Behind the $7 billion Santos bid

Summary: Templeton Global Growth Fund can see value in energy stocks as a fall in the volume of US oil production looms. Ruling families in the UAE and Brunei are prepared to make a major plunge into Australian gas, which reflects their belief that there is a better longer term outlook for the commodity. If a truce can be achieved in Syria, the stage could be set for a new oil cartel comprising Russia, the Middle Eastern countries and others in OPEC that would stop ruthless price wars. |

Key take-out: The oil and gas market is in a state of misery but there have been fascinating signs that the people “in the know” are beginning to make long-term oil and gas investments. |

Key beneficiaries: General investors. Category: Oil and gas. |

One of the most miserable sectors of the market at the moment is energy including gas and oil. I don't bring any immediate joy but there are some fascinating developments taking place below the surface, which I will explore today.

It's not surprising that the oil and gas market is in a state of misery with production from Iran set to hit the market and prices looking weak and inventories running high.

Yet there have been some fascinating signs in the capital market that the people “in the know” are beginning to make long-term oil and gas investments.

As discussed previously part of my international diversification includes holding a number of international investment companies including Templeton.

Listed investment company Templeton Global Growth Fund (TGG) reported to the stock exchange early this month that it had allocated 12 per cent of its portfolio to energy. Although TGG might have been better to wait, the company filed with the stock exchanges two graphs to justify what is an unusual investment for this group (the company said the graphs were confidential and not for publication but once they are on the ASX website the documents are public).

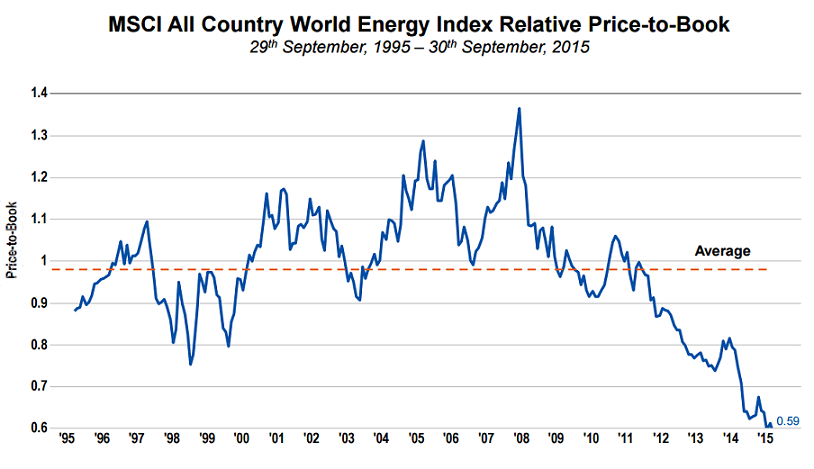

The first graph shows the extent of the dramatic fall in the prices of energy stocks which around 2007 and 2008 were trading at a market value about 1.3 times the book value of assets. They are now down to 0.6 per cent of the book value. That's an incredible fall and shows the extent of the enormous losses that have taken place in energy stocks. TGG could therefore see value.

Source: Templeton Global Growth Fund, FactSet, MSCI

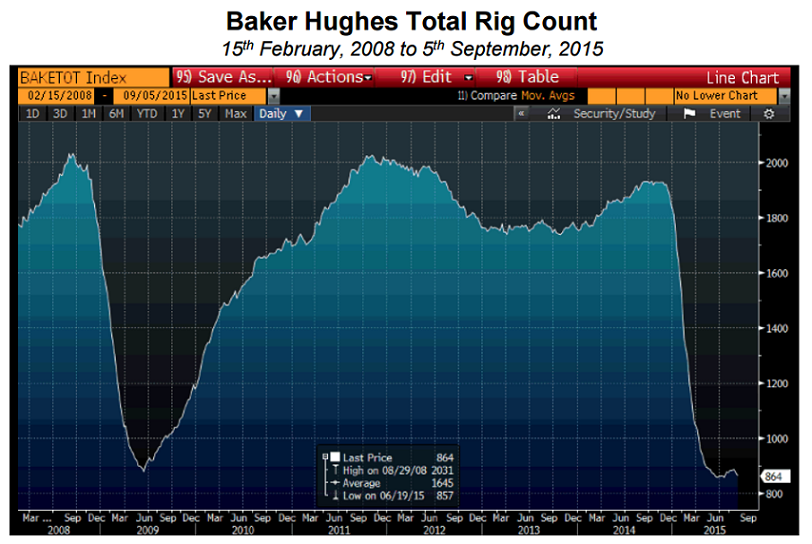

One of the reasons why the oil market could change is the extent of the looming decline in US shale oil production. Shale oil production is very different from the conventional oil production where a well is drilled and may continue to produce oil for a long time. In the case of shale oil the wells only produce for two or three years and new wells need to be drilled to replace the ones that have extracted all available oil.

