Australia's Top 3 healthcare monopolies, and more

By Graham Witcomb, Analyst - InvestSMART.

Last Night's Markets

Australia’s Top 3 healthcare monopolies

Ask Evan

Next Week

Last Week

Last Night's Markets

| Name | Price | % Change |

|---|---|---|

| Dow Jones Industrial Average | 26,719.13 | - 0.13% |

| S&P 500 | 2,950.46 | - 0.13% |

| Nasdaq Composite | 8,031.71 | - 0.24% |

| The Global Dow USD | 3,081.49 | 0.1% |

| Gold | 1,402.80 | 0.42% |

| Crude Oil WTI | 57.65 | 1.02% |

| Australian Dollar / US Dollar | 0.6927 | - 0.69% |

| Bitcoin / US Dollar | 9,900.16 | 0.07 % |

| U.S. 10-Year Bond Yield | 2.06 | 0.2% |

Australia's Top 3 healthcare monopolies

Warren Buffett has said ‘In business, I look for economic castles protected by unbreachable moats’. In analyst-speak, this investing titan is referring to something known as a ‘sustainable competitive advantage’ – a quality of the business that protects it from competition.

Moats come in many forms and they aren’t always easy to measure. But their strength does tend to correlate with one factor: market dominance. There’s no better demonstration of strength than being able to knock out competitors so that you have more and more of the playing field to yourself.

In many ways, you could argue Australia is the ‘land of monopolies’ – or oligopolies to be precise. Banks, groceries, shopping centres, hardware, and toll roads all spring to mind. The healthcare sector, in particular, is loaded with them.

Healthcare companies often have strong competitive advantages, patent protection, economies of scale, high returns on capital and non-discretionary revenue. Those features mean that several healthcare niches have cascaded towards a few firms controlling the field.

Hearing implants

While none of the companies in this article are true monopolies, one comes close – hearing implant maker Cochlear (ASX: COH). And as far as moats go, they don’t get more piranha-filled.

Once a Cochlear implant is surgically embedded into a patient’s head, it remains there for decades – up to 70 years in fact. Cochlear’s customers are then locked into a perpetual ‘upgrade cycle’ of replacing the external sound processor.

This type of competitive advantage is known as customer captivity due to the high cost of switching brands. Because Cochlear founded the industry, it has a major advantage over competitors – it got the first wave of initial hostages customers.

A virtuous cycle tends to develop in high-tech industries where customer captivity is high: the company with the most customers can invest the most in research, which leads to more advanced products, and this, in turn, attracts more customers, in addition to those already bolted-on. Things tend to snowball.

.png)

Indeed, Cochlear’s captive customers and industry-leading research budget has blessed the company with the highest market share of any major healthcare stock on the ASX: Cochlear has a 60% share of new implant sales worldwide, which is more than three times larger than its nearest competitor, Swiss-based Sonova.

As you might expect, Cochlear’s competitive advantages bring formidable economics too. Cochlear earns a wide margin on selling processors because customers have little negotiating power over prices once the implant is in their head. Cochlear’s overall profit margin is 19% and the company earns an outstanding return on capital of 50%, higher than any other stock mentioned throughout this review.

Pathology

Selling Cochlear implants requires a lot of people – researchers to design the device, salespeople to sell it, and surgeons to fix it into your skull. Pathology tests, on the other hand, mostly rely on mega labs filled with costly automated equipment. Put another way, the pathology industry is ‘capital intensive’.

This being the case, pathology works best with a ‘hub and spoke’ model, where equipment is centralised and the output of many peripheral collection centres is funneled into it. That way, the expensive machines never run idle.

Small pathologists often can't afford to keep up with the latest technology and gadgets, so they face a miserable choice – sell out to larger competitors or gradually go out of business. After hundreds of small acquisitions, just two companies now dominate the industry: Sonic Healthcare (ASX: SHL) and Healius (ASX: HLS).

Their grip on the sector has strengthened significantly over the past 10 years. Economies of scale played a big part, but so too did some unexpected consequences of deregulation.

