Australian property lures Chinese buyers

| Summary: Wealthy Chinese investors are snapping up property right across Australia, and beyond Sydney and Melbourne they are taking a particularly shine to Brisbane and the Gold Coast. What’s more, the number of suburbs across the nation with a median property price of $1 million has gone through the roof. |

| Key take-out: More and more Chinese millionaires are looking at ways of investing their capital outside of China, and Australian property is a prime choice for thousands. Indeed, as residential property buyers push higher, the evidence is clear that growing offshore demand is a key driver. |

| Key beneficiaries: General investors. Category: Property. |

As Australian house prices gain even more momentum amid high clearance rates and a strong outlook in 2014, a key question keeps arising: Is Chinese money influencing the local property market and, if so, to what extent?

Recent anecdotal evidence suggests wealthy Chinese buyers are indeed significantly – and increasingly – impacting the market. Not only that, but more detailed findings show where in Australia the Chinese are buying.

Real estate agents report strong demand in inner-city Melbourne and Sydney from Asian – predominantly mainland Chinese – property buyers. On Queensland’s Gold Coast, activity is reported to be particularly intense: Andrew Bell, head of Ray White real estate in Surfer's Paradise, recently estimated that 25% of local sales were going to Asian buyers.

To understand the magnitude of the demand: 64% of Chinese millionaires have either already emigrated with their wealth or have plans to do so, according to a new report conducted by the well-regarded Hurun Research Institute.

Back in 2012 $US3.79 trillion left China illegally just through ‘over-invoicing’ of trade settlements, a report by Global Financial Integrity found – and cash making its way out of China is only getting bigger.

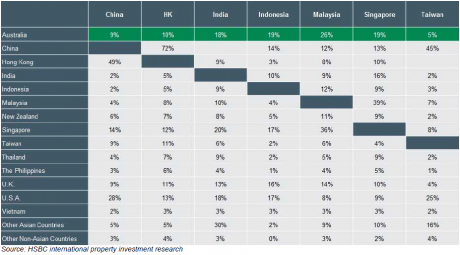

This week global bank HSBC went into more detail, listing Australia as one of the most popular investment destinations among affluent Asians. It found 37% of affluent Asians currently own an investment property overseas, and that they are looking to invest further in the next year.

Australia is the one of the highest-ranked investment destinations for the Chinese, HSBC says, with 9% of affluent Chinese from the mainland choosing Australia and 10% of those from Hong Kong. It’s also the number one destination among wealthy Indonesians, while it was second for Malaysians and Singaporeans.

Alice Del Vecchio, head of mortgages for HSBC in Australia, says that while Sydney and Melbourne have the highest house prices nationally, with prices rising 13% and 12% over the past year, cities like Brisbane provide investors with a better entry point into the Australian property market which has only lifted 3.8%. Access to universities, a large public service sector and holiday homes in Queensland could also be a drawcard, she says.

In fact, affluent Asian investors are beginning to favour Queensland and the ACT over the traditional markets: 25% are looking to buy property in Queensland, followed by 23% in the ACT, 20% in Victoria, 18% in NSW and 16% in Western Australia, says Del Vecchio.

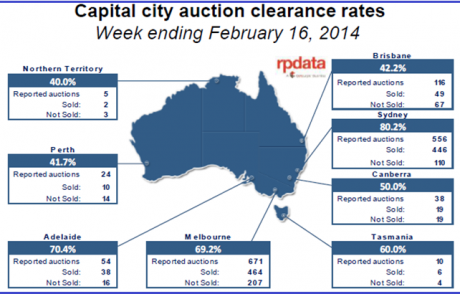

Meanwhile, across Australia residential prices have risen around 10% over the past 12 months, pushing more house values to six-figure levels. On Thursday RP Data research reported 275 suburbs – that’s 12% of the entire market – now have a median house value of more than $1 million.

One in four of these suburbs worth more than $1 million are located in Sydney, followed by 12% in Perth and 10% in Melbourne.

“Five years ago, around 5% of all suburbs nationally had a median house value which was more than $1 million,” says Cameron Kusher, RP Data’s senior research analyst.

A combination of buoyant market conditions and low interest rates are making Australian property extremely attractive as an investment, and with this expected to continue Kusher expects the median value to trend higher throughout 2014.

Editor's note: ROS refers to Rest of State.

* This article is part of the 'It's Time' series in Eureka Report focussing on new opportunities for investors in 2014. Click here to see the entire series.