Are we valuing stocks correctly?

Summary: The RBA's recent cash rate cut has once again highlighted the impact of historically low bond rates on how we value companies. Sustainably lower rates will theoretically justify increases to valuations, and those companies generating sustainable earnings will most likely see inflated price-earnings multiples for the foreseeable future. However, if lower interest rates are a function of challenging times, then on a company specific basis, a poor earnings outlook will drag on valuations. |

Key take-out: With some stocks appearing fully priced, we believe more than ever now that bottom up, analytically based stock picking will reward investors. Regarding the often talked about chase for yield, our view is that investors need to be mindful of valuation. Yield is not representative of value, which in our view should be the key determinant of any long term investment decision. We continue to believe that it's best to focus on finding cheap companies with solid growth prospects. |

Key beneficiaries: General investors. Category: Economics and investment strategy |

Although the recent RBA interest rate cut to 2.25 per cent is good news for many, it has further complicated the job of a stock analyst. The yield-hungry SMSF army is driving share prices higher, and, given the outlook for more interest rate cuts, there is a possibility that share prices will go way above their fundamental valuations.

Share prices are already high, but if the bond rate does stay low for longer than expected, there is the chance they will remain so.

Investors in 2015 regularly discuss how “fundamentally expensive” the market has become. But such terminology is all relative to whether you view the current bond rate as sustainable when valuing a business. In our analysis below we will discuss this in the context of the discounted cash flow valuation approach (and an input to your discounted cash flow valuation).

The outlook for inflation is below trend and, with many developed economies employing aggressive quantitative easing policies, it appears likely that interest rates are to remain at historically low levels for some time.

The conundrum is this: Do we follow the yield-seeking crowd, or do we sit back and risk being wrong in the short term by highlighting the increasing risks of chasing shares at current prices?

It is important to distinguish between value and yield. It can be argued that a business (or stock) is worth the present value of the cash that it can generate into the future. Whereas yield is a function of the businesses' share price and the amount of earnings paid out to shareholders. They are two very different concepts.

At the larger end of the market, stocks with reliable dividends are in high demand, and often trading well above historical valuations. The Commonwealth Bank of Australia hit $93 this week, with talk it will make an attack on $100 after it reports its interim results later this week.

Typically at Eureka Report we are looking for small and mid cap stocks, where often the dividend is less of a focus. Despite this, many smaller growth stocks are also trading on inflated multiples. Any stock with a strong growth outlook is usually on a very high price-earnings (PE) multiple, often above 20.

As a result it is increasingly difficult to find quality growth stocks that are trading at reasonable discounts. This time last year there was growth stocks such as Vita Group (VTG) that traded on a PE of seven times, with a fully franked eight per cent dividend yield.

At this point in 2015 it seems there are very few of these bargain situations left in the market: But if low bonds rate are here to stay, then PEs of 20 are not as expensive as they would appear on a historical basis.

If you compare current equity multiples to current bond rates, then equities are far cheaper. The current 10-year bond rate of 2.4 per cent equates to an inverse yield (or effectively a PE) of 41.7! A historically more sustainable bond rate of say six per cent equates to a PE of 16.7.

Buying a company for yield versus earnings

Valuations are based on earnings. Traditionally, one approach has been to consider changes in earnings and then determine the appropriate multiple to pay for those earnings.

In more recent times it would seem that many shares have been driven by their dividend yield and the differential to government bonds.

For example, the investors buying CBA in the $90s are focusing on the 4.5 per cent yield, rather than the earnings multiple or capital risk they are taking on. The earnings multiple is 16.5 times and the capital risk includes the looming enhanced capital adequacy requirements being forced on banks by a range of regulators.

This environment has created an issue that management teams across the spectrum know the easiest way to lift their share price is to increase the dividend payout ratio.

Many companies are now sacrificing reinvesting in their business to grow to satisfy yield-hungry investors. The short-term thinking may be fine for now, but if earnings are cut then the current amount paid out in dividends will prove to be unsustainable.

If earnings do come under pressure then that will, at least to some degree, halt the current yield buying frenzy.

Discounted cash flow valuation

The technical details of a discounted cash flow valuation are well worth understanding. First, let's explain how the declining bond rate affects valuation in theory. Put simply, if bond rates are lower than usual then it's reasonable to have price earnings mutliples at levels that are higher than usual.

One of the major inputs to the discount rate we use for a discounted cash flow valuation is the risk-free rate. Theory suggests you are meant to plug in the 10-year bond rate for the risk free rate. The risk-free rate is combined with a market risk premium to calculate the cost of equity. The risk premium is included to account for the risk taken investing in a stock above that of a government bond.

The rate at which cash flows are discounted is, broadly speaking, consisted of two key things – the cost of debt and the cost of equity. Together these make up the weighted average cost of capital (WACC).

Our earnings forecasts are discounted by this cost of capital (WACC) and as such the lower the rate, the higher the valuation.

Most analysts use a long-term average bond rate in their DCF models. This should make sense as the model attempts to discount all future earnings of a business, which would normally capture a range of interest rate environments.

With the yield curve now suggesting rates will be lower for the foreseeable future, this bond rate assumption (i.e. 10-year Australian government bonds) may need to be challenged. For many years it has been roughly five per cent six per cent – and has on occasion hit as high sa 15 per cent in the late 1980s – but in recent times it has dropped as low as 2.4 per cent.