To understand why, we need to leave the lab and head to the doctor’s office. Doctors essentially act as a gatekeeper, separating the pathology provider and patients. Most medium to large medical centres have a space dedicated to the collection of specimens which is leased by a pathology group. The rent a provider is willing to pay for these collection centres is an indirect financial incentive for a practice to be affiliated with a particular pathology network.

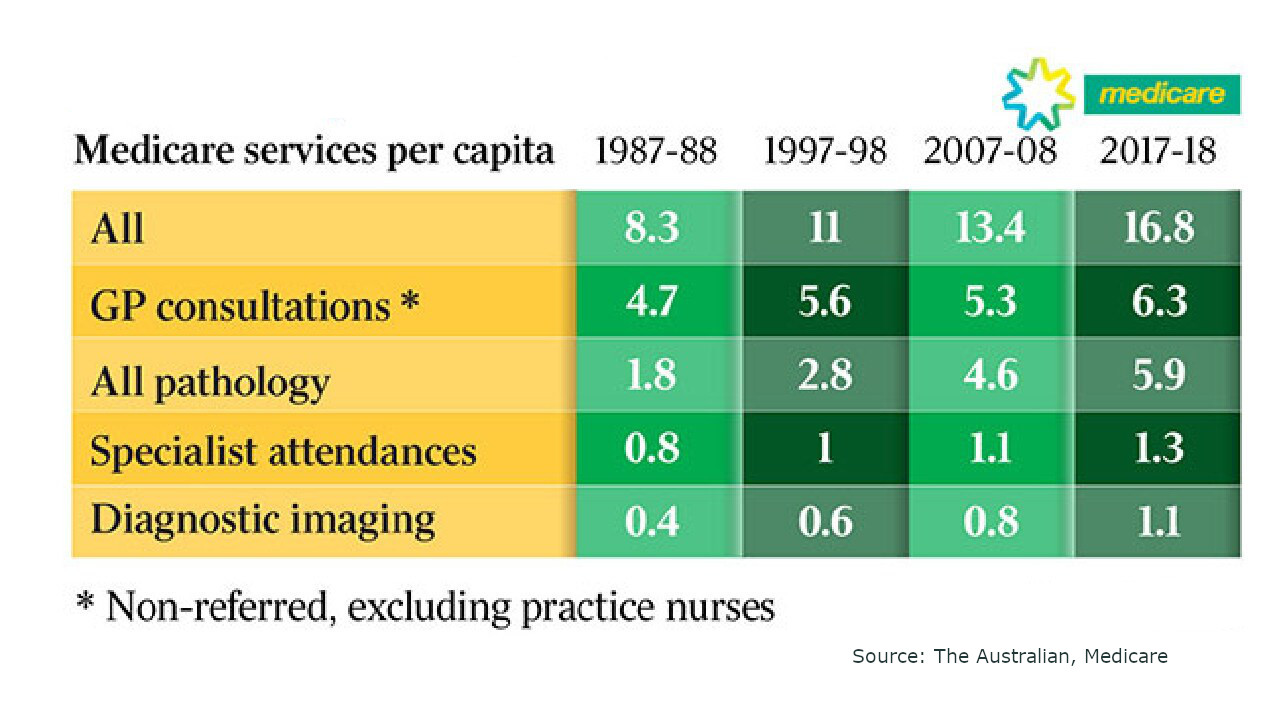

Over the past 30 years, demand for pathology services has more than tripled on a per capita basis, far exceeding growth in other medical specialties (see Table).

In an effort to curb runaway Medicare costs, the Government removed restrictions on the number of collection centres a pathology network could operate in 2010 with the expectation that such a move would boost competition.

And it did ... sort of. Given the ongoing stream of referrals to be gained from the associated practice, competition for collection centres sizzled. Rents rose dramatically.

However, the two dominant players, Sonic and Healius, could afford much higher rents than smaller operators due to their more efficient operations and wider margins.

The unintended consequence of deregulation and the land grab that followed was an even less competitive environment. Small pathologists couldn’t keep up with skyrocketing rents and so progressively sold to the only two pathology networks that could pay high rents and still turn a profit.

Sonic and Healius have increased their combined market share by 12% since the collection centre restrictions were lifted. Sonic now controls 42% of the pathology market and Healius a further 35%.

