Australians are missing out on the benefits of rising exports

Net exports -- which accounted for around half of real GDP growth over the past year -- continued to climb in the December quarter and are set to contribute solidly to growth when the national accounts are released. Nevertheless, the ongoing deterioration in the terms of trade -- only partly offset by the weaker dollar -- ensures that Australians aren't seeing the true benefits of the export upswing.

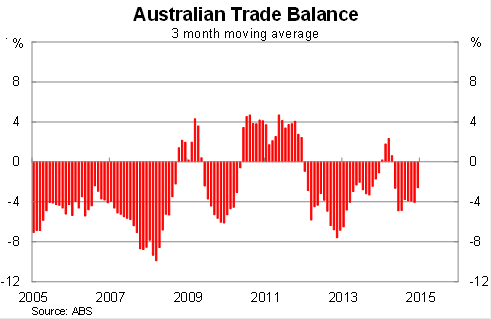

On a monthly basis, Australia's trade deficit more than halved to $436 million in December -- its lowest level since March. That completes a quarter where the bottom line has improved and should contribute to growth.

The value of exports rose by 1.4 per cent in December but, with the terms of trade tumbling, exports are 4.1 per cent lower over the year. Growth was driven by higher exports of rural goods and gold, which more than offset a decline in non-rural goods. Services contributed modestly.

By comparison, the value of imports fell by 0.7 per cent to be 2.8 per cent lower over the year. The weaker dollar is beginning to hurt for some importers, particularly those importing immediate goods, which were down 3.2 per cent in December.

With the Australian dollar easing -- down 9.8 per cent since the end of November against the US dollar -- imports will come under increasingly pressure in the months ahead. That'll be good news for Australian businesses which act as a substitute for what was, until recently, cheaper foreign goods.

A key part of the outlook for both trade and the broader economy relates to Australia's terms of trade. Normally economists assume that nominal variables don't matter – that they cannot have an effect on the real economy.

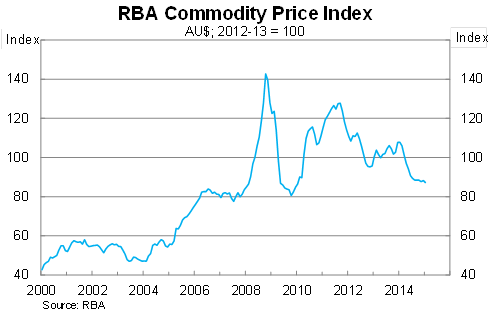

That holds for the most part but significant shifts in prices -- usually for commodities such as oil or the terms of trade -- can have very real and often dramatic effects on the economy. In Australia's case, the sharp fall in the terms of trade has offset much of the recent gains in export volumes. Basically, the terms of trade is weighing on the income received from these exports and the goods and services we can buy using that income.

Export prices were unchanged in the December quarter but are 9.1 per cent lower over the year. This largely reflects lower commodity prices, which are down 19 per cent over the year to January.

Adjusting trade for changes in prices paints a very different picture of net exports. While the value of trade is currently in deficit, the volume of trade remained in surplus during the December quarter. Based on my calculations, net exports are set to contribute around 0.5 percentage points to real GDP growth when the national accounts are released.

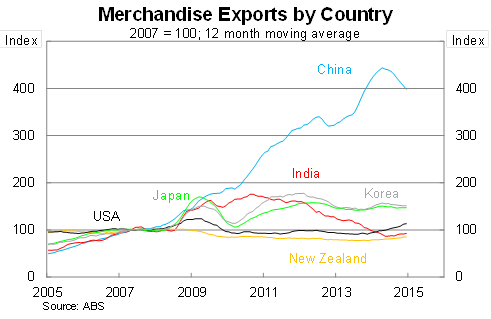

Exports to China rose during December -- admittedly on a non-seasonally adjusted basis -- but are now 18.6 per cent lower over the year. The annual data is showing a distinct downward trend -- largely reflecting softer commodity prices -- and that is likely to continue over the next year.

The outlook for Chinese trade is somewhat mixed. On one hand, the Chinese economy is expected to grow at a solid -- albeit slower -- pace over the next couple of years. But Chinese authorities are attempting an economic rebalancing of their own -- away from infrastructure and residential investment towards household consumption -- and their success will be detrimental to the demand for Australian exports and commodities.

The trade data in December was fairly solid. Net exports appear set to contribute around 0.5 percentage points to growth in the December quarter – less than the 0.8 percentage point contribution the quarter before – but a fairly reasonable result nevertheless.

Lower interest rates -- and the prospect of an additional cut in March or April -- should weigh further on the exchange rate and provide further stimulus to exports. China though remains the key and its rebalancing will go some way to determining the trade outlook over the next few years.