Austerity drags on the US recovery

The United States economy picked up over the back half of 2013 and the recovery appears to be gathering some momentum. But the US federal government continued to provide a significant drag on growth, while achieving little in the way of sustainable debt reduction.

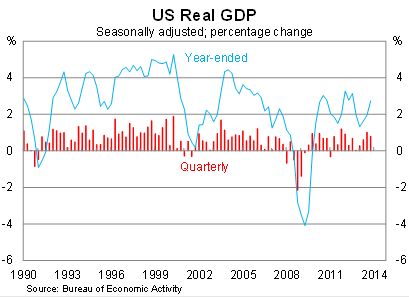

The United States economy expanded by 0.8 per cent in the December quarter, meeting market expectations, and justifies the Federal Reserve’s decision to begin winding back its asset purchasing program at the beginning of January. Growth climbed by 2.7 per cent over the year to the December quarter.

The result is a positive one, providing signs of an improving economy but there remain some frustrating aspects. In particular, federal government austerity continues to slow the economic recovery, while simultaneously providing no sustainable debt relief.

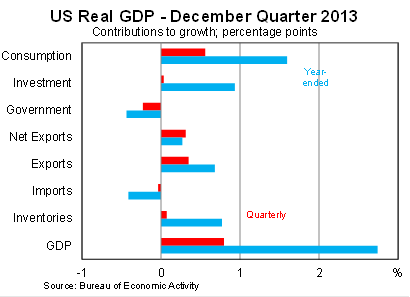

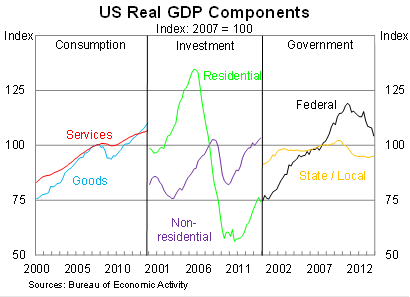

Government spending declined by 1.3 per cent in the December quarter, driven entirely by a 3.3 per cent decline in federal government spending. After rising modestly in the September quarter, it was widely anticipated that austerity had ended. Evidently that wasn’t the case. Government spending is now at its lowest level since September 2006. To offer some perspective, if federal government spending had simply remained at its December quarter 2012 level, it would have added 0.5 percentage points to GDP growth.

It is disappointing that the federal government and Congress continue to stand in the way of recovery, pursuing austerity measures that have achieved nothing in creating a sustainable budget. Instead, its only achievement has been to sabotage the recovery and make it more difficult for the long-term unemployed – most of whom lost their jobs through no fault of their own – from finding work.

The recent budget accord prior to Christmas indicates that austerity will soon end, providing some upside to the US economy in 2014. The one wrinkle remains whether Congress will choose to extend unemployment insurance for the almost 4 million Americans who have been unemployed for longer than six months. The Congressional Budget Office estimates that a failure to extend these benefits will reduce economic growth by 0.2 percentage points throughout 2014 and result in 200,000 fewer jobs.

Consumption was the big driver of growth as expected, rising by 0.8 per cent following a fairly soft result in the September quarter. Household conditions have improved over the back half of 2013, prompted by greater job creation and augmented by rising asset prices. While the later has come under threat over the past week, job creation should continue at a fairly moderate pace, slowly but surely removing the glut of long-term unemployed.

Business investment was up, albeit not by as much as indicated by durable goods orders and shipments activity throughout the quarter (Is the US pulling back on investment? January 29). A number of US businesses remain fairly cautious and unwilling to undertake large investment projects, particularly when they could profit from loose money and asset speculation.

Residential investment, however, declined by 2.5 per cent and remains at a remarkably low level for this stage in an economic recovery. The quarterly decline though potentially reflects some pull-back after a number of fairly strong quarters over the past couple of years.

Housing investment should continue to be a driver of growth over the next few years. Six years of weakness will not only have removed the housing overhang that existed prior to the onset of the global financial crisis, but will have also resulted in a housing shortage in key areas.

On a whole, growth provides clear evidence that the US economy has improved over the past six months, providing a clear justification for the Federal Reserve to beginning tapering its asset purchases. Job creation and household spending indicate that there is greater optimism in the US economy heading into 2014, but the key challenge will be ensuring that optimism remains in place as the Fed continues to wind down its asset purchases.

It remains frustrating that the recovery hasn’t been faster and that US Congress actively pursued flawed economic policies that effectively sabotaged their own economy. Growth could have realistically pushed above 3 per cent over 2013 and hundreds-of-thousands of extra jobs could have been created in the process.