Australia is asleep at the wheel

Last week I satirised Australia’s outmoded belief that the rate of interest can be used to fine tune the economy. This belief was ensconced in the so-called “Taylor Rule”, which accurately described what central banks tended to do until the economic crisis hit in 2007. That rule saw the inflation rate and the unemployment rate as the two key economic indicators, and the interest rate as the key mechanism needed to achieve an acceptable balance between them.

Of course, the crisis blew that rule out of the water, and issues that central bankers once dismissed as unimportant - like, for example, asset price bubbles or the level of private debt - suddenly had to be discussed.

Well, everywhere except Australia anyway. The Reserve Bank of Australia released its Statement on Monetary Policy last week, and it is notably sanguine about both asset prices and private debt.

Rising asset prices? Good things - they will help consumption via the wealth effect (page 61). The recent house price rises in particular? They just reflect the historic inverse relationship between house prices and interest rates (page 39). Private debt, especially mortgage debt? Relatively moderate growth levels, a stable debt to income ratio, and no evidence that house prices are being driven by mortgage debt (page 39). It’s a pity that first home buyers aren’t coming to the debt party though, since that’s holding back the rate of credit growth (page 45).

Nothing to worry about then, let’s put interest rates on cruise control and go back to sleep.

Ahem. Except that both the content and the tone of this statement could have been lifted from the US Federal Open Market Committee meeting of June 2007, just before the US economy crashed into the retaining wall of the subprime crisis.

Now I’m not saying that Australia faces a similar crisis in the immediate future but you’d think, after the shockwaves in the US and Europe after asset bubbles burst and private debt growth tanked, that there’d be at least some discussion of points that the authorities there now concede are important -such as asset bubbles and private debt growth. But no, Australia’s avoidance of the extreme symptoms of what was first called the GFC - or global financial crisis and was later renamed the “North Atlantic Financial Crisis” has led to a smug belief that we have nothing to learn from what happened in the US and Europe.

As a fully paid up member of the Society of Australian Curmudgeons, I beg to differ. A North Atlantic eye on Australia’s current situation reaches to a vastly different assessment of the challenges it faces today.

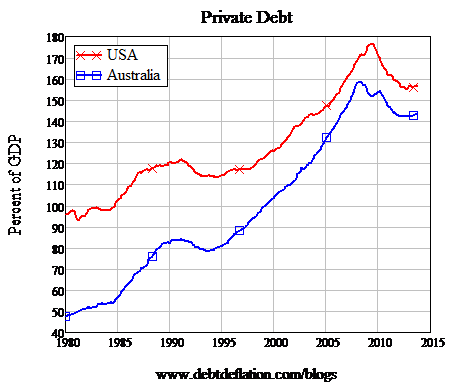

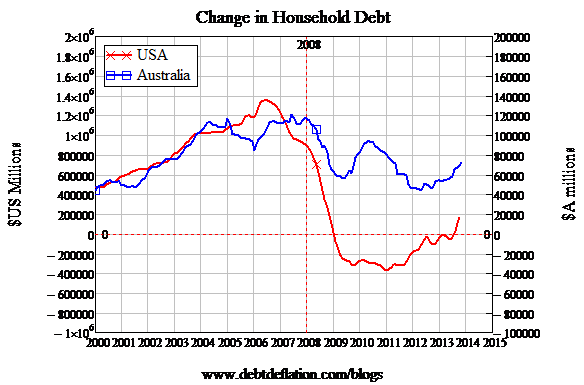

For starters, we had as big a private debt bubble as the US: not quite the same magnitude, but a faster run-up from a lower level - and on the surface, a similar level of deleveraging too (see figure 1).

Figure 1: The level of private debt in the US & Australia

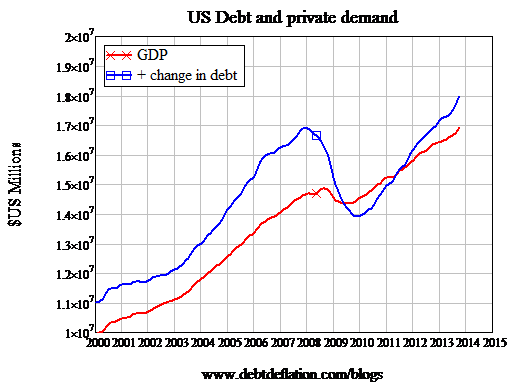

Looking more closely however, there are substantial differences. Firstly, the US had genuine deleveraging: private debt actually fell in nominal terms, and not merely as a percentage of GDP. So the reduction in debt reduced aggregate demand, as figure 2 indicates (the actual impact of the change in debt on demand isn’t quite one-for-one as shown here, but this gives a good idea of the direction of the impact).

