Asset allocation alert 2: DAA, a new investment approach

Summary: Dynamic Asset Allocation funds go beyond investing based on fundamentals, given that markets often behave in ways inconsistent with underlying fundamentals. The funds implement a “risk on/risk off” approach and typically consider factors such as momentum, volatility and sentiment. |

Key take-out: DAA funds are a nimble way to embrace a wide range of asset classes within a structure that can move between them rapidly when markets begin to dysfunction. |

Key beneficiaries: General investors. Category: Investment portfolio construction. |

The by-product of low economic activity is the RBA's ongoing winding down of interest rates, with some commentators suggesting that our rates will bottom out at 1.5 per cent pa. That of course is shocking news for retirees who need adequate income to live on – and has the related drawback that low interest rates add fuel to an already heady stock market. (Doug Turek addresses several of these issues in his lead story today - Asset allocation alert 1: Bonds and traditional index funds fade.)

The good news is that there are a range of funds now available to Australian investors – which invest across multiple asset classes using a “Dynamic Asset Allocation” (DAA) approach – to generate regular income with low volatility, to meet the needs of retirees frustrated by low interest rates.

The problem for retirees was eloquently put last month by RBA Governor Glenn Stevens:

"How will an adequate flow of income be generated for the retired community in the future, in a world in which long-term nominal returns on low-risk assets are so low…(Investors) have to accept a lot more risk to generate the expected flow of future income they want."

Alan Kohler put it in simpler terms last weekend:

“The hunt for yield among (retirees) seeking a reasonably comfortable life is truly heart-breaking.” (See Kohler's Week, May 16)

As we work through the opportunities to overcome these problems using DAA technology, you may be tempted to think (as I do) that this topic should move to the forefront of your portfolio construction thinking.

Enter Dynamic Asset Allocation

Dynamic Asset Allocation (DAA) is a systematic process of implementing a “risk on/risk off” approach. It fills a hugely significant gap between investing based on “fundamentals” and responds to the reality that markets are often dysfunctional (i.e. behave in ways inconsistent with underlying fundamentals).

Proponents of DAA technology use different methods to select and re-balance portfolios. Most adopt an approach which invests across a range of different asset classes, with varying techniques for identifying signals to buy or sell out of some or all of those assets. Factors like momentum and volatility are typically overlaid, as well as subjective criteria like sentiment.

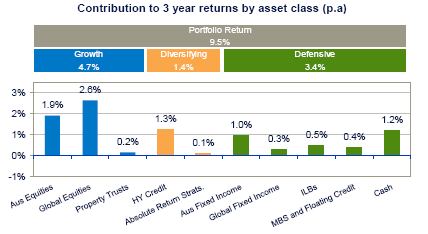

Figure 1 below shows the various components of the largest fund available to Australian retail investors in the DAA space, the Schroders “Real Return” fund, over the last three years and their contribution to overall returns.

Figure 1. Multi asset investing, Schroders Real Return Fund (CPI 5 per cent target). Source: Schroders.

Let's stand back and consider where DAA investments fit in the overall portfolio. Standard investment theory relies on “Strategic Asset Allocation” (SAA) to build a (so-called) diversified portfolio which can generate growth with “acceptable” levels of risk for investors in accumulation phase, and which changes its components and allocations over time to focus more on income with “acceptable” levels of risk for investors in retirement phase.

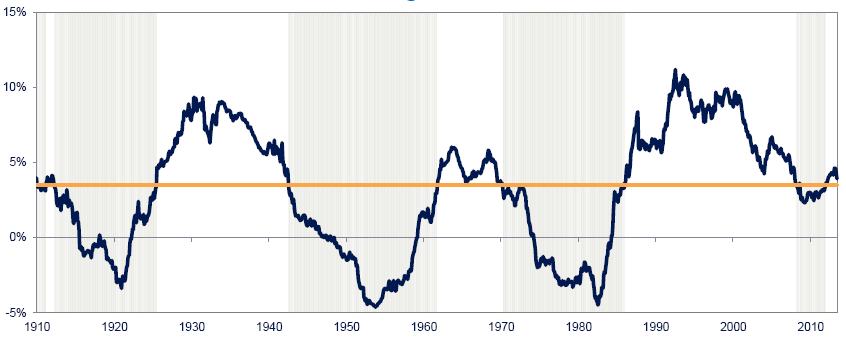

What retirees actually need is an income return which exceeds the underlying inflation rate. The problem is that when measured against this criteria, SAA is an absolute failure. Figure 2 below shows that “Conservative” portfolios built using an SAA approach have failed to generate even CPI 3.5 per cent over half of the time in the last 100 years! Furthermore, the SAA portfolio showed negative returns 27 per cent of the time over the last 100 years. In the real world, risk is often far above what the SAA textbooks would consider to be “acceptable”.