So when there is a sharp fall in shale oil drilling activity it foreshadows a big fall in production in a year or two. The second TGG graph shows just how steep the reduction has been which foreshadows a big fall in the volume of US oil production in coming years. The US looks like returning to being a significant oil importer.

Source: Templeton Global Growth Fund, Bloomberg

And then I noticed that among Australian investment companies, Argo's new investments are increased stakes in Origin and BHP.

And finally the Middle Eastern family that has been one of the more astute global investors is the ruling family in the United Arab Emirates. Along with the family ruling in Brunei they are looking at making a major plunge in Australian gas via a possible $7 billion takeover bid for Santos. Santos has rejected the tentative proposal and at this stage I am not going to enter the debate over what Santos might be worth.

The United Arab Emirates ruling family's preparedness to make a major plunge into Australian gas is not a signal of any short-term movement in oil and gas prices but it reflects their strong belief that there is a much better longer term outlook, at least for gas.

And if you look closely at the news commentaries coming out of the Middle East and go beyond the military victories and defeats, there is an undercurrent of oil politics running through Russia's Middle Eastern strategies.

If we go back to 2014 when the oil price was around $US100 a barrel, US Secretary of State John Kerry asked the late King Abdullah of Saudi Arabia to flood the market with oil with the aim of reducing the price and hitting Russia as “punishment” for its acquisition of Crimea. Kerry thought the combination of European sanctions and lower oil prices would cripple Russia. Instead what the twin actions did was substantially increase the prestige and power of President Vladimir Putin while greatly damaging the US oil production industry.

King Abdullah was happy to oblige because had he decided to attack the high-cost US industry by flooding the market it would have caused America to be very angry. But Kerry gave him a chance to hit the US at the invitation of the secretary of state so there could be no protest. While Russia was hit its lower currency cushioned the blows.

There is no doubt that Russia seeks stability in the oil market and fully understands the enormous power that comes to any group of countries or organisations that control the oil and gas business.

Students of the oil market will remember the price wars of the 1920s which ended in 1927 at a meeting at the Achnacarry, Scotland castle of Royal Dutch Shell chief Sir Henri Deterding.

At that Scottish castle meeting Sir Henri met with leaders of the forerunners of British Petroleum (Anglo-Persian Oil Co) and Exxon (Rockefeller's Standard Oil of New Jersey) plus other major oil companies. A cartel was formed that ended the price wars and controlled the oil market for around two decades. Fortunes were made.

Almost 90 years later a new cartel is being envisaged. By contrast only two years ago Iran and Syria were discussing a pipeline to send gas to Europe to take market share from the Russians. Now the game has completely changed. Russia is directing an enormous military force into Syria in combination with Iran with close links with Iraq. The Saudis have invited Russia to join OPEC. Although that initial invitation was rejected it was clearly a sign that the Saudis are looking for cooperation between Middle Eastern countries and Russia and given the looming reduction in US production that becomes possible.

But first, in the Russian view, the Syrian civil war has to be sorted out and Islamic State and the so-called Syrian rebels either removed from the area or greatly contained. (Russia sees Islamic State as a long-term threat to its Muslim states.)

If during the next year or so Russia, Iran and Iraq can sort out the Syrian situation then we have the seeds of an oil and gas cartel comprising Russia, the Middle Eastern countries and others in OPEC. But Russia and its allies have to first achieve a military victory and/or truce in Syria, which is no certainty. But assuming it takes place the stage is then set for a new oil cartel which will be very different to what happened in the Scottish castle because the European representative will be Russia rather than the UK. The US is absent.

I don't think that such a cartel would be silly enough to cause prices to go through the roof, but they will share markets and stop ruthless price wars. Gradually the oil and gas prices will rise to provide better returns. Clearly there is a risk to these strategies that electric cars may reduce long-term oil demand. Given that the mainstream media reporting on the Middle East concentrates on the military rather than the oil and gas implications you may think I am drawing too long a bow.

There are no certainties in this sort of strategic prediction but from time to time there are reports that unveil more about what may take place in oil politics. And a good indication of the likely future will be the vigour with which the United Arab Emirates ruling family seeks gas in Australia either via Santos or by buying into some other consortium.

(For the next few weeks energy is going to remain on my mind because my wife and I are off to do a spot of grandsons sitting in Newfoundland and Newfoundland at this time of year is incredibly cold. My weekly column will return on December 2.)