An inflection point for gold

|

Summary: After reaching a trough in mid-March, gold prices have lifted by around 5 per cent to over $US1,200 at the moment. While some of this movement may reflect the depreciation of the US dollar, deeper analysis reveals that it's much more than just a dollar story, particularly in the context of deflationary forces dissipating and asset prices surging. |

|

Key take-out: Its early days, but fears of a gold slump appear to have abated now. Moreover, gold support is growing as the need for wealth preservation and volatility protection increases. |

|

Key beneficiaries: General investors Category: Gold. |

From a 2015 trough reached around mid-March, gold prices have increased by over 5 per cent or just over $US60 an ounce ($US1,206 at the time of writing).

It's fair to say that a lot of this movement may simply reflect the depreciation of the US dollar. The Greenback goes down and commodities go up - well that's where the pressure lies anyway. Looking at things a little deeper, however, shows it's much more than just a dollar story.

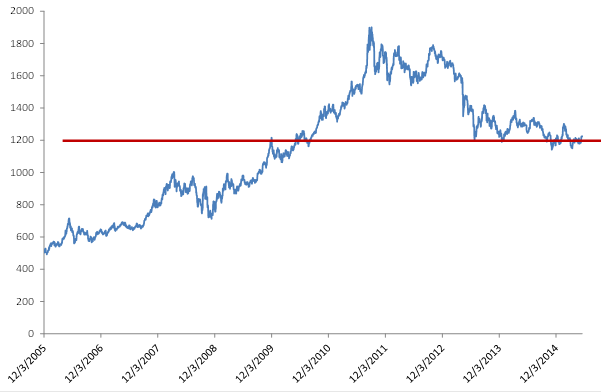

Chart 1: Gold prices bouncing

As you can see from the chart above, gold has effectively been bouncing along the $US1,200 mark for two years - but why would it do that? Inflation is apparently dead; in Britain they're in deflation supposedly, while elsewhere, inflation remains very low.

Yet despite this global inflation slump, gold has remained well bid at the $US1,200 mark. And it certainly doesn't seem to be able to fall through that figure on a sustained basis.

That's even the case as the US dollar surged 25 per cent from mid last year. Gold held its ground largely, only hitting a low of roughly $US1,158 - although then again it hit a high of $US1,288.

So why, faced with all that, does gold have so much support? Not enough to push it higher admittedly, although that is being tested as the US dollar weakens. It's this persistence around current levels that is interesting.

I suspect, ultimately, that the market is telling us that we're at a point of inflection. While inflation remains low globally, many of the disinflationary forces, or deflationary forces that were thought to be in play, have dissipated. In conjunction with the previously strengthening US dollar, this was a significant headwind for gold.

At the same time, though, asset prices are surging and central banks continue to ramp up the printing presses. Globally, central bank balance sheets continue to push higher, with the major central banks holding assets between 15 and 20 trillion US dollars. That's around a quarter of global GDP - an absurd amount.

We find, outside of Britain, that inflation is picking up on both sides of the Atlantic and inflation protected bonds in the US and Australia have received very strong buying interest as a result.

It's not that the market is necessarily concerned about an inflation outbreak though. Well, not consumer price inflation anyway - the slump in commodity prices, and crude in particular, has ensured that consumer price inflation has remained low. Asset price inflation is different and markets are certainly concerned about that.

With that in mind, the most likely message that investors are receiving is that concerns over cash as a store of value remain elevated. Similarly, there appears to be growing concern in the market about the volatility that will be unleashed should central banks ever try and exit ultra-loose monetary policy. I wrote about some of this last week (see Cash hits bottom, May 13).

Unfortunately, given the way the world is being run at the moment, cash not only provides a very low return, but increasingly, cash and cash like products do not protect the value of your wealth. Alternatives must be found and gold should be a part of that strategy.

I don't want to get too excited about the recent run up or the prospects for a rebound. Gold is still down from its 2015 peaks (just over $US1,300) and well down on levels seen a year ago. Moves can be large and gold lost nearly $US21 just overnight (May 19).

There is a positive signal though, and it's one complemented by the actions of central banks, which remain, according to the latest figures from the World Gold Council, strong buyers of the yellow metal. For the first quarter of 2015, central banks didn't increase their purchases over last year but, the fact is, 2014 saw the second highest gold demand from central banks in over a decade. That they didn't increase over that level - in the first quarter - is not indicative of a drop off in demand.

Indeed, if not for a dramatic slump in ETF demand for gold from 2013, gold demand would be significantly higher now - between 10-20 per cent. With that in mind, what is interesting about the latest figures is the sharp turnaround in demand from ETFs. The first quarter of 2015 saw the first net bought position from this segment since the fourth quarter of 2012.

It shows the extent to which perceptions of gold are changing. Its early days, but fears of a gold slump appear to have abated now. Moreover, gold support is growing as the need for wealth preservation and volatility protection increases.