Australia's economic outlook: The four main risks

Summary: The RBA's forecasts help to shape financial markets including the ASX200 and pricing for government bonds. |

Key take-out: It is somewhat unusual that the RBA is forecasting lower commodity prices but maintaining a bullish view on growth. |

Key beneficiaries: General investors. Category: Economy. |

Despite a surprise decline in economic activity during the September quarter, the Reserve Bank of Australia (RBA) is confident that the economy will record strong and improving growth over the next three years.

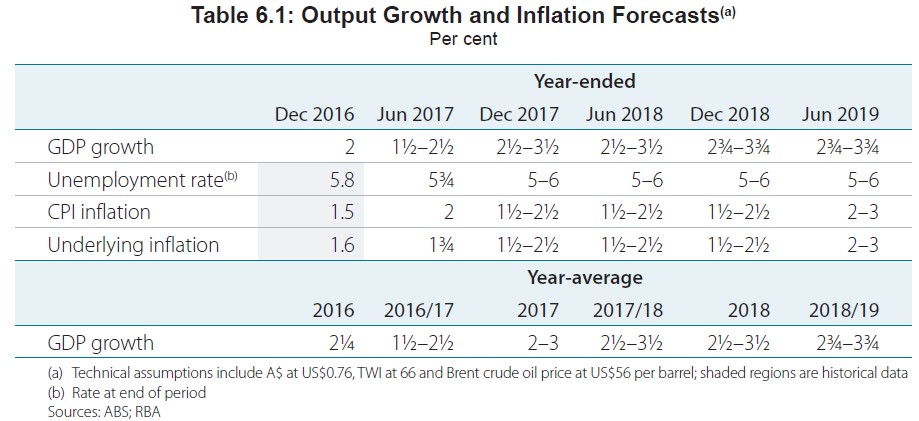

The RBA's Statement on Monetary Policy, released every three months, paints a fairly optimistic outlook for the Australian economy. It forecasts that real GDP will rise by between 2.5 and 3.5 per cent in the 2017 and 2018 calendar years.

The result is much stronger than the estimate of 2 per cent in 2016, and exceeds average annual growth over the past decade.

These forecasts help to shape financial markets including the ASX200 and pricing for government bonds. But it is important for investors to realise that there is considerable uncertainty surrounding this outlook.

It's also worth remembering that the RBA has an awful track record when it comes to forecasting economic growth. Reserve Bank research, published in 2012, indicates that there is no evidence that the bank can predict economic growth in either the short or medium-terms.

VIDEO: The RBA's rates dilemma, February 14

In recent years, there has been a tendency by the bank to overestimate growth and paint an optimistic picture of the economic outlook. Whether this is intentional or a product of modelling deficiencies is unknown but it has resulted in regular downgrades to the outlook.

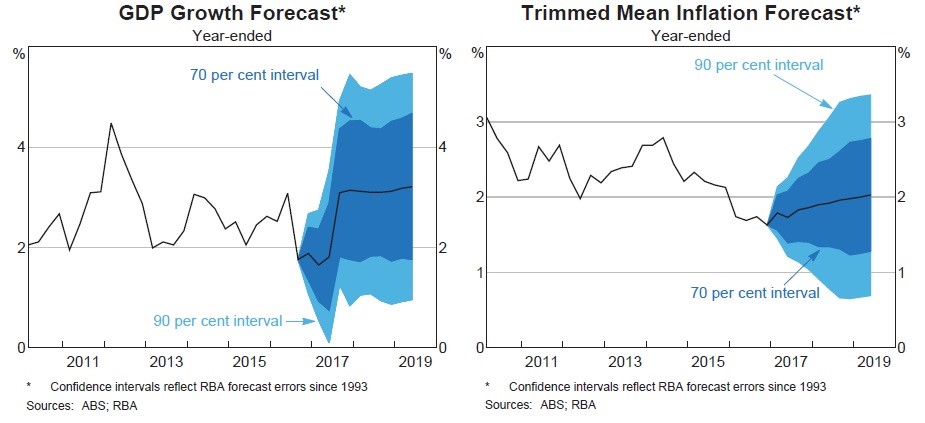

To the RBA's credit, it acknowledge its shortcomings when publishing its official forecasts. The graphs below, contained in Friday's statement, show the confidence intervals surrounding the RBA's forecasts for GDP growth and inflation. The darker intervals indicate that the RBA is 70 per cent confident that inflation or growth will fall within those parameters.

If those confidence intervals strike you as being quite wide, that's because they are. When you remember that market pricing is based on that central scenario, you can get a good feel for the risks facing market participants. This is a useful habit for investors to get into: it isn't sufficient to merely understand the most likely scenario but to also recognise the range of plausible scenarios.

Right now there is a high level of uncertainty surrounding Australia's economic outlook. Market volatility might be fairly mild – some might say too mild – but risk surrounding commodity prices and domestic demand, not to mention geopolitical risks, is high.

The International Monetary Fund (IMF), for example, has urged the RBA to cut the cash rate by 75 basis points over the next six months. They believe that a "'low for longer' strategy would be best suited” to manage the existing low-growth and low-inflation environment.

Both Macquarie Bank and Credit Suisse have declared that the RBA's existing forecasts are too bullish. Macquarie expects rate cuts in May and August this year; Credit Suisse also expects further rate cuts and a downgrade to the RBA's official forecasts in the months ahead.

As I noted in early February, there may be limited scope for the Reserve Bank to cut rates further (Will the RBA step in to tackle the dollar?; February 1). Assuming that market conditions hold, with the US Federal Reserve hiking rates by between 50 and 75 basis points this year, the RBA can only afford another 25 basis points of easing before they run the risk of undermining foreign capital inflows and Australia's current account deficit.

