Are we approaching a gas price crisis?

There are some organisations claiming that if New South Wales doesn’t free up coal seam methane extraction, the state will ‘run out of gas’ and that NSW faces a gas supply crisis.

Considering NSW has never had a substantial reliance on gas from its own state this claim seems rather puzzling. The vast majority of NSW’s gas needs historically have been met from imports from Victoria and SA’s Cooper Basin (via Moomba).

No one is talking about either of these sources of supply drying up any time soon. Also NSW’s gas demand isn’t growing so rapidly that the current pipeline capacity from other states is inadequate. So if NSW was to extract very little coal seam gas it wouldn’t really change the nature of its supply arrangements.

However, it is becoming apparent that LNG plants in Gladstone are finding it difficult securing enough gas from their Queensland coal seams to meet their contracted commitments to large overseas customers, at least in the short-term.

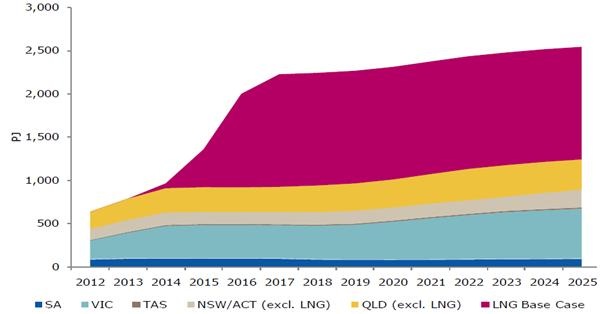

The chart immediately below illustrates the huge boom in demand for gas as a result of the LNG plants in purple. This is many, many times the demand for gas from NSW.

Eastern Australia demand for gas by source

Source: AGL Energy

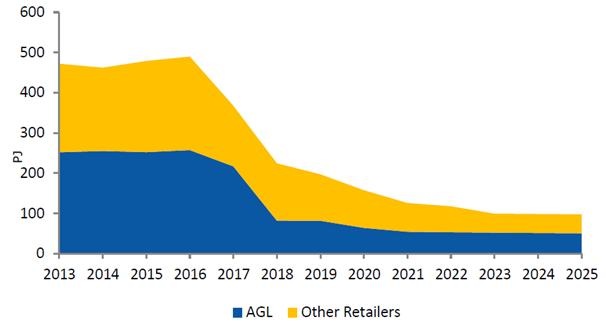

Now just as this demand reaches a peak in 2016/2017, Australian gas retailers – who take care of the lion’s share of eastern Australian demand for gas – face a large drop-off in contracted gas supply.

Eastern Australia gas retailers contracted gas supply

Source: AGL Energy (2013)

Now guess who gets priority:

a) A huge overseas customer that has signed a decade long contract that has underwritten a billion dollar investment in an LNG plant, and is more than happy to pay $10 per gigajoule?; Or

b) A relatively small Australian customer with no contract who complains like hell paying above $6 per gigajoule?

The issue is that NSW will find itself not so much running out of gas, but rather competing fiercely with Queensland LNG plants to access gas from the Moomba plant in the Cooper Basin in 2017.

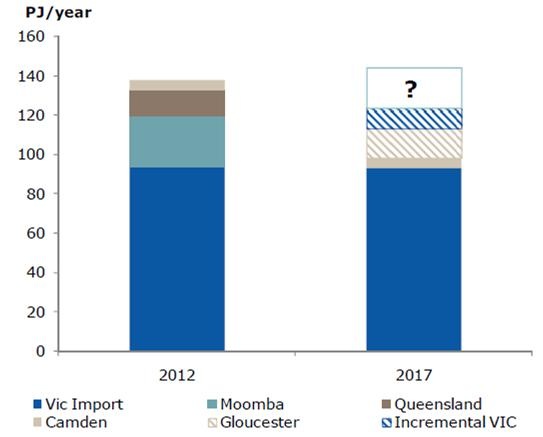

The chart below prepared by AGL Energy illustrates the potential change in supply sources for NSW. Victoria remains the dominant supplier but Moomba gas is diverted to LNG leaving a gap requiring new supply possibly from Victoria or NSW CSG.

Source of gas supply for NSW -2012 vs 2017

Source: AGL Energy (2013)

Now in the end such a shortfall won’t eventuate, it’s just prices will spike up until demand starts to come down to match supply.

So the issue is where will this reduction in demand come from?

A recent report from ACIL Allen Consulting (ACIL Tasman, the energy supply industry’s consultant of choice has merged with Allen Consulting) points out a likely scenario:

“The emergence of a gas price spike would have potentially damaging effects on downstream gas users, particularly those for which gas costs comprise a large component of operating costs. …

“The industries likely to be most vulnerable to high gas prices are feedstock industries such as fertiliser and basic chemical manufacture. Other gas intensive operations such as large-scale mineral processing facilities are also relatively price-sensitive. Combined-cycle gas turbine (CCGT) electricity generating plant is sensitive to increasing gas prices, because higher fuel costs ..reduce plant competitiveness relative to coal-fired plant (even after carbon prices).”

Now of course the Australian gas pipeline industry (which commissioned ACIL-Allen) is rather concerned about this scenario. So what did they propose?

They want the Renewable Energy Target cut and government to provide support to gas-power generation and gas field developers.

The problem with this is that it might actually make the problem worse for manufacturers.

Firstly, developing new gas fields in areas facing less community resistance will take time, possibly several years and after the LNG ramp-up supply squeeze is over.

Secondly, any new gas supply will still be priced at levels linked to prices that can be obtained via LNG plants. At about $8 per GJ this will still probably leave many gas-intensive manufacturers such as chemical and fertiliser plants globally uncompetitive.

Thirdly, cutting back the RET will make things even worse for manufacturers because they’ll face greater competition for gas from power generators. Not only that, but wholesale electricity prices will rise. This is because increasingly expensive gas generators will more frequently set the market clearing price, with less supply from near zero marginal cost renewables.

Considering many of these manufacturers receive exemptions for the cost of the RET but not LNG-linked gas price rises, this is the last thing manufacturers need.

But it might help out gas pipeline owners.