Are bond ETFs for you?

Summary: Some fixed income ETFs have delivered returns of up to 15% over the past year as the capital values of bonds rise when cash rates decline. The index approach has performed better than actively managed bond funds and is a convenient and low-cost option for retail investors. There is a risk that capital growth in bond prices will come to an end, triggering capital losses in bond portfolios, but forces driving this are unlikely to appear in Australia anytime soon. |

Key take-out: Check the specific details of any ETF you are considering, and when buying an ETF it's best practice to set a “limit” order to buy as close as possible to fair value. |

Key beneficiaries: General investors. Category: Investment bonds. |

Australian fixed income ETFs have delivered sensational returns over the last 12 months, ranging between 8.31% p.a. and 15.25% p.a. These numbers haven't been widely reported, with many investors bemoaning the declining returns in their cash and fixed income portfolios, as prevailing interest rates continue to decline.

Yet it is the decline of official cash rates that has driven these great returns in the fixed income ETF market – as capital values of bonds rise when their coupon payments become more valuable after cash rates decline. Although the common theme from market commentators is that rates must start to rise in the future – and that there is the prospect of a looming bond market correction – including ASX-listed fixed income ETFs may be a valuable addition to an investor's overall portfolio. Indeed fixed income ETFs stand as a key alternative to actively managed fixed income funds such as the successful Bentham fixed income funds featured in Eureka Report today (see Top fund managers: Bentham Asset Management, February 11).

ETFs should be a familiar concept to regular Eureka Report readers – they are rule-based investments which trade on the ASX like a share, but which also allow for ongoing creation of new units (or redemptions if demand falls). Because of their “open-ended” feature, ETFs should trade close to their net asset value, avoiding the premia or discounts at which many listed investment companies (LICs) can trade.

There are 10 fixed income ETFs available in the Australian market, giving exposure to Australian government or corporate bonds, and their returns for the year ended January 31, 2015 are shown in Table 1 below (the only weak performer in this list is the Russell Select Corporate Bond ETF with an annualised return of 5.07%):

Name | ASX Code | Total Return | Management Fees (p.a.) |

SPYDERS S&P/ASX Australian Government Bond Fund | GOVT | 11.48% | 0.22% |

SPYDERS S&P/ASX Australian Bond Fund | BOND | 10.78% | 0.24% |

Vanguard Australian Government Bond Index ETF | VAF | 10.18% | 0.20% |

Vanguard Australian Fixed Interest ETF | VGB | 10.97% | 0.20% |

iShares UBS Composite Bond Index ETF | IAF | 10.19% | 0.24% |

iShares UBS Government Inflation Bond Index | ILB | 15.25% | 0.26% |

iShares UBS Treasury ETF | IGB | 10.88% | 0.26% |

Russell Australian Government Bond ETF | RGB | 13.30% | 0.24% |

Russell Australian Semi-Government Bond ETF | RSM | 8.31% | 0.26% |

Russell Australian Select Bond ETF | RCB | 5.07% | 0.28% |

Table 1: ASX Listed Australian Fixed Income ETFs. Source: Morningstar

How bond ETFs work

Traditional ETFs track and invest in indices which are calculated based on the market capitalisation of their constituents. Broad share market indices like the S&P/ASX 200 are compiled based on the proportion of each stock compared to the total index, calculated based on the market capitalisation of each stock.

In the fixed income indices which these 10 ETFs invest, the index calculation methodology relies on the market value of each component bond to determine its weight within the index.

This approach delivers an observed pattern of outperformance compared to actively managed bond funds. Australian research houses have been reporting on the underperformance of most actively managed bond funds since the early 2000s, leading to the launch of these ETFs as a convenient and low-cost way for retail investors to access this index approach.

The two State Street “SPYDERS” ETFs are broadly typical of the ETFs in this space. They invest in fixed income indices compiled by Standard & Poor's. Others use indices from alternative providers, with most using a very similar methodology to compile the index. Full details of index methodology are provided on the index provider websites and/or the ETF issuer websites.

For example, there is detailed information available on the S&P website regarding the index composition methodology: click here. This is one of the great benefits of ETFs – the way they invest is highly transparent, assisting the investor's decision whether to buy, hold or sell.

Both State Street ETFs invest in bonds based on their market value, with the Australian Government Bond Fund (code: GOVT) investing in bonds issued by the Commonwealth or State Governments with maturities greater than one year from the date of each index re-balancing.

Similarly the Australian Bond Fund (code: BOND) invests in ASX-listed corporate bonds with an investment grade credit rating (i.e. a minimum credit rating of BBB- from Standard & Poor's), again with a minimum maturity of greater than one year from the date of index re-balancing.

There are strict rules on the types of bonds that can be included in each index including:

• For GOVT, the bond must be issued by the Australian Government, state government, territories or semi-government bodies;

• For BOND, the bond must be issued by the Australian Government, state government, Australian corporate, sovereign issuers and Kangaroo bonds issued into the Australian market and ASX-listed;

• As noted above, eligible bonds must be rated investment grade or above, and have a minimum term of one year from the date of each re-balance.

