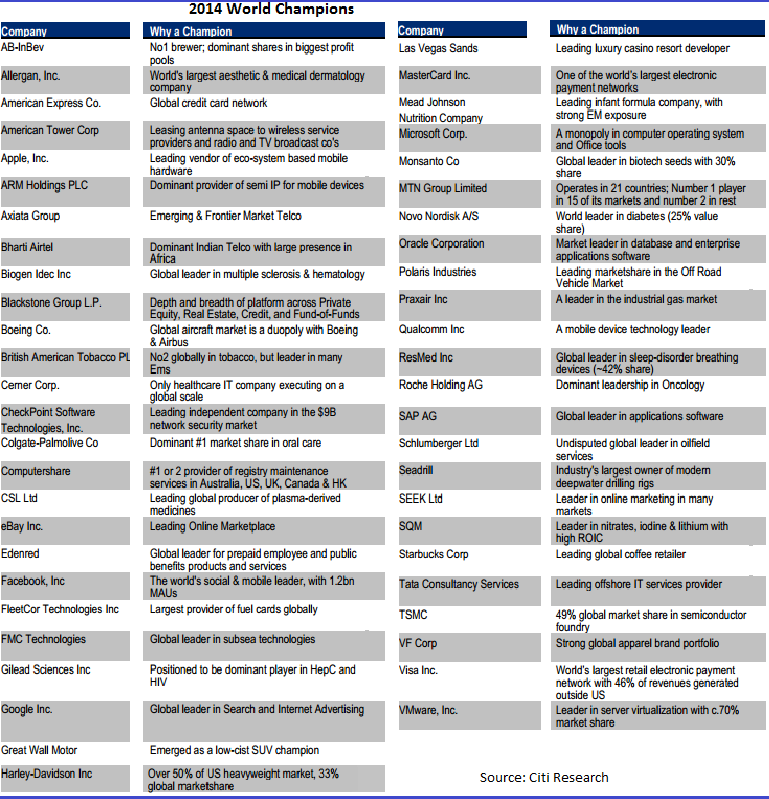

Australia's four global champions

| Summary: Australia has four companies listed in the ranks of Citi’s 2014 world champions, among the likes of Apple, eBay, Facebook and Google. But they’re not our biggest companies by market capitalisation or profit. They have been ranked based on their global scope, market share and business models. |

| Key take-out: Local brokers have mixed recommendations, but Citi likes Computershare, CSL, ResMed and Seek for their international growth platforms. |

| Key beneficiaries: General investors. Category: Shares. |

Australia’s most widely held stocks have missed out on the selection in Citigroup’s top 50 global champions.

Rather, our healthcare and online stocks have stolen the limelight from the likes of our big four banks, the miners and Telstra (TLS).

The global investment firm instead decided that online job agency Seek (SEK), sleep disorder device maker ResMed (RMD), blood plasma company CSL (CSL) and stock transfer services company Computershare (CPU) were more deserving to sit among the exclusive list.

To identify these companies, Citi asked its analysts from across the globe to search for companies within their coverage with global scope, leading market share and enduring business models.

Of the 174 stocks which best fit these parameters, Citi then refined the list to 50 by finding the companies with the best historical and forecast financial performance. Each company was individually profiled and evaluated across an array of performance metrics, the bank says, including healthy balance sheets, strong EPS growth and high cash flow.

What’s particularly interesting is that of our four local winners, Citi has only one – ResMed – currently rated as a buy. Seek and Computershare are rated neutral, while CSL is a sell.

How can this be? According to Citi’s note, the exercise was done irrespective of current ratings because it was designed to highlight companies with significant and enduring business models over the long term, rather than their predicted share price performance in the next 12 months.

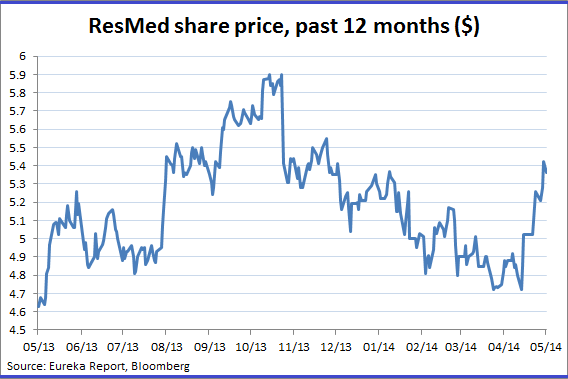

ResMed

What makes ResMed a champion – and what sets it apart from its three peers – is Citi’s positive outlook for the company over both the short and long term.

Despite recent challenges to the company’s business in the US (see this week’s Collected Wisdom), the investment bank says ResMed’s ongoing product innovation and its strong execution will sustain the company at the forefront of the industry.

ResMed currently has a 41% market share in the treatment of sleep apnoea around the world, with 54% of its business from the Americas, 36% from Europe and 10% from the Asia Pacific.