Their industry dominance comes with a catch, however: while revenues tend to be stable, Medicare makes up the bulk of them and the Government has been lowering pathology test fees year-in, year-out.

Despite formidable competitive positions and staying power, both Healius and Sonic earn thinner margins and lower returns on capital than other healthcare oligopolies. Sonic, the stronger of the two, only has a profit margin of 8% and a return on capital of around 10% – nothing to sneeze at, but a far cry from Cochlear’s eye-watering returns.

So maybe, in the end, deregulation did work. It concentrated the industry into just two major players. And as their market shares increased, economies of scale lowered their average costs. And now, with a lower cost base, the Government can cut pathology fees further than would otherwise have been the case.

Plasma therapies

If you could take the best parts of both Cochlear and Sonic, then mash them together in a Play-Doh Fun Factory, you may end up with something that looks like CSL (ASX: CSL).

Like Sonic, this blood products maker has significant economies of scale.

A large proportion of CSL’s costs are fixed, including blood collection centre infrastructure and manufacturing plants. Fractionation facilities cost billions of dollars to build, and the large regulatory burden of operating one ensures it’s almost impossible for new industry entrants to get a foothold.

Then there’s the upfront cost of research and getting a proposed product through the various stages of the clinical trial process – a process which easily costs hundreds of millions and can take 5–10 years for a single drug.

Furthermore, smaller players without their own network of collection centres rely on buying raw plasma on the open market, which doesn’t come cheap – a barrel of raw plasma will set you back around $21,000, or $130 a litre. After manufacturing expenses, the industry’s average total cost per litre is around $155.

This is where economies of scale really pay off for CSL: its average total cost per litre of $100 is nearly a third less than the industry average. CSL’s gross profit margin has increased from 48% in 2009 to 56% today. Being the largest in the industry, it now has higher operating margins than almost all its competitors.

With this cost advantage, CSL can be more competitive on price when it comes to selling its products because the company can remain profitable at a price point that would leave other competitors losing money.

No new firm has entered the sector in 20 years. In fact, after several mergers, the number of plasma product companies has declined from 13 in 1990 to just six today, with CSL, Shire, and Grifols accounting for roughly 90% of the market. The antibody industry is a tight oligopoly and CSL is the largest player, with around 34% of the global market.