Figure 2: Genuine deleveraging in the US

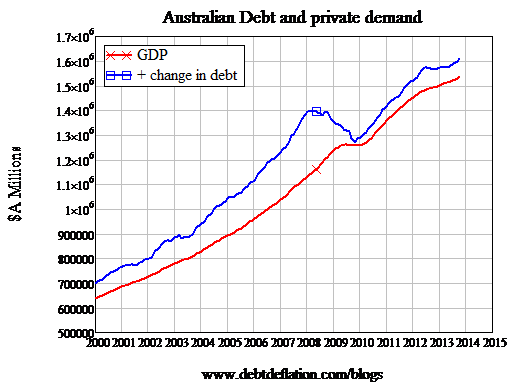

Australia didn’t delever: the change in private debt remained positive throughout the crisis.

Figure 3: A Kangaroo bounce in Australia with no deleveraging

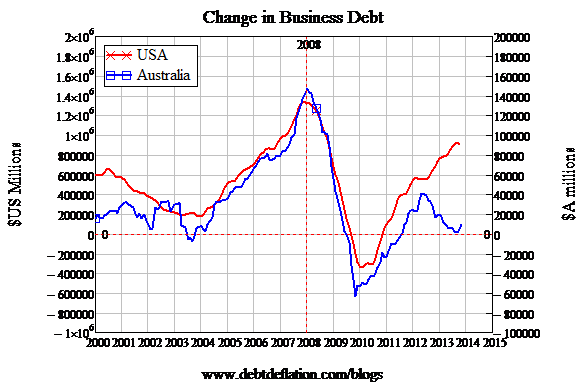

This was clearly because of the impact of government policy that encouraged the household sector to continue borrowing: specifically the First Home Vendors Boost. The business sectors delevered in both countries - with Australia’s delevering being proportionately larger and longer than the America’s (see figure 4).

Figure 4: Siamese twins on business sector deleveraging

But while American households also delevered (as much by bankruptcies and debt write-offs as by deliberate debt repayment), Australian households continued to borrow through the crisis - and they’re now borrowing ever more strongly as the housing bubble regenerates itself (see figure 5).

Figure 5: Deleveraging in the US, continued borrowing in Australia

That period of deleveraging by both households and businesses in the US is what caused the Great Recession. Australia avoided a slump at the same time because household re-leveraging more than compensated for business sector deleveraging.

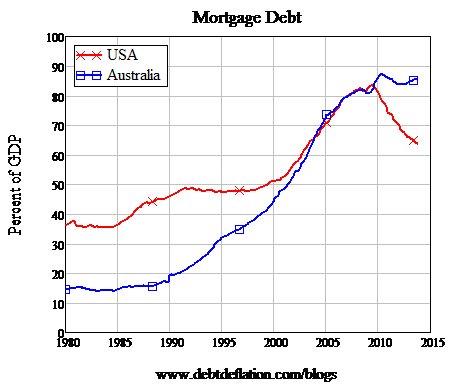

Household debt did fall as a percentage of GDP in Australia, but only because for a while, debt rose more slowly than did income. But the reduction in the debt burden was miniscule: by far the main component is mortgage debt, and this peaked at 87 per cent of GDP in 2010, fell trivially to 84 per cent, and is now back at 86 per cent and rising.

In the US it dropped substantially (see figure 6), from about 83 per cent of GDP down to 64 per cent. This is still well above the 40 per cent level that applied before Wall Street realised that it could turn a buck from selling junk bonds to Main Street, but it has given the US consumer some headroom for consumption that his Australian counterpart doesn’t have.

But the Reserve Bank doesn’t seem to worry about household debt growing from this already record level. While the crisis in Europe and America temporarily shook the conventional economic wisdom, in Australia it was confirmed by our avoidance of a recession. The conventional wisdom can’t see why private debt is an economic issue, and only obsesses about the level of government debt.

That theme disappeared in America for a while (and was challenged in Europe despite the Maastricht Treaty’s government debt strait-jacket). But Australia didn’t learn from what went wrong in the rest of the world.

Figure 6: America climbed down from the mountain of mortgage debt, while Australia continued to climb

But then again, neither, it seems, has the rest of the world. As Martin Wolf observed last week:

“Indeed, it is astonishing how little this crisis has shaken conventional wisdom. On the contrary, it is widely believed that it is safer to rely on private borrowing than on public borrowing as a source of demand. An expansion of private borrowing to buy ever more expensive houses is deemed good, but an expansion of government borrowing, to build roads or railways, is not. Privately created credit-backed money is thought sound, while government-created money is not. None of this makes much sense.”

Indeed. Yet again, we are learning from history that we don’t learn from history.

Steve Keen is author of Debunking Economics and the blog Debtwatch and developer of the Minsky software program.