cent excise negating the benefit of the subsidy, TOP anticipates a level playing field will see ARW finally live up to some of the early potential they saw in the business.