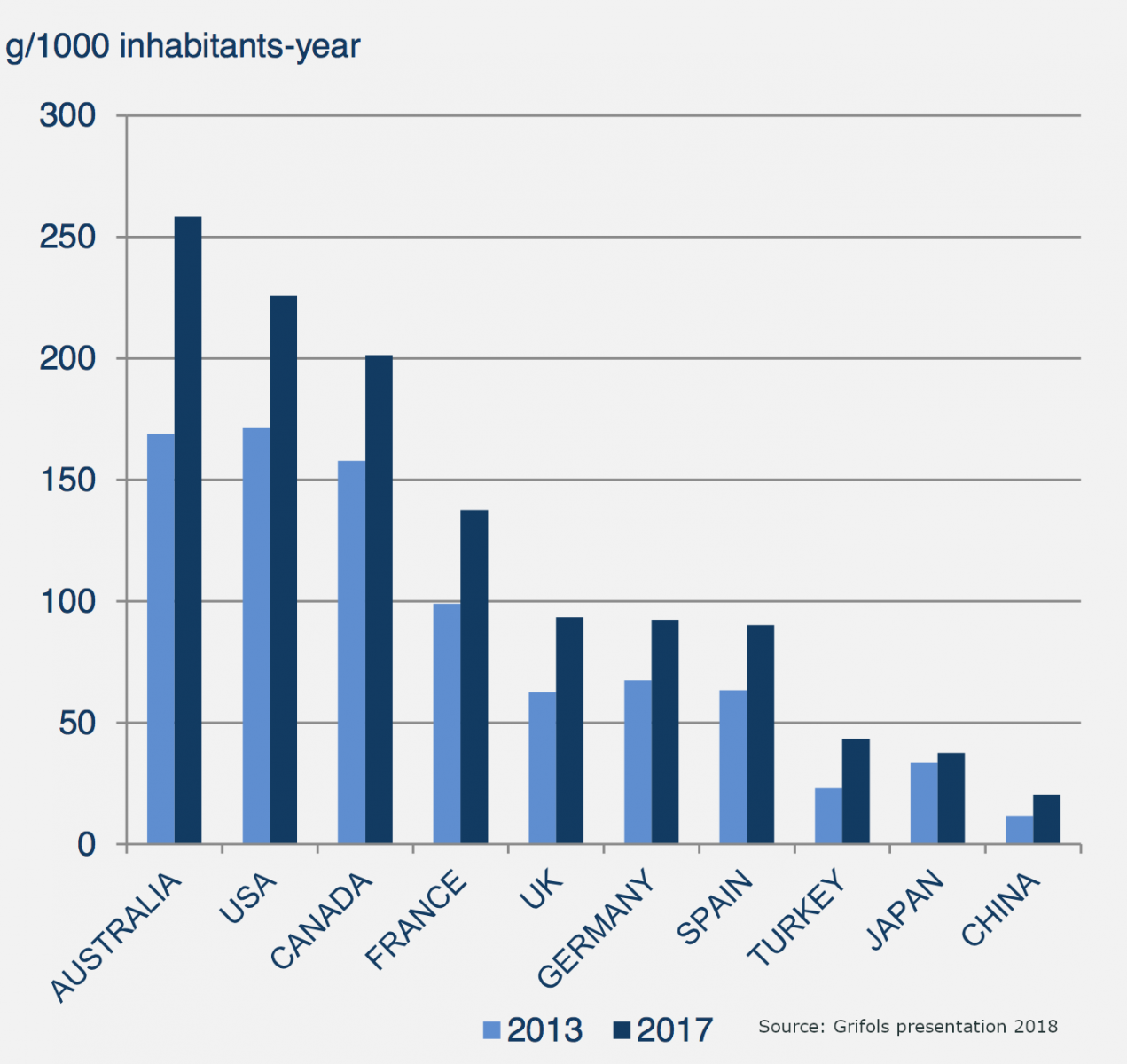

It gets better. CSL’s products are life-saving medicines, with demand almost certain to grow. Developing countries currently use a fraction of their antibody needs due to the high expense. Since 2013, antibody utilisation has grown significantly in all regions thanks to rising incomes (see Chart below). There’s still a way to go before developing countries have utilisation rates anywhere near that of developed nations, so we expect demand for plasma products to grow materially over the next decade.

The S&P/ASX 200 Healthcare Index has returned 327% over the past 10 years, compared to just 71% for the ASX 200. Healthcare beat every other sector hands down.

A big part of that is because unlike most other industries, healthcare is a collection of oligopolies with strong competitive advantages, economies of scale and growing demand. That’s not to say healthcare will always outperform – the price you pay remains the trump card – but if you’re looking for high-quality businesses, healthcare offers some of the most fertile ground on the ASX.

Enjoy the hunt … and your weekend.

Ask Evan

In this week's live stream (filling in for Alan whilst he is enjoying the Scottish Highlands), Evan Lucas, Chief Market Strategist at InvestSMART answered your questions about discusses investment techniques, how to deal with underperforming stocks, ETFs, index funds, Facebook's new cryptocurrency Libra, and how the unemployment numbers affect inflation.

Don't forget, our Q&A live stream has migrated to a new platform on the InvestSMART website which can be found here - Alan will be back at the helm in July.

Next Week

By Craig James, Chief Economist, CommSec

Second-tier data to round off financial year

- A relatively quiet week is in prospect. The focus is an appearance from the Reserve Bank Governor. No ‘top shelf’ economic data is scheduled.

- The week kicks off on Monday with the Reserve Bank Governor to participate in a panel discussion at the ANU Crawford Australian Leadership Forum in Canberra. Clearly everyone is keen to get clues on the timing of the next rate cut.

- On Tuesday, the regular weekly reading on consumer confidence is published by ANZ and Roy Morgan. And the Australian Bureau of Statistics (ABS) releases its annual publication “Selected Characteristics of Australian Business 2017/18”. Statistics include business performance, innovation and finance demand.

