Big boys scramble into small caps

| Summary: As a whole, the Australian small caps sector has underperformed the market in recent times. But small cap stocks are definitely in the investment spotlight, with several multinational fund managers either launching, or flagging, small cap product offerings, and two listed small cap focused listed investment companies being floated so far this year. |

| Key take-out: Superannuation funds, keen to add diversity to their equity portfolios, have shown keen interest in small cap offerings. |

| Key beneficiaries: General investors. Category: Shares. |

The launch of a string of small cap offerings touting their stock picking abilities is a sign that the stars are starting to align for the underperforming sector.

Fidelity Worldwide Investment is the latest fund manager to launch a new Australian small to midcap fund that will focus on stocks outside the largest 50 ASX stocks, while Credit Suisse and First NZ Capital announced last week that they intend to form a partnership to offer small cap coverage in this country.

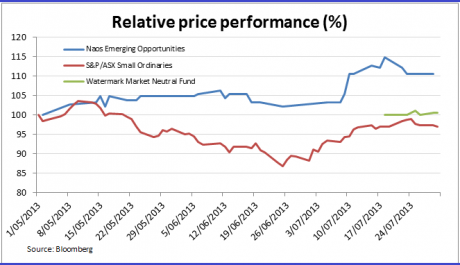

The news follows on from the successful float of two listed investment companies (LICs) on the ASX. Watermark Market Neutral Fund (WMK), which has a substantial number of emerging company stocks in its portfolio, got away this month after raising around $70 million from investors; and the NAOS Emerging Opportunities Company (NCC) is trading at more than 5% above the February initial public offer price of $1 a share and is at a 7.4% premium to its pre-tax net tangible asset (NTA) value.

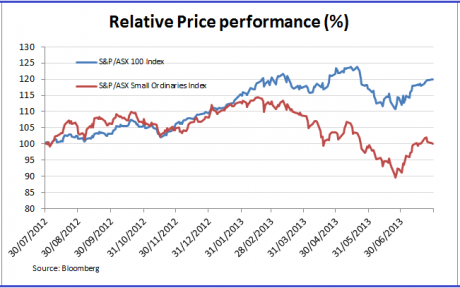

The introduction of such products may sound counter intuitive given that the S&P/ASX Small Ordinaries Index is lagging the top 100 stock benchmark by a whopping 19% over the past year. But this doesn’t surprise the senior consultant for Frontier Advisors, Fraser Murray, as he notes the strong interest for such products from superannuation funds.

Frontier, which has $144 billion under advice, is an independent asset consulting firm that counts a number of industry super funds as clients.

“A lot of fund managers realise there is a lot of demand out there and small cap offerings usually can get a premium fee, particularly since the small cap fund manager has been typically outperforming quite significantly,” says Murray.

While the S&P/ASX Small Ordinaries has generated a 5.3% loss in the year to June 30, the low benchmark has helped small cap fund managers generate a return that is almost 20% ahead of the index, according to the latest fund manager survey by Mercer Investments. This outperformance over the index is called “alpha”.

Murray thinks that supply is not keeping up with demand as large investors are actively seeking alpha in this market.

“Most small cap managers probably have the ability to take up to $1 billion in funds under management before it becomes too difficult,” he adds. “And some of the large [investors] can look for some very big mandates (which is an allocation of funds to a manager).”

This means small cap managers have limited capacity to meet the needs of large institutional investors at a time when sentiment towards small caps may be turning.

“I think this is an excellent time to be in small caps,” says the head of Australian Unity Investments, David Bryant.

He thinks the cycle is turning for small caps as confidence is trickling back into the market. Large caps have so far been the biggest beneficiary of this, but valuation gap between the big and small-end of the market is starting to become hard to ignore.

“The small cap sector is an area where we have been less invested in compared to previous times, and this is the period where we are reviewing that closely as it is of much more interest [to us],” says Bryant.

Australian Unity Investments has $7.1 billion in funds under management.

While things are looking up for small caps, Contango Asset Management’s failure to get its mid-cap LIC offering off the ground late last year shows that stirring retail investor interest in this uncertain market is still challenging.

Firstly, investors want to see a track record of outperformance before committing. This is probably why Naos and Watermark were able to get their LICs away. Contango, in contrast, isn’t known for managing mid-cap stocks.

Another factor is infrastructure. Fidelity can leverage their ample distribution and marketing resources to launch new funds when smaller managers would struggle.

A spokesperson for Contango told Eureka Report that they have not shelved plans for their mid-cap fund and that they are still talking to brokers, but says he didn’t think the timing was perfect enough yet.

“The market has risen on thin volumes and if the fund is coming back, [brokers] will have to be banging the door down to talk to us,” he says.

Confidence among brokers has been weak over the past year or two as retail investors have generally been reluctant to commit additional capital to the share market.

But if the current trends in small cap land persist and the premiums on LICs continue to increase, you may not have to wait long to see a marked change in conditions.