Australia can't run away from tax reform

Without widespread tax reform, the Australian government faces a prolonged period of sluggish wage growth and poor productivity. That might sound pessimistic but that’s the simple equation laid out by outgoing Australian Treasury secretary Dr Martin Parkinson.

Speaking to the Business Council of Australia yesterday, Parkinson couldn’t be clearer: we can reform our tax system and boost productivity or we will suffer slower growth.

Structurally, the Australian economy faces a number of challenges -- primarily related to an ageing population and the end of the mining boom -- which, in the absence of strong productivity growth, will weigh on economic and income growth.

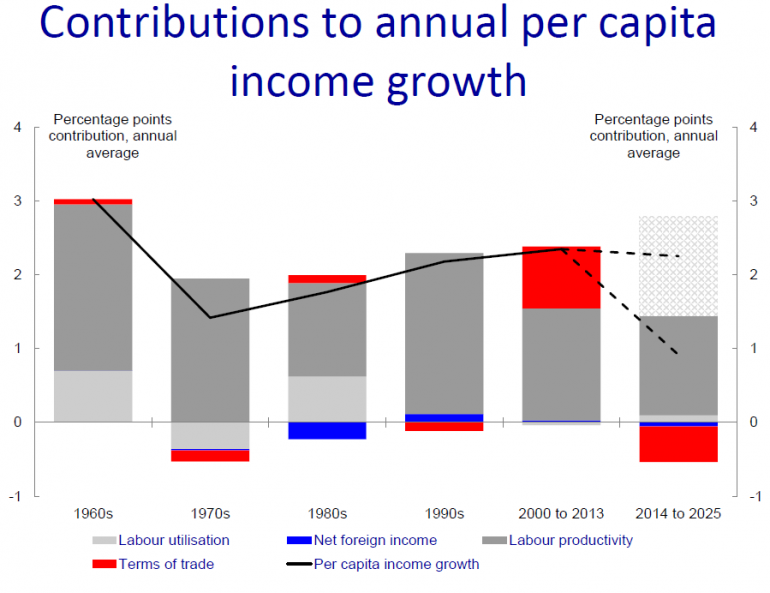

The graph below decomposes per capita income growth into factors such as labour productivity and the terms-of-trade. The two key messages from the graph is that productivity growth is by far the most important factor behind income growth, and the terms of trade can be both a blessing and a curse.

We have benefited from a high terms of trade for years, but the boom is over. The terms of trade will weigh heavily on growth over the next decade and, in the absence of stronger productivity growth, income growth will ease to less than 1 per cent per year -- its slowest pace in over 50 years.

The faded area in the ‘2014 to 2025’ column reflects the additional productivity growth necessary to maintain income growth at around its ‘2000 to 2013’ level. Productivity growth of that nature is largely unprecedented in Australia.

There are a variety of ways to increase productivity but few are more important than tax reform. The tax system creates the incentives under which businesses and household engage with the broader economy; it can promote or squash innovation and provides incentives (or disincentives) for productive investment.

“Genuine tax reform also requires more than an across the board cut in tax rates -- it is about improving the structure of the tax system to reduce the cost that raising revenue imposes on the economy,” Parkinson said. “It is as much about how much revenue is raised, as how it is raised.”

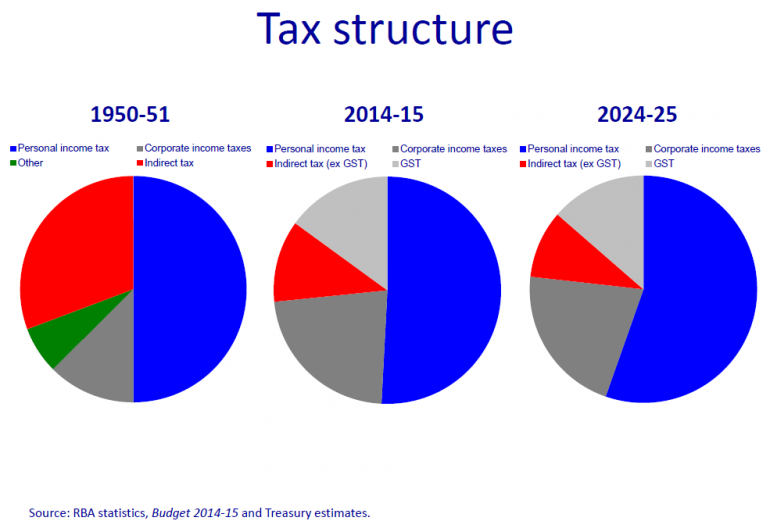

Australia’s tax system is heavily weighted towards direct taxes on personal and company income. The tax structure has shifted over time -- the introduction of the GST mixed things up -- but is set to shift further towards income tax over the next decade.

It isn’t immediately obvious, but that represents a problem. Research shows that personal income taxes are among the least efficient source of tax revenue and place a considerable tax burden on the broader economy. Personal taxes distort economic activity, providing a disincentive to work hard and in some cases to work at all.

The Australian economy would benefit by shifting the tax structure away from direct taxes towards indirect taxes and the GST. But Parkinson is under no illusions: such reform will be difficult.

“There would be significant transitional challenges and the hearts and minds of individual Australians would need to be won over,” Parkinson said. “But the challenges we face over the decade ahead require such change.”

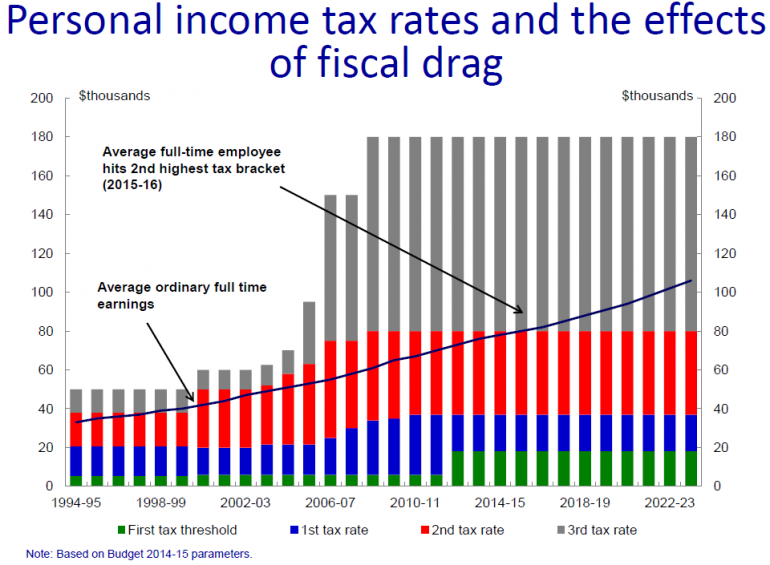

A failure to reform the tax system will have considerable costs. First, it will place increasing pressure on the federal budget at a time when the demand for government services is increasing. Second, it will place a greater burden on households.

According to Parkinson, the average tax rate paid by an individual will increase from 23 per cent to 28 per cent over the next decade. That represents a 7 per cent decline in the after-tax income for the average person. That’ll be great for tax consultants and the tax minimisation industry but it’s a pretty ordinary deal for the rest of us.

The federal government won’t have any problem selling tax cuts to the public but tax cuts are not possible without raising taxes somewhere else. With the demand for government services rising, particularly within the health and aged care sectors, there really is no other choice.

Tax reform will be difficult, and whoever pursues it will consume a lot of political capital. But if our politicians want to create a prosperous future for the Australian economy (and make it much easier to run a surplus), then tax reform really should be high on their agenda.