- Also on Tuesday Reserve Bank Assistant Governor, Michele Bullock, delivers a speech “Modernising the Australian Payments System” at the Central Bank Payments Conference in Berlin.

- On Wednesday, the ABS releases March quarter data on Engineering Construction. As well as providing data on recent activity, there are estimates of the amount of construction remaining to be done. There was $66.2 billion of engineering work yet to be done as at December 2018, up from $62.5 billion in the previous quarter. Excluding the resource sector (coal, oil, pipelines etc.) work to be done stands at $40.4 billion, below the record high of $45.3 billion in March 2012.

- On Thursday the ABS releases the Finance & Wealth publication for the March quarter. The report provides detailed estimates on household wealth. Lower home prices have restrained wealth levels. But in the March quarter wealth would have been boosted by a sharp rise in sharemarket assets. The All Ordinaries index rose 9.7 per cent in the quarter.

- On Friday, the Reserve Bank releases the estimates of private sector credit (effectively, loans outstanding). Consumers and businesses haven’t been keen to take out new debt in recent months. Annual credit growth fell from 3.9 per cent in March to a 5½-year low of 3.7 per cent in April.

- Also on Friday the Australian Prudential Regulation Authority (APRA) releases the May estimates on bank deposits and loans. APRA also provides estimates on credit card lending. Credit card lending by banks to households fell from $39.85 billion to an 8-year low of $39.62 billion in April, down 3.9 per cent over the year.

Focus on G20 Summit and US housing

- In the US, two key data surveys on home prices will be released with two readings on consumer sentiment.

- The week begins on Monday in the US when the Chicago Federal Reserve releases its National Activity index. The Dallas Federal Reserve also issues its June manufacturing activity index.

- On Tuesday in the US, a raft of data is set for release. There are two measures of home prices – the S&P/Case Shiller home price index as well as the Federal Housing Finance Agency (FHFA) measure. In March, the S&P/Case Shiller index was up 0.7 per cent to stand 2.7 per cent higher than a year ago.

- Also on Tuesday the Conference Board releases its survey of consumer confidence. The Richmond Federal Reserve issues its influential manufacturing index. There is also the regular US weekly data on chain store sales along with data on new home sales in May. And US Federal Reserve Chair Jerome Powell speaks at the Council on Foreign Relations in New York.

- On Wednesday the regular weekly reading on new mortgage applications is released together with data on durable goods orders and international trade – exports and imports of goods.

- The data on durable goods orders is seen as a proxy measure of business investment – especially the ‘underlying’ estimate that strips out ‘lumpy’ defence equipment and transport goods like aircraft. Over the past eight months, durable goods orders have effectively been marking time. Orders fell by 2.1 per cent in April.

- On Thursday, the final estimate of economic growth (change in GDP – gross domestic product) is released for the March quarter. The economy has been tracking nicely although showing some signs of slowdown in just the past few months. The economy is estimated to have grown at a 3.1 per cent annual rate in the March quarter.

- Also on Thursday, data on pending home sales is released with the regular weekly data on new claims for unemployment insurance.

- Also on Thursday in China, industrial profits figures are scheduled. Profit growth is down 3.4 per cent over the year to May as trade tensions with the US intensify.

- On Friday, data on personal income and spending is issued for May. If the economy is losing momentum, it should show up in the spending estimates. But the personal income/spending data is also important as it contains the Federal Reserve’s preferred measure of inflation - the core personal consumption deflator.

- Also on Friday in the US, the University of Michigan releases its final June estimate of consumer sentiment. And the Chicago purchasing managers index is issued.

- Also on Friday in Japan, the G20 Summit kicks off in Osaka with trade talks between US President Donald Trump and Chinese President Xi Jinping expected to resume.

Last Week

By Shane Oliver, Head of Investment Strategy and Chief Economist, AMP Capital

Investment markets and key developments over the past week

- Share markets pushed higher over the last week as the Fed and the ECB hinted strongly at monetary easing ahead and as it was confirmed that Presidents Trump and Xi will meet on the sidelines of the 28-29 June G20 meeting in Japan. Expectations for monetary easing saw bond yields push even lower with a new record low in Australia. Commodity prices rose with oil boosted after Iran shot down a US drone and iron ore making a new five year high. The $A rose above $US0.69 as heightened expectations for Fed easing pushed the US down.

