Billabong poised for a turnaround

| Summary: Another debt restructure and asset sales at Billabong this week has put some serious heat into an already rising shareprice. After numerous take-over bids and ongoing market concern about the retailer's inability to focus, the company's shares remain 98% down from their peak, but the renewed activity should warrant close attention from speculators. |

| Key take-out: While questions remain about the new debt holders, there are enough variables here to excite the market. |

| Key beneficiaries: General investors. Category: Shares. |

| Recommendation: Outperform (under review). |

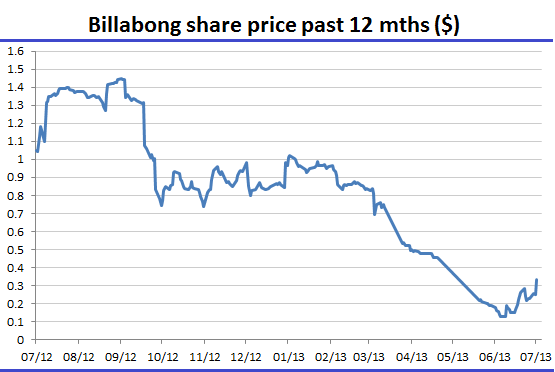

In the past month, the Billabong International Limited (ASX: BBG) share price has doubled to $0.335. However, it is down 98% from its peak of $14 over the past six years. Significant shareholders are heading for the exit, and major lenders including Commonwealth Bank and HSBC have sold their debt at $0.80-$0.85 in the dollar. The buyer is the New York-based Centerbridge Partners, which specializes in leveraged buy-outs and distressed securities.

Billabong has 479 million shares on issue, and at $0.335 per share, its market capitalization is $28.4 million. Turning back the clock by fifteen months to April 2012, TPG bid $842 million (or $3.30 per share) for Billabong – but this was rejected.

A few months later, in July 2012, and following another earnings downgrade, TPG offered $695 million or $1.45 per share. While $1.45 is less than half the $3.30 a share TPG had offered previously, there had been a $225m rights issue for debt reduction purposes in the interim, so the number of shares on issue had grown from 258 million to the current 479 million. In other words the total value of the bid was little changed from the bid lobbed in April.

After TPG exited in October 2012, the President of Billabong’s American Division since 1998, Paul Naude, together with a consortium of financiers, including Sycamore Partners, waited until December 2012 to ‘drop in’ (pun intended) a $1.10 per share bid, valuing the company at $527 million. This was a slight premium to the $1.02 per share price of the six for seven rights issue, which had taken place six months earlier.

A fourth bid was made in January 2013, also at $1.10 per share, by VF Corp, the owner of Timberland and the North Face Brands, in conjunction with Altamont Capital Partners.

On 22 February 2013, Billabong reported its results for the six months to December 2012. The $537 million loss saw shareholders’ funds cut from $1.027 billion to $573 million. Net debt, inclusive of tax liabilities and deferred payments, was $253 million at 31 December 2012. Of significant concern was the implosion in revenue from “continuing operations” - down 15 per cent to $701 million (from $828 million in the previous corresponding half-year). Revenues from Europe and The Americas, which accounted for a combined 60 per cent of “continuing operations”, were down 26 per cent and 19 per cent, respectively.

Naude and Sycamore Partners, and VF Corp and Altamont Capital, appeared to have joined forces at this point and, in April 2013, lodged a conditional bid. At $0.60 per share, this was Billabong’s fifth in twelve months, and this time it valued the company at $287 million. After this bid was withdrawn, Billabong was suddenly fighting for its corporate life. Alternating refinancing and asset sale transactions discussions ensued with none other than Sycamore Partners and Altamont Capital.

Newly departing chief executive Launa Inman was appointed to the top job at Billabong in May 2012 after a very successful career at Target. Ted Kunkel resigned as chairman at the November 2012 annual meeting after joining the board in February 2001. Peter Myers, after a combined 18-year career at APN News and Media and Network Ten, joined as CFO in January 2013. Talk about timing! One thing we say at Montgomery – it doesn’t matter if you are an Olympic rower, if the boat has a leak, no amount of even furious rowing is going to get you anywhere.

At Billabong, Inman has been frustrated by her inability to fully implement a transformation strategy while potential bidders were going through the books.

But the biggest problem is probably the fact that Billabong lacked focus. It was a ten brand business operating in 100 countries with a wholesale, retail, e-commerce, skate, surf and snow strategy.

Surf wear isn’t a fashion statement anymore, and the company’s target market is alienated when dads start wearing a Billabong T-shirt! Big international retailers with economies of scale and slick e-commerce offerings are cutting into Billabong’s traditional market. Inman claims that trading conditions have turned the corner in the US, but industry experts believe Europe remains a massive drag.

Inman announced her departure last night, fourteen months into “the four-year turnaround strategy”.

This is a most operationally and financially leveraged situation, as Altamont Capital and the Blackstone Group have just agreed to refinance $325m of Billabong’s debt as well as acquire the DaKine brand for $70m. This should provide the company with $100m for working capital requirements. Altamont will be issued with 84.5m options, or 15 percent of the fully-diluted capital, exercisable at $0.50 per share.

Scott Olivet, former Chairman and CEO of Oakley Inc, will replace Inman as chief executive.

There are many unanswered questions: We don't know what the revenue and earnings will be when Altamont Capital's 84.5 million options - or the 15% of the fully diluted capital - gets to be exercised at $0.50 a share. On top of that we don't know where the notes - that give them 40% of the company - will be converted either. But there's enough variables here to excite the market and speculators will be punting on a turnaround with the new regime.

Source: Bloomberg.

Roger Montgomery is the founder of The Montgomery Fund. To invest, visit www.montinvest.com.