In reality just about every stock analyst in the country would be using a discount rate or weighted average cost of capital (WACC) above what the current yield curve implies.

In effect what this means is that the majority of analysts in the market are assuming that the low bond rates are not sustainable and that the 'bubble' will burst.

The short-term risk to this theory is that if bond rates do stay low, and there is no global black swan event or major decline in earnings, then share prices will remain supported above what our models suggest they are worth.

A model is only as good as its assumptions!

When forecasting cash flows and deciding on an appropriate discount rate (WACC), there are numerous assumptions with varying degrees of sensitivity to the final valuation.

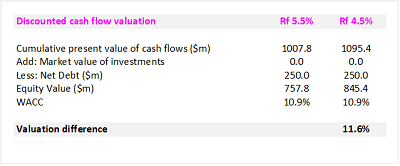

The example below displays the sensitivity of a reduction in our assumed risk free rate from 5.5 per cent to 4.5 per cent (holding other assumptions constant). The scenario justifies an increase in this valuation by 11.6 per cent.

Often when there is uncertainty we will just input what we view as a conservative assumption. Usually we can be confident enough in forecasts for the next two to three years, but after that uncertainty increases.

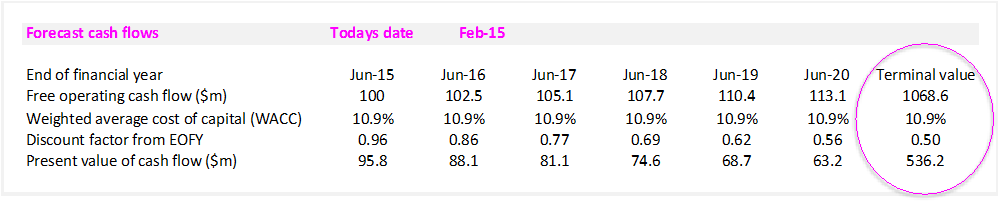

The terminal value attempts to capture the value of all earnings beyond the last year we forecast. A key assumption for the terminal value is the long-term growth rate. Most analysts will have a two to three per cent assumption for the long term growth rate.

In the example below the terminal value accounts for over half the group valuation and it is important to note that it is highly sensitive to changes in assumptions.

In relation to the earlier conundrum of whether or not to lower our cost of capital assumption, there are some offsetting changes to consider.

A crucial point is that in reality, a lower interest rate environment is usually a result of challenging economic times. If this is the case, and a moderation of earnings forecasts is appropriate, then this will, at least to some degree, offset the earlier increase in valuation.

For a company that has a poor earnings outlook, lower earnings growth will have a negative impact on valuation. This has the potential to offset the positive impact on valuations that lower rates create.

This can lead to a stock trading on a lower PE than it has historically averaged despite the market itself re-rating. This is what many people refer to as a classic value trap. A good place to find examples of this currently is in the mining services sector.

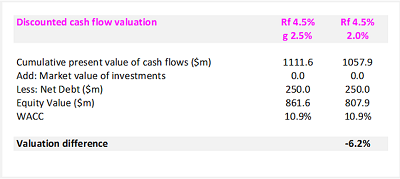

As an example of the mathematics, below we reduce a growth rate assumption from 2.5 per cent to two per cent, with a decline in valuation of about 6.2 per cent.

DCF valuations are but one piece of the puzzle

A discounted cash flow valuation is one of many valuation tools. Although it has its shortcomings in some situations, there are a number of positives that we like about the approach.

These include:

- The ability to value a business that has long term growth options that can't be captured in a PE multiple.

- To allow us to account for and stress test our risk assumptions – i.e. by adjusting the cost of capital (WACC)

- Sensitivity analysis of how much changes in assumptions and earnings forecast affect the overall valuation.

As well as the assumptions required for a DCF, we think it's just as important to focus on cash flow forecasts, profit margins and returns on capital.

What does this mean for your investment portfolio?

These are unprecedented times and while making generalizations is always fraught with danger, the key aspects of valuation today are:

- If sustainably low interest rates are here to stay, the market will likely, in aggregate, trade on higher PE ratios then it has historically averaged. The overall PE of your portfolio and the market will be higher

- If lower interest rates are a function of challenging times, then on a company specific basis, a poor earnings outlook can act as a drag on valuations. This will result in sectors and stocks seeing a contraction of PE multiples for some time. Some sectors that spring to mind are mining services or traditional retail and may prove to be a classic ‘value trap'.

- Businesses that can tangibly grow their earnings and improve their return on invested capital will be rewarded. Investing in such businesses at seemingly high multiples may prove a profitable strategy.

Summary

Sustainably lower rates will theoretically justify increases to company valuations. The market and company's generating sustainable earnings will most likely see inflated PEs for the foreseeable future.

Our view is that you need to be careful in getting too caught up in the current yield boom. Yield is different to value, which in our view should be the key determinant of any long term investment decision.

The market is at risk of becoming complacent about the capital risk that is being taken on to achieve higher income through dividend yields.

Instead, we think it's best to focus on finding cheap companies with solid growth prospects. Those that will more easily come out the other side of the current low interest rate environment.