RBA Governor Philip Lowe is well aware of the importance of foreign capital to Australia's economic performance.

“Year after year, for more than two centuries now, capital from the rest of the world has helped build our country,” said Lowe in a speech delivered in Sydney last week. “If we had had to rely on just our own resources, we would not be enjoying the prosperity that we do today.”

So we now have a central bank that is faced with low-inflation and low-growth – both of which they are hopeful will right themselves – while also facing what appears to be a lack of genuine policy instruments.

I don't think that they can deliver on what the IMF proposes and I have my doubts as to whether they can deliver the rate cuts that Macquarie predicts. If the Federal Reserve gets cold feet – or the Trump market rally begins to reverse – then the RBA may receive a little more breathing room that would allow for further rate cuts.

Risks to the outlook

The Statement on Monetary Policy also contains a discussion on the key risks facing the Australian economy. The main risks are discussed below:

- The Chinese economy and steel production

According to the RBA, “stronger-than-expected activity in the [Chinese] housing market has supported demand for steel” and the “near-term forecasts for iron ore and coking coal prices are predicated on a profile for Chinese steel production that is higher than previously anticipated.”

The rise in commodity prices, driven by stronger-than-anticipated demand for steel, has been a recent bright spot for the Australian economy. It's the main reason why our trade surplus has surged to a record high and in the process supported nominal GDP growth (great for the Federal Budget) and domestic income growth (great for business income and profits and, eventually, wages).

Nevertheless, “steel production is still forecast to decline gradually because the Chinese authorities have introduced a range of measures that are expected to dampen residential investment” and there are “already signs that these measures are having an effect on housing market activity in some cities.”

The RBA also expressed concern that “the recent policy stimulus has added to already high levels of debt”, which “increases the potential for financial dislocation and economic disruption in the future.” It speculates that Chinese authorities may need to tighten monetary policy to reduce capital outflows and that, in turn, could lead to slower than expected Chinese growth.

- Commodity prices and the terms of trade

There is a great deal of uncertainty surrounding commodity prices and Australia's terms of trade. At the moment the RBA believes that higher commodity prices will be temporary and will be wound down over the forecast period. As a result, it doesn't anticipate that higher commodity prices will “lead to a material change in mining investment, wages or household consumption.”

However, if higher commodity prices do persist – or in the process of unwinding don't fall as far as expected – then it creates some upside risk for the Australian economy. National income would be higher than anticipated, feeding into wage growth and pushing inflation towards the RBA's annual target.

Any material change to commodity prices will drastically change the economic outlook. The private sector banks betting on further rate cuts are doing so largely because they are assuming that commodity prices will fall. In light of that it is somewhat unusual that the RBA is forecasting lower commodity prices but maintaining a bullish view on growth.

- Momentum in the labour market

The RBA is forecasting a modest reduction in the unemployment rate over the forecast horizon. Part of the reason is that economic growth over the next three years is expected to be driven by commodity exports, which as a general rule are not considered labour-intensive.

Any increase in labour demand could also be “accommodated by providing part-time workers with additional hours rather than hiring new workers”, which would reduce the under-utilisation rate but not the unemployment rate.

Higher commodity prices could boost employment growth but at the same time we have automobile manufacturers leaving Australia and a lack of investment across the non-mining sector. The safe bet is that the unemployment rate remains at a relatively high level; I expect it to increase towards 6 per cent during 2017.

- Housing

The RBA acknowledges that housing is one of the major sources of downside and upside risk for the Australian economy.

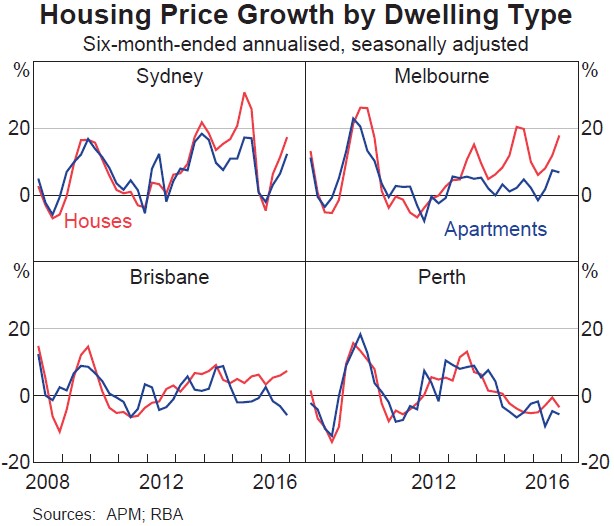

House price growth picked up over the second half of 2016, particularly in Sydney and Melbourne, which could lead to stronger spending and renovation activity. But the risk of a housing downturn is ever present and if one occurs then a “significant number of projects currently in the residential construction pipeline” may be delayed or even cancelled.

Investor activity in residential markets is currently quite strong but the RBA acknowledges that “history shows that sentiment can turn quickly, especially if prices start to fall.” Historically low rental yields and falling rents across some cities suggest that valuations are stretched.

Monetary policy, particularly as it relates to Australia, is in a really interesting spot right now. The optimism of the RBA is coming up against a banking sector that is more circumspect.

Commodity prices and the housing sector are the two areas that warrant close watching – not just due to investor exposure, although admittedly housing and mining stocks are two of Australia's favourite investments – but also due to the effect that these sectors can have on the broader economy.

We have seen in recently years the damage that falling commodity prices can have on federal budgets, private sector wages and inflation. I'm not sure the RBA has the ammunition to manage another collapse in the price of iron ore and coal.

Similarly we can hardly afford a decline in Sydney and Melbourne house prices, although many analysts would argue that we can't really afford an increase either.