Big banks face lower return risks

Summary: Higher capital levels have already led to a lower returns on equity for the major banks than investors have become accustomed to. |

Key take-out: Many analysts expect that ROE will remain at its existing level over the next couple of years. I'm more pessimistic. |

Key beneficiaries: General investors. Category: Shares. |

If you are an Australian investor focused on equities then it's almost certain that you have some exposure to Australia's banking sector. The major banks account for a quarter of the market capitalisation on the ASX200 (the financial sector more broadly accounts for around 34 per cent).

A key issue for financial stability is the capitalisation of Australian banks. A bank's capital represents its capacity to absorb unexpected losses; for a given level of financial risk, the higher a bank's capital the lower their risk of becoming insolvent.

The global financial crisis revealed that many banks had failed to hold sufficient capital given the risks they were taking. The regulatory debate since then, driven by the Basel Committee on Banking Supervision, has focused on addressing that by forcing banks to not only hold more capital against their assets but also to hold higher quality and more liquid capital.

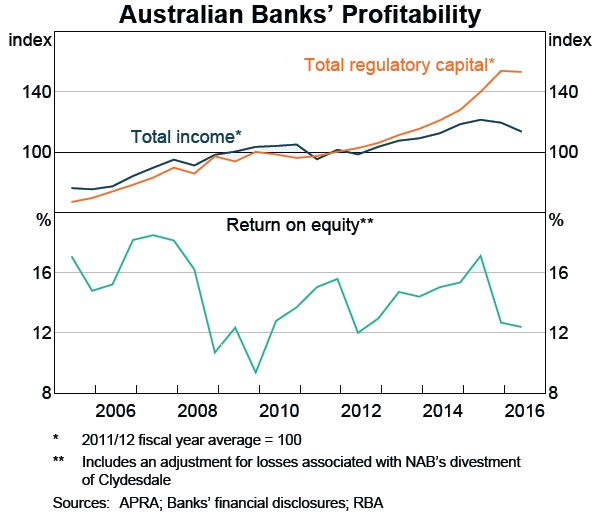

According to the Reserve Bank of Australia, "the ongoing implementation of these measures has contributed to a material rise in bank capital globally and a reduction in return on equity (ROE)". In other words, higher capital requirements place downward pressure on profitability and eventually dividend payouts.

Australia's Financial System Inquiry, released in 2014, focused on two key reforms to bank capital requirements.

The first was that domestic capital standards must be set so that Australian banks are "unquestionably strong" to ensure that the banking system remains resilient and continues to operate in the event of an adverse financial or economic shock.

The second recommendation was that the average risk-weight applied to mortgages by the major banks would converge with the average risk-weight used by other banks. Under the existing regulations, the major banks were allowed to set their own risk-weights to mortgages, an opportunity not afforded to smaller banks and other financial institutions.

This provided the major banks with a significant competitive edge that allowed them to take on more debt and issue mortgages at a lower interest rate than their smaller competition. In practice, the major banks leveraged up to the point where they were holding just a few cents in capital against every dollar of mortgage assets.

It's worth explaining how these risk-weights work because they are far from intuitive. Assume that we have a bank with $100 billion in mortgage assets and they are required to hold risk-weighted capital worth 10 per cent of that value. Now, assume that the bank places a risk-weight on mortgages of 25 per cent.

How much physical capital does that bank hold against their mortgage assets? The answer isn't $10bn ($100bn times 10 per cent) but actually $2.5bn ($100bn times the capital ratio times the risk-weight on mortgages).

The Australian Prudential Regulation Authority (APRA) implemented higher risk-weights on Australian mortgages on July 1 this year. According to the RBA, "the increase in risk-weights is expected to have a large effect on their CET1 ratios, reducing them by an estimated 0.7 to 1.1 percentage points, all else equal". CET1 or Common Equity Tier 1 refers to the highest quality capital that a bank can hold and a decline in that ratio means that a bank isn't as well capitalised as it once was.

