Better days for gold ahead

Summary: The gold price has been rising since the last Fed meeting but is bouncing around its five-year lows. But the US dollar may have run out of puff. If that is the case, a key factor weighing on gold, US dollar strength, will have been removed. |

Key take-out: Although there may be better days for gold ahead, there won't necessarily be a sharp reversal on price action straight away. |

Key beneficiaries: General investors. Category: Gold. |

The US Federal Reserve's meeting last week has really shaken markets and forced a major rethink about things that were assumed to be certain. One is the timing and magnitude of the Fed's long awaited rate hike. While the Fed dropped the word patient, they were clearly more dovish and even downgraded their growth and inflation forecasts. Inflation isn't expected to get to the top of the target this year and readers will remember that inflation rising toward target (even exceeding it) was a precondition for the Fed to tighten. Many now openly question whether they'll hike this year at all – and that's a view I'd agree with.

Since that surprise statement from the Fed, there has been quite a bit of volatility on global markets – commodities and currencies in particular. The Aussie dollar for its part is up about 3 cents from its pre-Fed low, while euro has spiked – nearly 5 euro cents.

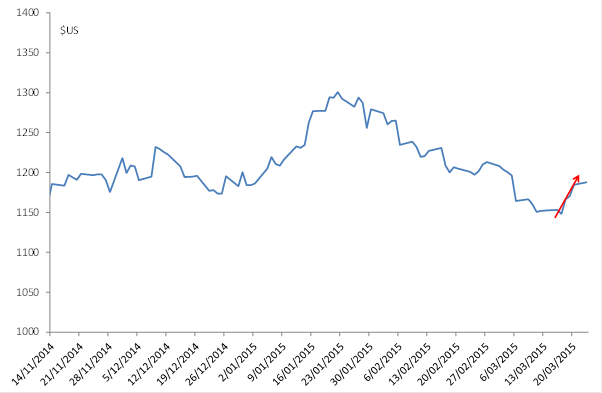

It's little different for gold. In the lead up to the Fed meeting, gold had dropped $US150 from a peak near $US1300 in late January. Post Fed, gold has recovered maybe a third of that so far – $50, rising in every session since the Federal Open Market Committee meeting and in seven of the last eight thus far.

Chart 1: Gold pushing higher post Fed

Even so, gold still looks to be bouncing around its five-year lows – and viewed over that time frame the downtrend still appears intact. I wonder, however, whether we may see a reversal of that price action over the next year. Much will depend on the direction of the USD and I've got good reason to believe that the US is close to a point where they are feeling a little uncomfortable.

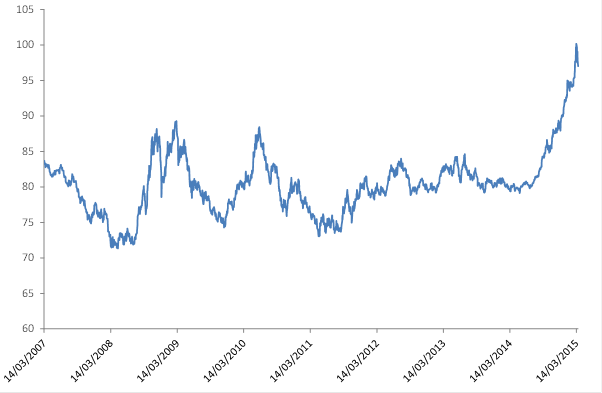

The main reason for that? An American fear of a current account deficit. Concerns over US dollar strength and a current account deficit that was far too wide have driven an official push to weaken the greenback twice in modern history. Back in 1985 during the plaza accord and again, less formally, from 2000-2004 when officials contended themselves with an aggressive communications and PR campaign – also known as jawboning.

Both attempts were very successful as we know. The important thing for investors to note now, is that we're not too far away from the trigger points that sparked previous devaluation attempts.

In both instances, the US dollar index was up over the 100 mark – about 105 back in 2000. Currently the dollar index is at 97 and it actually just pipped 100 in the days before the Fed meeting. On the current account deficit side, the US seems to get concerned with anything much over 3 per cent – it's at 2.4 per cent now. So we're close although we're not quite there. Having said that, it is quite plausible that the US government will be even more sensitive to a higher US dollar given that foreign debt and public debt are so much higher than back in 2000. In that regard, the Fed's more dovish commentary could be the first step in making sure that the US dollar doesn't get too high – and it seems to be working.

Chart 2: Can the US dollar push much higher?

If I'm right about US concerns over a strong US dollar and the threat that poses to the current account, and foreign debt etc, then the US dollar run may have just run out of puff. Now I'm not sure at this point whether the USD will drop another 10 per cent or simply stays where it is. What I am suggesting is that US concerns over the current account deficit etc may at least keep a cap on the USD. That is, that the unit it won't push much higher on a sustained basis. Maybe the 100 mark on the dollar index will become a very strong resistance level – a line in the sand if you will.

If that's the case, then one of the key factors weighing on gold – USD strength – will have been removed. The US dollar will cease to be a key headwind for gold.

That's not to say that we'll necessarily see a sharp reversal on the price action straight away. While gold has generally fallen in response to the stronger USD, it seemed largely immune from this latest spike. Maybe immune is too strong, but it certainly didn't fall as far as a 1-1 move with the USD would suggest. Maybe a slow grind higher might be a better characterisation. Either way it appears that there may be better days for gold ahead.