Figure 2. 10 year rolling returns, conservative SAA portfolio, horizontal line is CPI 3.5 per cent pa. Source: Schroders.

The problem with SAA is that it can't cope with rapid changes in markets. But with the growth of high frequency trading, and leverage dominating the major derivatives markets, minor changes in market sentiment can quickly translate to significant movements in asset prices – irrespective of the fundamental value or strength of those assets.

What does this mean for private investors?

There are consequences here for private investors, especially so for retirees, because once an investor enters retirement phase they will begin to take a pension which is derived from their investment portfolio (for those fortunate enough to be “self-funded retirees”).

As a guide, the initial pension for a retiree could be 6 per cent of the total value of their superannuation, and that will rise over time in line with inflation. Because of the volatility of SAA based portfolios, these ongoing pension payments can eat into the capital value of the portfolio quite significantly in times when that value has fallen. Look at it this way: if the debits against your portfolio rise over time, but the credit balance falls significantly in times of market turmoil, it's obvious that something has to give.

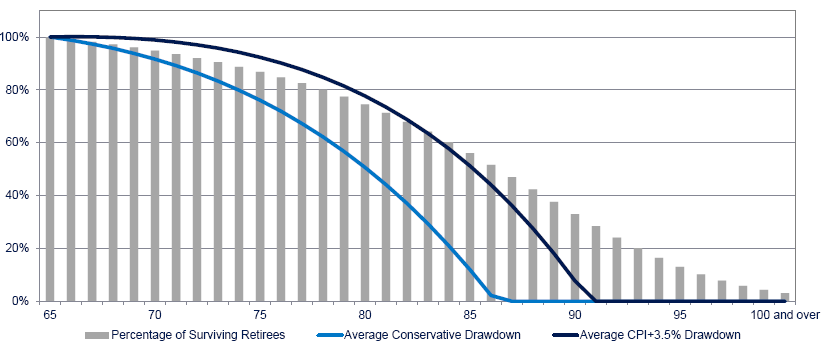

That “something” is your ability to continue to survive comfortably in old age. That is compounded by the increases in longevity, with more than half of those who retire at 65 now living to 85, with one third now living into their 90s.

Figure 3 below shows the improved resilience of a portfolio based on DAA principles, with a retiree relying on a standard SAA portfolio starting to run out of money well before their likely age of death.

Figure 3. Impact of drawdown of pension starting at 6 per cent indexed for inflation, comparison between SAA “Conservative” portfolio and a DAA based portfolio generating CPI 3.5 per cent pa. Source: Schroders.

How does DAA performance stack up?

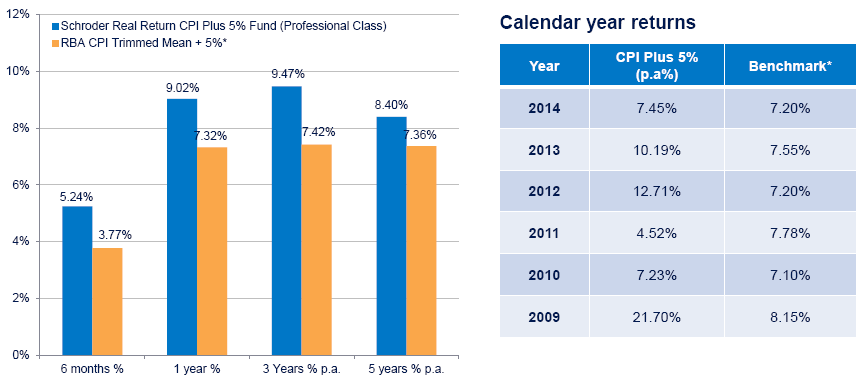

There are several multi-asset investment funds available in Australia, using a DAA approach. The first such fund to launch is the aforementioned issued by Schroders, whose “Real Return” fund with an objective of producing CPI 5 per cent pa returns is the largest of this type of fund available.

