Australians are saving for the rainy days ahead

The global financial crisis spooked Australian households and they haven't recovered. Household savings increased significantly following the crisis and, with an uncertain economic outlook, it appears likely that Australian households will remain fairly cautious over the next few years.

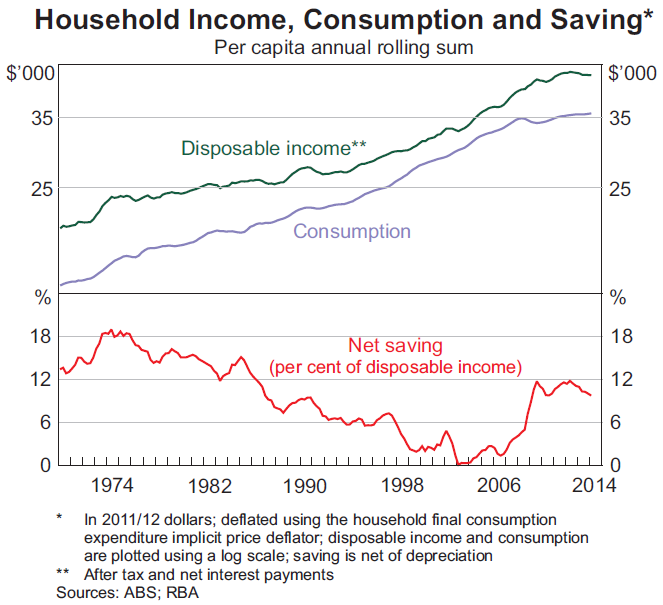

Household savings in Australia declined significantly between the early 1970s and the early 2000s. Since 2006 the household savings rate has rebounded to its highest level since the mid-1980s.

The Reserve Bank of Australia notes in a Bulletin article released yesterday that the earlier trend was driven by a number of factors.

More specifically the decline in household spending reflects a combination of “increased availability of credit, falling real interest rates, more stable economic outcomes and rising asset prices”. They note that “changes in household income growth and expectations may also have affected the … savings ratio”.

In other words, a combination of banking deregulation, inflation targeting and good economic conditions encouraged households to grow less cautious throughout the 1990s and early 2000s.

Since then, and despite continued good fortune, our saving habits have obviously changed. Our higher savings rate has given rise to the ‘cautious household’ theory that saw households fall back into their shells when the global financial crisis began.

Given household spending accounts for over half of real GDP, this shift has had a significant effect on growth and may have implications for our economy in the future.

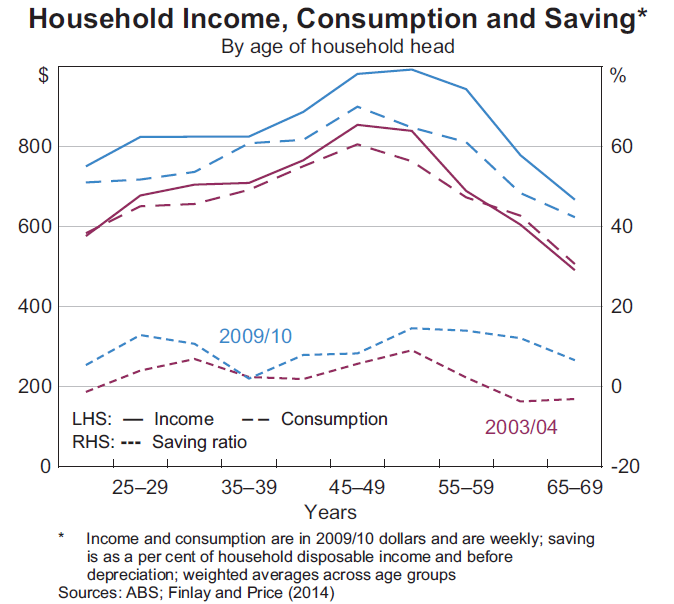

Analysing trends in household saving is difficult at the aggregate level and the likely drivers, while probably accurate, always feel a little dissatisfying. As a result, the RBA utilised the Household Expenditure Survey to identify specific changes in behaviour across different age groups and socioeconomic factors.