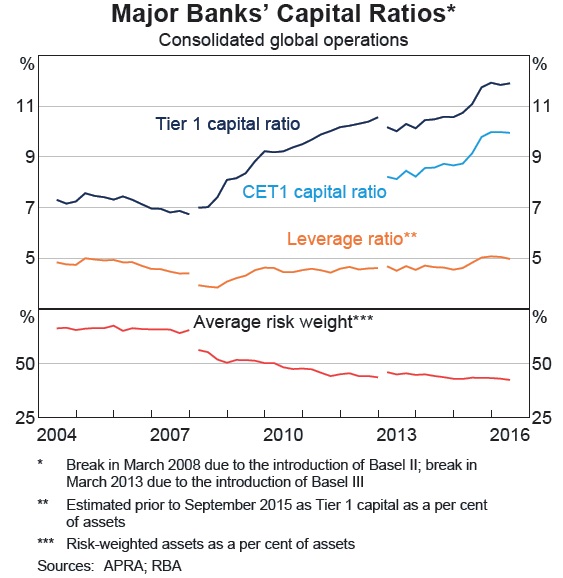

In response to these developments, the major banks have raised more capital and increased their capital ratios. The major banks' Tier 1 capital ratio was around 12 per cent in the June quarter 2015, which is around 50 per cent higher than its level at the onset of the GFC.

According to the RBA, “the major banks' CET1 ratio is well above the standard regulatory requirement, and a buffer is expected to be maintained even after taking into account the effect of higher mortgage risk weights in the second half of the year.”

According to the RBA, "much of the increase [in the capital ratio] was due to a reduction in average risk weights as the composition of banks' portfolios shifted towards mortgage lending (which tends to attract a lower risk weight than lending to businesses)". By shunning risky business lending in favour of issuing greater mortgages, the banking sector has managed to boost its profitability and ROE.

More recently, the increase in "the major banks' capital ratio has largely been due to an increase in capital; the major banks have raised around $20bn of new equity and an additional $7bn from retained earnings since the start of 2015".

On a risk-weighted basis, Australia's major banks are relatively well-capitalised by international standards. According to an APRA report released in December 2015, the major banks' CET1 capital ratio had moved into the top quartile of international banks following the decision to raise capital during the second half of 2015.

Of course this assessment is based on the historical risk assessment of the housing and business sectors. A change in that risk assessment, particularly heightened risk across the property sector, would lead to a significant downgrade to the CET1 capital ratio. Our banks are well capitalised on a risk-weighted basis but perform quite poorly on an unweighted basis.

This discussion on risk-weights is essential to understanding recent developments in the major banks' ROE. Higher capital levels have already led to a lower ROE for the major banks than investors have become accustomed to.

Many analysts expect that ROE will remain at its existing level over the next couple of years. I'm more pessimistic, based on my expectation that we will see a broad-based reduction in the level of mortgage approvals combined with an ongoing shift towards higher capital. If this occurs then ROE will fall towards levels not seen since the global financial crisis.

It's worth remembering, however, that the ROE available from our major banks continues to be high by international standards. The sheer size of their mortgage lending has ensured that the returns from investing in the Australian banking system exceed the average returns found overseas.

The major banks' have responded to the reduction in ROE by increasing the spread between their products and the cash rate. According to the RBA, "most lenders increased their standard variable housing rates by 15-20 basis points in the second half of 2015 after the announcement of higher risk weights on Australian mortgages".

Some banks have also looked to reduce their focus on divisions that have historically achieved lower returns. NAB divested its UK Clydesdale subsidiary earlier this year and ANZ announced that it would narrow its focus in the Asian region. The major banks' wealth management arms have also come under increased internal scrutiny.

Investors will need to determine whether they are willing to tolerate a lower ROE. A lower ROE isn't without its benefits since it also coincides with lower risk and volatility and that may be appealing to some investors.

Perhaps the greatest risk is that investor pressure to maintain an elevated ROE and dividend payout encourages the major banks to take on additional risk or shift the composition of their books further towards mortgages at the expense of small and large businesses.