- Round three of US/China trade talks on the way? It’s very good news that Presidents Trump and Xi will meet to try and re-start trade talks. Ultimately, I expect a deal as it’s in both sides’ interests given the economic damage not resolving the issue is causing. Whether this meeting gets us there though remains to be seen given the damage to goodwill that has already been done. It’s noteworthy that Trump seemed a lot keener on the talks – having had another “very good” call with Xi – than the Chinese side which simply acknowledged that they would go ahead. China may just listen politely and conclude they would be better of negotiating with a more conventional president.

- Of course, the big difference between now on the trade front and its threat to growth compared to last year is that central banks are more dovish. And this was underlined in the past week by both the ECB and the Fed sounding very dovish and looking to be preparing for monetary easing in the months ahead. ECB President Draghi noted that “in the absence of improvement..additional stimulus will be required” and the Fed was dovish across the board in downgrading its activity assessment, inflation expectations and dot plot of Fed officials’ interest rate view. Both look likely to start easing around July/September. While shares are still vulnerable to a short term pull back in the months ahead on weak data or trade or geopolitical fears investors who bet against the ECB and the Fed over the last decade would have made a big mistake. And the same likely applies now, with global growth and shares likely to be higher on a 6-12 month view.

- Its hard to see the Fed easing more than the RBA. Current market pricing is for around 100 basis points of Fed cuts over the next 12 months compared to around 60bp from the RBA. Our view is that the US economy is not that bad and its more likely to be around 50bp from the Fed. Growth in the US is running at 3.2% year on year compared to 1.8% in Australia, unemployment plus underemployment is 7.1% in the US compared to 13.7% in Australia, job separations or quits are at a cyclical high in the US compared to a multi decade low in Australia and there are less unemployed people than vacancies in the US compared to 2.5 times more in Australia.

- Australian shares are now just 2% away from their resources boom high reached on 1 November 2007. While US shares made it back to their 2007 high in 2013 and global shares did the same in 2014, Australian shares took longer because of much higher interest rates after the GFC, the absence of money printing, the high $A until recent years, the collapse in commodity prices and the fact that the 2007 high was a much higher high for Australian shares than it was for global shares. The fact that Australian companies provide more of their return in dividends – with a dividend yield of 4.5% compared to around 2.5% for global shares – means we really need to assess them including dividends, ie with an accumulation index, and on this basis the Australian share market surpassed its 2007 record high way back in 2013.

.png)

Source: Thomson Reuters, AMP Capital

- Is it sustainable? In the short term who knows! Going through past bull market highs after a long period below can attract investors into the market because of all the attention it causes so it could push on for a bit. But after such a huge run – the market is up 18% year to date and 6% since around the election – it is getting vulnerable to a technical pull back, and soft economic data, global trade uncertainty or geopolitical threats could provide the trigger. However, looking beyond the short term, the combination of low bond yields, easing central banks and a likely pick up in global growth in the second half point to even higher share prices on a 6-12 month horizon.

- On something completely different...clearly The Pet Shop Boys are not great fans of some politicians but seeing this makes me wonder how come I never get a welcome like that? - although things didn’t end so well for the Ceausescu’s nearly 20 years later! I wouldn’t mind one of those Lincolns though!

Major global economic events and implications

- US economic data released over the last week was a mixed bag. Headline manufacturing conditions indexes in the New York and Philadelphia regions fell sharply suggesting trade and other uncertainties are continuing to impact. However, they may not be as bad as they look with the components of the Philadelphia survey holding up pretty well. Meanwhile housing starts are showing signs of responding to falling mortgage rates

- While the ECB and Fed swung dovish big time, the Bank of Japan seemed more relaxed…for now. The pressure remains on though given ongoing weak core inflation of 0.5% in May and a soft manufacturing PMI reading. The Bank of England was a bit more dovish though.