Between 2003-04 and 2009-10, household saving increased among younger and older households, with consumption growth trailing income growth significantly. Through middle-age, the change was less pronounced.

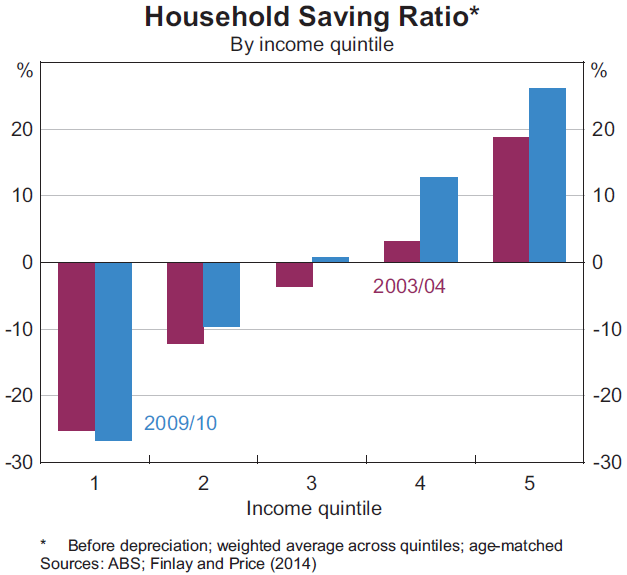

Wealthier households are inclined to save more, though the savings rate rose among all wealth quintiles increased between 2003-04 and 2009-10. By income group, savings have increased among four of the five quintiles with low income earners the only group that saved a lower share of their income between 2003-04 and 2009-10.

Going beyond its descriptive analysis, the RBA applies a model to explain changes in the savings ratio, using a variety of variables such as income and wealth but also household characteristics including education and age group.

Obviously income and wealth are strong drivers of saving behaviour. But it also finds that saving rose among those groups who were viewed as being vulnerable to income or asset price shocks, which suggests that the ‘cautious household’ theory has some merit. Effectively, in response to a less certain outlook, households made the prudent decision to wind back spending and prepare for the future.

Households with high debt levels have also taken a more cautious attitude towards spending. To some extent, this may reflect a change in our preference for debt, or again a response to a more uncertain future.

The savings ratio has also increased disproportionately among households with a higher level of education, which points to a “downward reassessment of expected future income prospects for these households”.

In short, the change in behaviour has been driven by a less secure outlook. This was prompted by the global financial crisis and although households escaped relatively unscathed their cautiousness has continued.

What does this mean for the future?

With our terms of trade beginning to decline and mining investment set to drop sharply, Australian households are likely to take a cautious approach to spending. In that regard, household saving should remain at a fairly elevated rate for years to come. But with negative real wages, I cannot discount the possibility that some households may dip into their savings in the near term to maintain their standard of living.

Changes resulting from the budget, including higher university fees and welfare cuts, are likely to lead to greater inequality and reduce the returns to education. Greater inequality would be expected to increase the aggregate savings ratio since the gains at the top of the income or wealth distribution should exceed the cut to savings at the bottom. Lower returns to education would encourage greater savings as households downgrade their assessment of future earnings.

Partially offsetting these factors, an ageing population is expected to reduce the savings ratio by around two percentage points over the next 15 years. The saving profile of the baby boomers picked up between 2003-04 and 2009-10, but older households tend to save less as they enter retirement, and so this shift will put downward pressure on the aggregate savings ratio.

An uncertain outlook for the Australian economy suggests that households will continue to take the same cautious approach to spending that began with the global financial crisis. With income growth set to be fairly weak over the medium-term outlook, particularly as our terms-of-trade declines, this points to a fairly subdued household sector over the next few years.