Bank dividend risks: What to do

Summary: If Westpac's amount of shares on issue grows faster than its profit, some other lever must be pulled for the bank to maintain or grow its dividend. The market consensus is for dividend growth to continue at all four of the big banks, which creates significant downside risk. I am concerned about the pressure on bank profits and the trend of increased risk aversion and regulatory response. |

Key take-out: It may not be time just yet to sell the banks but they should be under scrutiny. If half an investor's portfolio is in the big four banks then diversification is a problem. |

Key beneficiaries: General investors. Category: Income, bank stocks. |

What's the outlook for bank dividends? Just now the question is being highlighted after Westpac announced a $3.5 billion capital raising in order to meet tighter regulatory requirements. It is the last of the big four banks to raise capital this year.

In the same breath Westpac announced a blunt 2 per cent cash profit growth. It's a simple equation to see that if profits grow by only 2 per cent, but the capital base (shares on issue) grows by a touch under 4 per cent, some other lever will need to be pulled for Westpac to be able to maintain its dividend, let alone grow it.

And we have seen Westpac scrambling to protect its profitability by announcing a lift in its variable home loan and investment property loan rates by 20 basis points. This is a clear signal from Westpac that the banks are being squeezed by both increased regulation and funding costs, and is potentially a sign of things to come – tougher operating conditions for banks.

The prospect of lower bank dividends likely makes many of Australia's mum and dad investors and SMSF-running retirees shudder, and for good reason. The Australian share market is overweight financials, to a point that it creates diversification issues for many portfolios that are aligned to the S&P/ASX200. Let's consider what can be done and what the genuine odds of a dividend cut might be.

Consensus forecasts for bank dividends

The market consensus (per Bloomberg) is for dividend growth to continue across all four of the big banks, each year through FY18 (beyond which forecasts begin to lose value in my view). The expectation is that on average big four bank dividends will be 9 per cent higher in four years, or grow at a compound annual growth rate of 2.15 per cent.

It is worth noting that these numbers may change as the consensus factors in Westpac's capital raising, but still consensus is indicating a rather upbeat scenario of steadily increasing dividends. My view is that this creates significant downside risk, should a dividend be cut it would disappoint the market.

Figure 1: Consensus forecasts for bank dividends per share (in $ per share)

Company | FY15 | FY16 | FY17 | FY18 |

ANZ | 1.807 | 1.830 | 1.885 | 1.993 |

CBA | 4.182 | 4.24 | 4.349 | 4.545 |

NAB | 1.979 | 1.983 | 2.01 | 2.115 |

WBC | 1.871 | 1.909 | 1.957 | 2.054 |

If consensus is so strong then what is driving the concerns?

Bank profitability in Australia is somewhat cyclical and ties in with the major sources of banking income, including property, domestic economic growth, the health of business cycle and the appetite of consumers for more debt. Unfortunately, all three of these drivers of domestic bank profits (call it the cream on top that drives the short term cycles) are unlikely to provide elevated growth over the next three to five years.

Additionally, the reality facing the banking system in Australia is that global interest rates now have ‘upside risk' – they are more likely than not to go up.

The specific risk here is that internationally sourced wholesale funding costs could lift, while domestic lending rates set by the Reserve Bank of Australia are falling, putting pressure on banks to keep pace. This squeezes bank margins from both sides.

I've got three outstanding concerns:

1. My first concern is that economic and situational forces are putting pressure on profits that the banks may produce, limiting profit growth as a source of dividend sustainability.

2. My second concern here is the continuing trend for increased risk aversion and regulatory response. Bank investors will be all too familiar with the impacts of this already as all of the big four have been sourcing additional capital in response to APRA adjustments to the way common equity tier one capital (CET) ratios are defined (in this case specifically increasing the risk weighting of some residential mortgage capital).

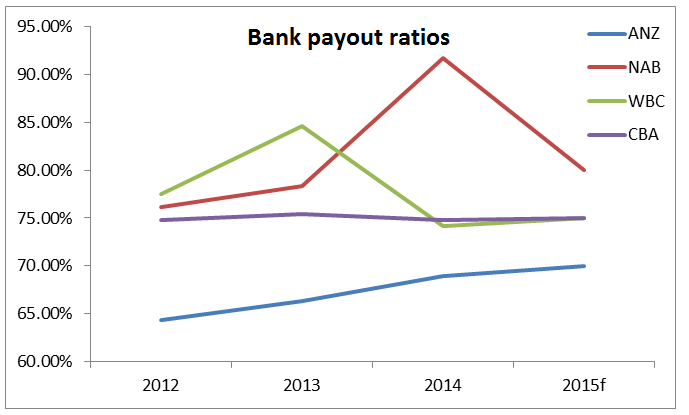

3. We need to watch the ‘pressure release valve' – payout ratios. In my view, the big four banks have all but exhausted this avenue for dividend flexibility by virtue of the ‘arms race' in dividends over the last five years. Below is a chart of the big four banks' dividend payout ratios and how they have changed in the last three years. It can be seen that the overall trend has been rising payouts:

So, how can I protect myself? Should I sell down the big four?

Not necessarily, but it is worth a thought. If an investor is near market weight then we are talking more than 40 per cent in bank stocks: In other words half their portfolio is in the big four banks – if this is your situation I would stress that diversification is a problem.

The Eureka Report Income First model portfolio currently holds a 5 per cent weight in each of ANZ and NAB and no other bank exposure, given the view that there is some building risk to bank dividends. This is justifiable in that it is considered a risk adjusted position.

Financials make up 47.4 per cent of the overall market – and this figure has actually increased in recent week, so I consider a 10 per cent overall bank position to be a significantly underweight bank stocks.

In the meantime, the dividends taken from bank shares are still strong. Where the key to this investment strategy will be found will be timing the exit, something very difficult to achieve with precision.

As an example, let's consider the Income First model portfolio, where my approach will be to assess holdings in view of the dividend periods. The model currently holds 5 per cent in NAB, and 5 per cent in ANZ. Both of these stocks report earnings soon (NAB: October 28 and ANZ: October 29), and will trade on an ex-dividend basis in early November. I don't believe that there is significant risk that the dividend will be cut leading into these reports, so I am happy holding our limited exposures.

My view is that the worst may yet be to come for bank share prices as the risks build and though it may not be time just yet to sell bank shares, they should well and truly be under scrutiny.