Australian property still boasting plenty of attractions

Summary: In property, rental growth is soft across the board and auction clearance rates are falling. But auction clearance rates aren't the primary method of selling a home and rental yields in the major capitals are still attractive compared to cash or bonds. |

Key take out: My analysis suggests property is still worth it. Remember, it's not as if other alternatives are doing any better. |

Key beneficiaries: General Investors. Category: Property. |

There's not a lot of love for the property sector at the moment nor a shortage of people who suggest it has done its dash. The question is whether property is still worth it as an investment, and admittedly the evidence against is compelling.

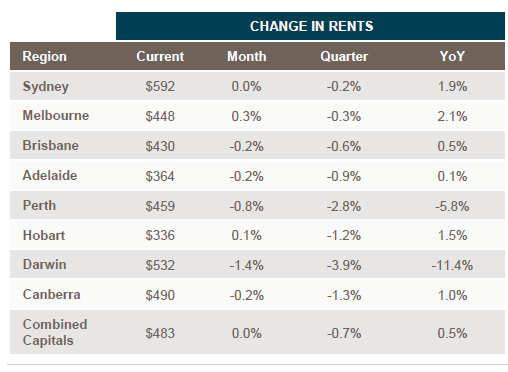

For a start, data provided by CoreLogic shows the weakest rental growth on record, with annual rent rising only 0.5 per cent to September – take a look at table 1 below.

Table 1: Rental growth the weakest on record

Source: CoreLogic

As the table shows, rental growth is soft across the board but especially in Perth, Adelaide and Brisbane. To give some perspective to these figures, the average annual rental gain over the last 10 years or so is generally between 3 and 5 per cent. So it's low, and if anything looks to be weakening further. So for instance over the first three quarters of the year, rental growth has been slightly slower at 0.3 per cent – and that includes a drop of 0.7 per cent for the September quarter itself!

Now the popular view, and this is certainly CoreLogic's view, is that supply increases, especially the huge supply of apartments coming on board, will see that rental growth trend lower still. It seems reasonable.

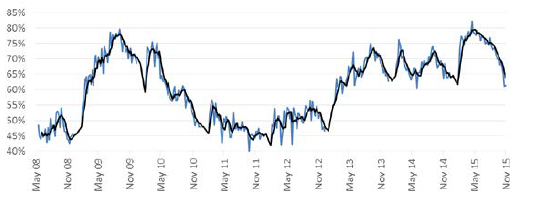

Yet if that wasn't bad enough, there is clear evidence that auction clearance rates are falling (dramatically in some cases). Take a look at chart 1.

Chart 1: Auction clearance rates falling

Source: CoreLogic

It shows auction clearance rates down from a peak of about 80 per cent earlier in the year to just over 60 per cent now. According to CoreLogic this is the weakest result in about two years. What a lot of analysts argue is that a fall in the auction clearance rate points to lower property price growth and there are a few in the market suggesting that prices could fall next year.

When you look at the actions regulators are taking in the market to restrict lending to investors, it's easy to see why people have that view. That lending component is certainly falling – by about 15 per cent since March. Annually, investor loans are down by 2 per cent which is the weakest annual growth in four years.

Now these are very bearish signals, there is no doubt, and they do clearly point to a slowing market. What isn't clear is whether the apparent slowing will last, and if it does, what the magnitude of it will be.

The analysis is made difficult by a few other issues which suggest all the talk about a slowing may be overdone. For a start, auction clearance rates aren't the primary method of selling a home – not by a long shot. So we can't put too much emphasis on a slowing in those rates. As it is, auctions account for slightly more than a third of total home sales in Sydney and Melbourne and maybe 27 per cent in Canberra. For the other capitals it is low single digits, in the main.

Auctions works best in a tight market obviously, which is supply constrained. In a tight market, you get more buyers turning up to auctions and the price gets bid higher.

Conversely when there is more supply on the market, fewer people turn up and an auction may actually work against the vendor. That's why I'm not necessarily convinced a fall in auction clearance rates instead signals a slowing market. Because they occur at a time when the number of auctions, the number of properties up for sale, has surged.

Similarly, and while investor lending has plummeted, lending for owner occupiers has surged. As a result, total lending is actually still rising at a rapid clip – more than 12 per cent annually on the latest figures.

Which brings us to those falling rents. Here too it's not obvious that this is in response to, or some signal of, weakness. Yes there is more supply coming on board, but most of it is apartments. This is important, because the fact is that the vast majority of dwelling stocks isn't apartments. More than 70 per cent is free standing homes and we know that there isn't a glut of free standing homes. So if rental growth is weak, it's not necessarily because of supply. In my opinion, I think a lot of it has to do with surging house prices in Sydney and Melbourne. If an investor is already making a great capital return there is less of a motive to seek rental returns.

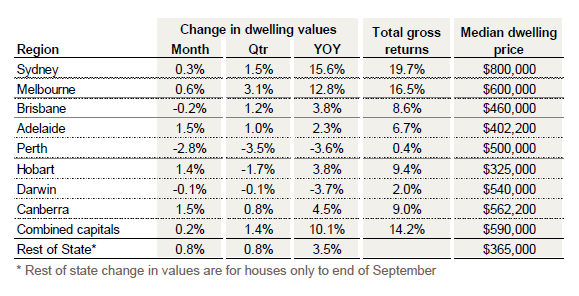

Not that rental returns are bad. Yes rental growth is falling and that suggests yields will moderate too. Yet rental yields are still at 3 per cent or above for the major capitals, sometimes between 4 per cent and 5 per cent which is an attractive yield compared to cash or bonds. Indeed the fact is that even with all of the above factors weighing on the sector, total returns are still very attractive in most cities and some of the large regions.

Table 2: Total returns are still excellent

As table 2 above shows, total returns which include rental yields and capital gain are very strong in Sydney and Melbourne and very attractive in Brisbane, Adelaide, Hobart and Canberra. You know what though? Those returns occurred even with all those negative factors I described earlier.

So is property still worth it? My analysis suggests it is, very much so. Remember, it's not as if other alternatives are doing any better. Some of the heat may come out of the market, sure. But that is probably a good thing. Otherwise, a general pick-up in confidence, strong jobs growth, and ultra-low rates – which the RBA governor, in a speech last night, assured us would be around for some time – should all support the sector.