Back above parity by Christmas

| Summary: The sharp sell-down in the Australian dollar ignores the economic fundamentals, including the ongoing demand for our mineral resources. The dollar should head back above parity with the US greenback this year, largely fuelled by Asian demand. |

| Key take-out: To really capitalise on regional demand, we must lead the way in the creation of a single regional currency to enable Australia to better-sell its commodities. |

| Key beneficiaries: General investors. Category: Economy. |

The Australian dollar has certainly had a quick retreat on every occasion when there has been the slightest suggestion of a weak domestic economy, such as this week’s employment data.

The domestic economy is, however, not the whole story when it comes to currency valuations anywhere in the world. In fact, the domestic economic scenario can for extended periods be a minor component of currency settings as external trade and capital flows dominate.

As long as the domestic economic outlook is not one of dire straits, a strong external environment made up of robust exports and capital inflow will certainly drive a currency to higher levels.

The Australian economy has been struggling for several years, I believe as a result of over-regulation and taxation. This is the same disease afflicting much of the “old first world”, but that is perhaps a story for another time.

My point, however, is that the Australian dollar rose from US76 cents in 2006 to $US1.10 through what was then a similarly underperforming economy. The economic woes over this period were masked by an incredibly strong export environment.

Both our farmers and miners have worked very hard over several decades to deliver “world’s best practice” levels of operation that have allowed them to successfully market their wares into the Asian region. The Asian economic expansion of the past decade is one of the wonders of the modern world, hence the success of those who have focussed their energies there.

Living with a higher dollar

That fantastic performance by our farmers and miners has led to upward appreciation of the currency, which is a weight for other exporters. We will just have to learn to live with a higher dollar. It can be done, and it really is something we need to do. But at current levels, the Australian dollar is I believe severely fundamentally undervalued.

Having been the first to forecast the Australian dollar to above parity in 2006 at US76 cents, when every major bank said this was a silly notion as the currency could never rise above US80 cents again, I can only highlight the straightforward and simple explanation for that forecast and a similar one being made again here. We are a nation of just 23 million people, sitting on the wealthiest pile of rocks in the world. And two billion people, just to our north, need and want those rocks.

Synchronised global growth

China is a powerhouse. The Chinese economy did not slow at all in 2013: GDP was 7.7%, the same as the year before, and its manufacturing sector continues to expand while the economy shifts towards services and consumption. Quite an achievement; one that remains robust in nature. The China boom, like the rest of Asia, has never stopped, and the resources boom will remain ongoing. This, at a time when the US is heading to above-trend growth, and when even Europe is now clearly coming back online.

My long-held forecast of synchronised global growth – across Europe, China and the US – is now a reality, and demand for resources will accelerate and remain quite competitive. There will be short-term volatility in commodity prices, but the trend will be firm-to-higher over coming years.

All of this positive on-the-ground reality around the world has occurred as people panicked over false fears regarding China’s growth rate and sold the Australian dollar aggressively. It seems some even sold, only because just about everyone wanted a lower Australian dollar.

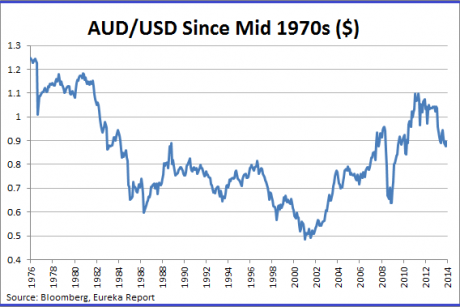

Well, you do not always get what you want, and the truth is the dollar is cheap. Parity to the US dollar is only the mid-point of the last 40 years or so. The Australian dollar fell from $US1.4930 to a low of US48 cents. By the way, I was in the media as the most aggressive bear on the Australian dollar from US78 cents to US48 cents. We have seen a long-term bounce back to the mid-point, and a short-lived overshoot to $US1.10, followed by this latest pullback.

Heading back above US parity

A lot has changed over this period, and I am not sure these global changes are yet to be fully priced into the Australian dollar. Commodity prices are much higher, Asia is the main driver of global growth, the US is in decline and is falling back into the global pack, and some weakness in its own currency is warranted. And global communications means faster and more efficient trade than could ever have been dreamed of years ago.

On top of this we are seeing appropriately higher levels of foreign investment, particularly from China, into our farming and mining sectors, as well as into property.

We have to live with an Australian dollar that is again on its way to US97 cents, and then probably $US1.03 by year-end. It could go higher again next year.

The math is simple: 23 million people, the wealthiest pile of rocks, two billion people close by. While soft domestic data will see the occasional sell-off, this should certainly be taken advantage of by exporters. This is what must be done now.

The single Asian currency

In the long-term however, there is only one solution. As I suggested when I spoke at the APEC Summit in Russia in 2012, as well as recognising three equal reserve currencies, the euro, yuan, and US dollar, we must begin to work toward a single Asian currency.

This will require enormous effort, as did the 30-year process that led to the creation of the euro. So the sooner we begin, the better.

It is only through a single Asian currency that Australia will be able to sell all its commodities successfully, and without undue upward appreciation of our currency.

For all of Australia to flourish long term, including the manufacturing sector, we must lead the way in the creation of a single currency for our economic region.

Clifford Bennett is Chief Economist, brushTURKEY clifford@cliffordbennett.com.au.