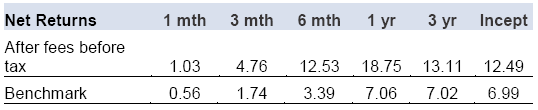

Its performance has been outstanding since launch, with returns in excess of its objective being generated in 4 out of 5 years since inception (although fees of 0.7 per cent pa reduced performance slightly below benchmark in 2010 and 2014):

Figure 4. Schroders Real Return Fund, CPI 5 per cent pa. Gross returns. Source: Schroders.

Recognising the need for a product to fill the gap left by declining term deposit rates, Schroders has recently launched a new version of their Real Return Fund, with a target of CPI 3.5 per cent pa. Both of these funds are available for retail investment, as well as through the new ASX “mFunds” service (i.e. can be accessed using selected stock brokers).

AMP offers its own version of the DAA style fund, through the AMP Capital Dynamic Markets Fund, which has an objective return of CPI 4.5 per cent pa. Unlike the Schroders Fund which is built entirely using specific asset class funds also created by Schroders, the AMP fund only invests into low cost ETFs and index funds. (Thankfully the Schroders Real Return fund rebates all internal investment fund costs back to the benefit of the investor).

Like the Schroders Real Return fund, the AMP fund has been successful in achieving its investment objective using DAA technology. Base fees are 0.58 per cent pa with a performance based fee in addition.

Figure 5. AMP Capital Dynamic Markets Fund performance, net of fees. Source: AMP Capital

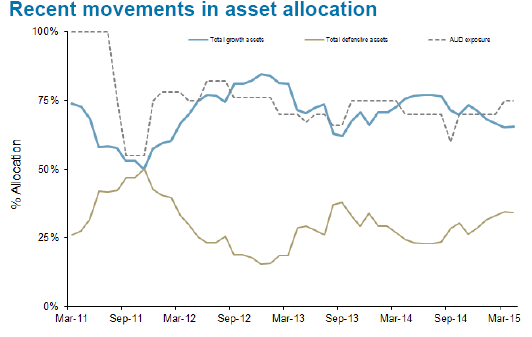

To demonstrate the “risk on/risk off” approach that underlies DAA funds, AMP shows the changes in portfolio composition for their fund. Note how the allocations to growth and defensive assets are inversely correlated and move dynamically over time:

Figure 6. Source: AMP Capital

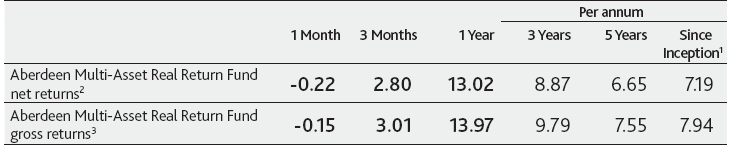

Aberdeen Asset Management is the other substantial provider of DAA funds, with its flagship Aberdeen Multi-Asset Real Return fund showing good results since inception. The Aberdeen fund targets CPI 5 per cent pa over a three-year period and has generated fairly consistent returns since inception. Fees are capped at 0.85 per cent pa:

Figure 7: Aberdeen Multi-Asset Real Return Fund. Source: Aberdeen Asset Management

Where to from here?

There are real risks in the global and Australian investment market, with prognoses ranging from the terrifying (we've never has a post-crash injection of liquidity like the present) to the relatively benign (the bond market bubble will be managed down in an orderly fashion by the US Fed). Whichever end of the spectrum you subscribe to, the present reality is that stock prices are high and cash rates are low. Think about DAA funds as a nimble way to embrace a wide range of asset classes within a structure that can move between them rapidly as markets begin to dysfunction. For retirees looking to downsize their exposure to Australian stocks, but unable to find adequate ways to create meaningful income streams, DAA funds should be carefully considered.

Dr Tony Rumble provides asset consulting services to financial product providers and educational services to BetaShares Capital Limited, an ETF provider. The author does not receive any pecuniary benefit from the products reviewed. The comments published are not financial product recommendations and may not represent the views of Eureka Report. To the extent that it contains general advice it has been prepared without taking into account your objectives, financial situation or needs. Before acting on it you should consider its appropriateness, having regard to your objectives, financial situation and needs.