Citi has a buy recommendation on the stock with a target price of $6.74 – a whopping 24.8% above yesterday’s closing price.

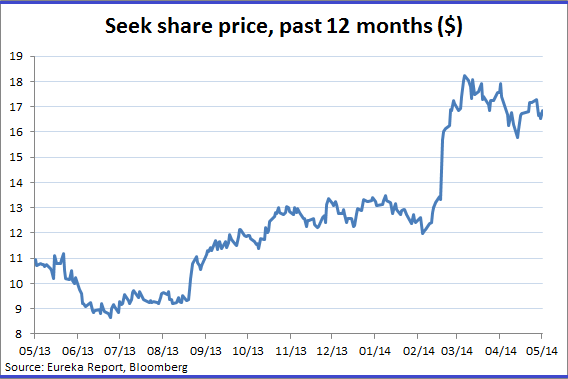

Seek

Seek’s online employment portals across both developing and emerging markets dominate their peers, Citi says, and this is set to continue into the foreseeable future.

“The lower capital requirements and scalability have translated to high returns on capital employed and robust operating margins,” the investment bank says.

However, in the past 12 months, Seek has soared more than 50% to yesterday’s price of $16.52. While Citi believes double-digit profit growth and further acquisitions will support the stock’s earnings multiple of around 27 times, any further upside in the short term is unlikely.

That being said, Seek is building a war chest of cash from its international assets. Though the company has a history of reinvesting its cash into new opportunities – which the market expects to persist – it could begin to dish them out to shareholders instead, says Citi.

Citi rates Seek as neutral, with a target price of $15.45.

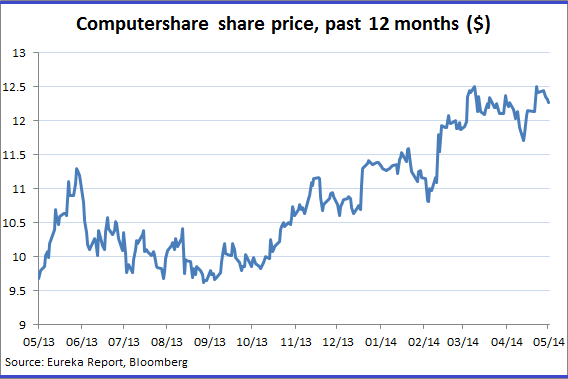

Computershare

As the global leader in registry maintenance with an attractive future in the years ahead, Computershare was a fit for Citi’s requirements.

For one, Computershare’s global scale allows it to hold significant advantages against its local competitors – underpinning strong returns on equity.

And though the company has endured large falls in capital market related incomes since the GFC, Citi believes its growth outlook remains promising. Over the next few years, Citi says strong cost control from the implementation of the global servicing model will help deliver earnings growth.

Despite perhaps requiring more capital in the future, its registry business is highly cash generative, enabling future acquisitions and a reliable 2-3% dividend yield over the next few years.

However, Citi thinks there are risks associated with the company having a new chief executive, who may want to set the bar too high, and the company trades at a premium to the industrials index. Further, material interest rate rises appear to be a long way off.

Citi rates Computershare as neutral, with a target price of $12.50.

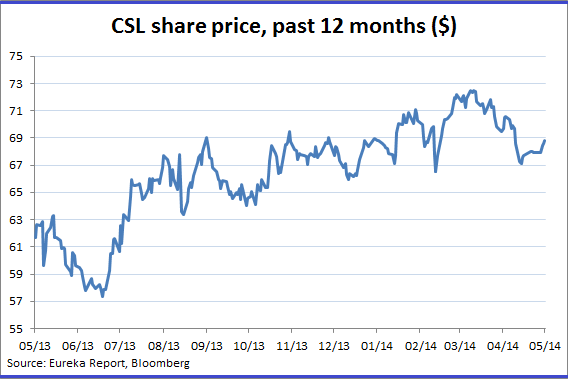

CSL

CSL maintains a significant competitive advantage over its rivals by being the lowest-cost producer in the sector, making it a champion stock for the medium term, according to Citi.

Its low-cost advantage derives from factors including high-quality manufacturing assets, a strong global marketing presence and a wide range of low-cost plasma products.

This has enabled it to consistently grow both organically and through acquisitions, with earnings per share (EPS) growing at a compound annual growth rate (CAGR) of 22% and a return of equity of 30% respectively since it listed in 1994, Citi notes.

In what appears to be somewhat paradoxical, however, Citi currently rates CSL as sell, pointing to its stellar share price rally over the last one and two-year periods, with a price target of $62.20

The investment bank views the stock as slightly expensive as current price-earnings multiples, as it believes such a premium rating will be difficult to maintain given the looming competitive threats in the immunoglobulin and haemophilia divisions.