Apple is at the top of the SMSF tree

Summary: Self-managed super fund trustees who have taken the plunge into international stocks are showing a heavy bias to US technology stocks. Meanwhile, separate data shows that only a very small percentage of SMSFs have a direct property exposure. |

Key take-out: Efforts by regulators to clamp down on spruikers luring investors into setting up SMSFs for the purposes of owning property appear to be working. SMSFs data shows only around 1 per cent of funds own a property. |

Key beneficiaries: SMSF trustees. Category: Investment Strategy. |

Australian self-managed super funds with direct holdings in international shares have taken a shine to mobile phone and computers giant Apple Inc.

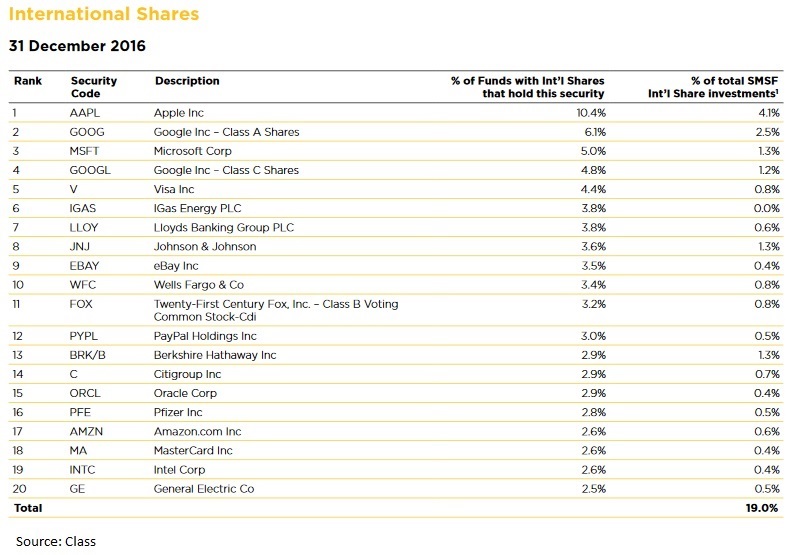

Data from SMSF administration software group Class, incorporated in its latest SMSF Benchmark Report, shows that just over 10 per cent of the self-managed funds in its research sample with non-Australian shares held an interest in Apple at December 31 last year. Apple accounted for 4.1 per cent of SMSFs' total international shareholdings.

In fact, more than 40 per cent of the 125,000 SMSFs in the research that had invested into offshore shares held stock positions in US technology companies, most of which are listed on the NASDAQ exchange.

They include shares in Alphabet, the renamed Google, Microsoft, eBay, PayPal, software giant Oracle, and computer chips maker Intel.

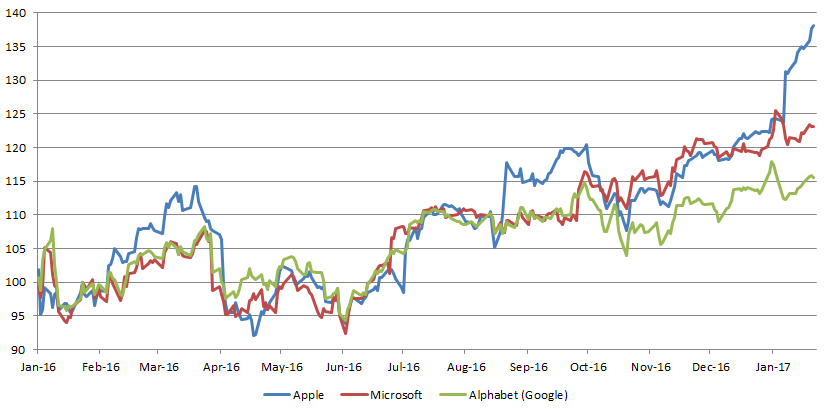

Chart: US tech bluechips, relative share price growth, past 12 months

Source: Bloomberg

Likewise, the biggest Australian stock holding was Telstra, accounting for 5 per cent of total SMSF domestic share investments.

BHP Billiton was next, accounting for 4.1 per cent, followed by Westpac, ANZ, NAB and Commonwealth Bank.

The banking and financial sector is also a major focus for SMSFs venturing overseas, with both Visa and MasterCard ranking in the top 20 holdings along with London's Lloyds banking Group and US banks Wells Fargo and Citigroup.

Meanwhile the Class report, which is based on an analysis of the assets held in SMSFs administered by more than 1000 accounting, financial planning and specialist administration businesses, found that the majority of SMSFs do not own direct property as an asset, despite popular opinion.

SMSFs owned less than 1 per cent of residential properties in Australia, compared to the 22 per cent owned by non-SMSF investors and the 68 per cent held by owner occupiers.

That SMSF market share of residential property represents about $64 billion of the $6.7 trillion estimated value of the total residential market.

Class chief executive Kevin Bungard said this new data showed that SMSFs were clearly not a significant driver of residential property prices.

“SMSF property purchases are just too small a part of the market to be having a big impact,” he said.

Almost 73 per cent of SMSFs (by number) do not hold any direct property at all, either residential or commercial.

And their indirect exposure to property through listed and unlisted trusts, at an estimated 7 per cent, is not dissimilar to the exposure of APRA funds at 9 per cent.

However, when SMSFs do hold direct property, it makes up about half their assets.

Those SMSFs that do hold direct property have a very significant exposure to it – about half the fund on average is made up of direct property, with proportionally less exposure to cash and shares than funds which don't have direct property.

“These figures are worthy of further discussion and analysis but we should not simply conclude that the members of these SMSFs with direct property are overexposed to this asset class,” Bungard said.

“Many of the members of these funds would have investments outside of their SMSF as well, so you would need to look at the totality of their wealth to be able to draw conclusions about the risks they are taking.”