Australian stocks: An air pocket or something worse?

Summary: It's now late November and the Australian share market has drifted for the entire year. While periods of stasis happen regularly, what's unusual about this one is that it's bucking the global trend – the US and New Zealand markets, for example, are hitting record highs. That's because our problems are domestic: Australian banks are dealing with negative publicity over capital concerns, while our miners are dealing with a commodity price rout. |

Key take-out: Nothing appears to justify an end to the Australian rally that's been in place since 2012. A lot of the negativity is already priced in, China has further to run and we are likely to see clarity soon about further capital requirements for our banks. We are simply in a hiatus – not a prolonged period of stagnation – that will resolve over time. |

Key beneficiaries: General investors. Category: Shares. |

Aussie equities have increased only three times in the last 15 sessions – for a fall of 3.9%. It's not necessarily that performances elsewhere have been fantastic, however. The S&P500 for instance has increased in 11 of the last 15 sessions, but this only yields a rise of around 2.2%. Still, that is an increase - and a new record high.

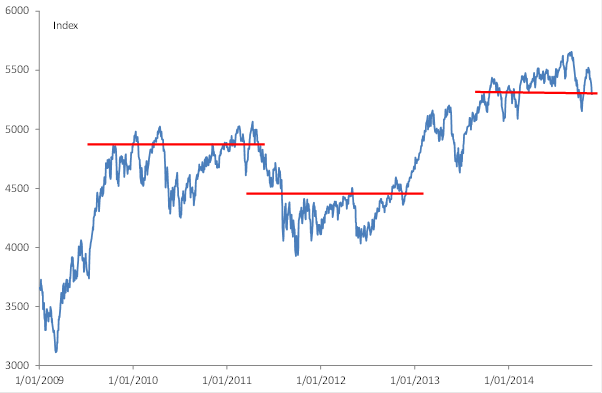

The problem for the Aussie market is that we only just came out of the last correction in September and now we look to be heading back toward that low – it's only 3.5% away. The broader picture is that it's now late November, the market is flat for the year (to be precise that is 0.2% higher) and really has done nothing since September 2013.

On an accumulation basis it's fair to say the market has done better, up 3%, but that's still a disappointing performance.

Now air pockets are not unusual for the Aussie market in this cycle. We've had three big ones since the GFC: immediately after the rally in 2009, again after the correction in 2011 and now.

What's reasonably unusual about this period of stasis (although it's not entirely without precedent), is that it's bucking the global trend or at the very least is not driven by global factors, like, say, the stasis of 2011-12 was. Even New Zealand's stock market is outperforming with only four days out of 15 trading sessions in the red. The Kiwi market is at a record high as well.

Naturally this all strongly suggests that the headwinds facing the Aussie market are domestically sourced. Truth be told, there really isn't a lot of good news anywhere in Australia at the moment.

On macro level, there are question hanging over the Australian market. Many economists in the have been talking about downturns or recessions for the last six years since the GFC. It may no longer be the consensus view, but the uncertainty does weigh on investor sentiment.

Similarly, and as discussed last week (Why banks are still attractive, November 30), our banks are dealing with a significant amount of negative publicity and concerns over capital. On top of that, there are threats from the regulator that they may impose macro-prudential controls to curb lending.

More to the point there is a common view that banks, to the extent that the above issues are only of a temporary concern - are expensive anyway!

Our miners, on the other hand, are dealing with a commodity price rout. Iron ore has dropped more than $US60 so far this year and there seems no let-up in momentum. Analysts are split as to:

- what's causing the fall, and;

- whether iron ore can recover.

That's not to mention the concerns that global investors have about the Australian dollar heading lower.

Those are some very serious headwinds, especially for our banks and miners which comprise about half the Aussie equities market. However, the sluggish price action isn't just limited to those two sectors. Staples like Woollies (WOW) and Wesfarmers (WES) have been belted, while healthcare stocks and Telstra (TLS) have fallen in roughly half the sessions over the last three weeks.

This price action is important as it points to a broader malaise – we can't then blame the market's current stagnation on China or the falling iron ore price. It wouldn't make sense.

Should investors be afraid?

Australian stocks seem to face more headwinds that other markets this is true, although it need not be this way. That's not so much an argument against investing in Australian equities, by the way, it's more an argument to invest overseas.

To my mind the issues confronting the Aussie market aren't structural. So for all the talk of a slowdown, we haven't had one. Growth is above trend on some key measures. I talked about the banks last week.

As for our miners, commodity prices are lower, this is true, yet I think many of the issues surrounding our miners – and other sectors – are related to sentiment rather structural problems per se.

Look at the response to China's very modest rate cuts on Friday. At the time of writing our big miners were up over 3%! Fortescue Metals Group (FMG) was nearly 9% higher. Yet, fundamentally, the Chinese rate cuts change nothing. Interest rates are not even the key policy tool of the Chinese government.

Regardless, while it may not seem this way now, prospects for the Aussie market remain very good. A floor will eventually be reached on the iron ore price – wherever that may be. Moreover, while iron ore is important to those who mine and sell it, it isn't the be-all and end-all for the Australian economy. In any case, our largest miners have breakeven points well below the current price and are ramping up production. Industry consolidation is the worst-case scenario investors can expect.

Only on Friday, the Head of the RBA's economic analysis department (Alexandra Heath) noted, as I have in the past, that the China story still has a long way to run. The process of urbanisation isn't over yet and not expected to end for another 35 years or so.

And while Chinese growth has slowed, the country is a much bigger economy now than pre-GFC. In the RBA's words (and this is the only common sense view I think):

“Many of the long-term drivers of the original increase in demand for commodities from China are still in play. The Chinese economy is continuing to evolve in ways that will support demand for resources, and the sheer size of the economy suggests that these demand forces will, over the medium to long term, remain strong.”

Similarly, we will soon have a little more clarity as to how much extra capital Aussie banks may be forced to raise, resulting from either the Murray Inquiry or the regulators. Both are due soon.

A lot of negativity is still priced into the Aussie market. Much of it misguided. I admit I am very surprised as to just how long this has lasted, but I'm not seeing anything that could truly justify an end to the Aussie rally that's been in place since 2012. I think we are simply in a hiatus that will resolve over time.

Consequently, I don't think we need to be afraid. Frustrated? Sure. But at this point there is little evidence, or reason, for a prolonged period of stagnation.