Unlike share market indices which are re-balanced annually or semi-annually, these fixed income indices are re-balanced monthly, and this assists with reducing the volatility that would be associated with holding bonds which may be susceptible to changes in value in line with shorter term instrument price fluctuations (such as bank bills).

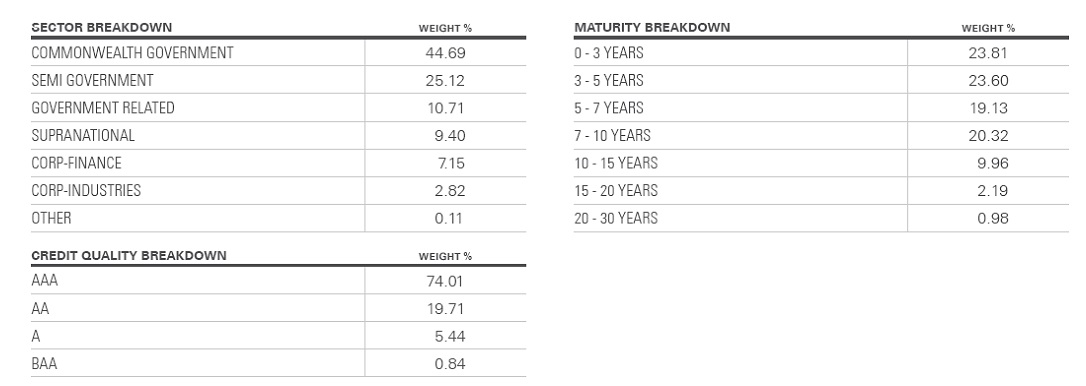

Interest payments are typically distributed quarterly. Capital gains or losses affect the net asset value of each ETF. Each ETF issuer provides details of individual holdings in easy to understand fact sheets. For example, BOND holdings (as at the end of November 2014) were:

Figure 2. Composition of BOND ETF. Source: State Street Global Advisors

Where to from here?

Of course, we now live in a world where post-GFC liquidity provided by central banks has drastically impacted on global financial markets. The typical method of injecting this liquidity has involved a massive increase in the issue of government bonds, which are then re-purchased by the central bank of the issuing country at prices above their par value. This “quantitative easing” allows the central bank to create a “negative” interest rate environment – but because it is effected through the bond market, this can lead to the creation of a bond market bubble.

Quantitative easing can and does increase the availability of leverage within the financial system – this is a desired outcome, stimulating lending and hence (so the theory goes) increasing real economic activity. This leverage has certainly found its way into the bond market – and so the worry is that as QE unwinds it has a double whammy effect on the bond market. Fears of the collapse of this bond market bubble have (rightly so) scared many investors away from bonds, and ongoing uncertainty about how this will end remains as a key investor concern.

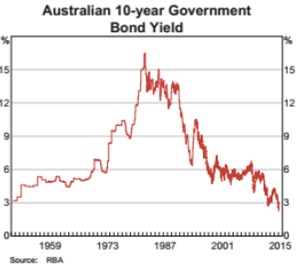

That's what Alan Kohler wrote about in his recent “Bubble Trouble” note (see Kohler's Week, February 7). After referencing the RBA graph showing how the Australian yield curve is now inverted (see Table 3 below), Alan wrote: “the problem faced by analysts is that not only has the curve gone upside down, but bond yields everywhere are at record lows, which means prices are at record highs.”

Table 3: Australian Government Bond Yield

It's certainly true that bond prices across the world, and in Australia, are at record highs. The risk to bond investors is that the capital growth in bond prices will come to an end (as QE unwinds and as interest rates rise). That will trigger capital losses in bond portfolios – but the good news for Australian investors is that these two forces are unlikely to appear here anytime soon.

Interest rates here are at 59-year lows and are likely to go even lower as we fight off a recession. And because QE wasn't a tool that was needed to be used by our central bank, we don't have concerns about local liquidity unwinding here either.

The benign view of the post-QE world (and one which the US Federal Reserve undoubtedly is hoping for) is that maturing bonds that are cancelled in line with the wind back of QE, which removes the problem of an overhang in the over-priced bond market. If that continues to happen, then the prospects for local bond investors should remain attractive – and fixed income ETFs will be continue to present attractive investment opportunities.

Be sure to check the specific details for the range of fixed income ETFs covered above, and whenever you buy an ETF it's always best practice to set a “limit” order so as to buy your chosen ETF as close as possible to its fair value.

Dr Tony Rumble provides asset consulting services to financial product providers and educational services to BetaShares Capital Limited, an ETF provider. The author does not receive any pecuniary benefit from the products reviewed. The comments published are not financial product recommendations and may not represent the views of Eureka Report. To the extent that it contains general advice it has been prepared without taking into account your objectives, financial situation or needs. Before acting on it you should consider its appropriateness, having regard to your objectives, financial situation and needs.