Australian economic events and implications

- Australian data releases were pretty lightweight over the past week. ABS house prices confirmed a roughly 3% fall in house prices for the March quarter but this was long ago reported by private sector surveys which have since shown a moderation and post the election a stalling in house price falls. Continuing strong population growth of 1.6% over the year to December quarter last year (led by Victoria at 2.2% year on year, Queensland at 1.8% and NSW around average) highlights an underlying source of strong demand growth in the economy including for housing. But a fifth fall in a row in skilled vacancies in May highlighted slowing jobs growth ahead and probably a further upwards drift in unemployment which we expect to reach 5.5% by year end and which will act as a constraint on property price increases. CBA’s business conditions PMIs rose further in June suggesting news of rate cuts may have helped.

- The minutes from the last RBA board meeting and a speech by RBA Governor Lowe reiterated the RBA’s key messages of late: that there is still spare capacity in the labour market; more rate cuts are likely; but help from fiscal policy is desirable. We remain of the view the RBA will in July/August, November and February taking the cash rate to 0.5%.

- There was good news on the fiscal front with a further lift in infrastructure spending in NSW and SA such that public capital spending will continue to grow at around 10% over the year ahead. This is good as infrastructure spending growth needs to remain strong for a while yet to help fill the gap from the housing downturn. We might need to see more though.

- Meanwhile RBA Head of Financial Stability Jonathan Kearns provided a bit of balance around the issue of mortgage arrears – pointing out that they are rising but remain low on global comparisons and well down on early 1990s levels and that arrears amongst loans made after lending standards were tightening are lower than those made before. Unemployment remains the key though – it can go up a bit but if it goes up a lot (to say to 6.5%/7% plus then it could have a bad feedback impact on the housing market). Which I suspect is what the RBA is trying to head off!

What to watch over the next week?

- The meeting between Presidents Trump and Xi at the G20 meeting on Friday and Saturday to try and restart trade talks will no doubt dominate over the week ahead.

- On the data front in the US the main focus is likely to be on core private consumption deflator inflation data for May to be released Friday which is likely to show a fall to just 1.5%yoy. In other data expect a slight fall back but to still strong levels for consumer confidence, a rise in new home sales and modest gains in home prices (all Tuesday), a modest rising trend in underlying durable goods orders (Wednesday) and a small rise in pending home sales (Thursday).

- Eurozone economic sentiment data for June (Thursday) will be watched for further signs of stabilisation after the fall through last year and core inflation for June (Friday) is likely to have remained weak at around 0.8%yoy.

- Japanese labour market data for May to be released Friday is likely to remain tight helped by the falling population and industrial production data will also be released.

- In Australia, RBA Governor Lowe is on a panel discussion on Monday, but I doubt he can tell us much more that is new in terms of the interest rate outlook. Private credit growth for May (Friday) is likely to have remained modest.

Outlook for investment markets

- Share markets remain vulnerable to short term volatility and weakness on the back of uncertainty about trade, middle east tensions and mixed economic data. But valuations are okay – particularly against low interest rates, global growth is expected to improve into the second half if the trade issue is resolved and monetary and fiscal policy has become more supportive and will likely become even more so all of which should support decent gains for share markets over the next 6-12 months.

- Low yields are likely to see low returns from bonds, but government bonds remain excellent portfolio diversifiers.

- Unlisted commercial property and infrastructure are likely to see reasonable returns. Although retail property is weak, lower for longer bond yields will help underpin unlisted asset valuations.

- National average capital city house prices remain under pressure from tight credit, record supply and reduced foreign demand. However, the combination of rate cuts, support for first home buyers via the First Home Loan Deposit Scheme, the relaxation of the 7% mortgage rate test and the removal of the threat to negative gearing and the capital gains tax discount point to house prices bottoming out by year end and higher than we had been expecting. We see a 12% top to bottom fall in national capital city average prices. Next year is likely to see broadly flat prices as rising unemployment acts as a constraint.

- Cash and bank deposits are likely to provide poor returns as the RBA cuts the official cash rate to 0.5% by early next year.

- The $A is likely to fall further to around $US0.65 this year as the gap between the RBA’s cash rate and the US Fed Funds rate will likely push further into negative territory as the RBA moves to cut rates by more than the Fed does. Excessive $A short positions, high iron ore prices and Fed easing will help provide some support through and will likely prevent an $A crash.