An income recession spells more gloom for Australia

Growth slowed considerably in the September quarter and the outlook for the Australian economy appears all but certain to be downgraded as we push into 2015. It can be unwise to focus too much on old data, but today's GDP release provides some important insights into the factors that will drive the economy over the next few years.

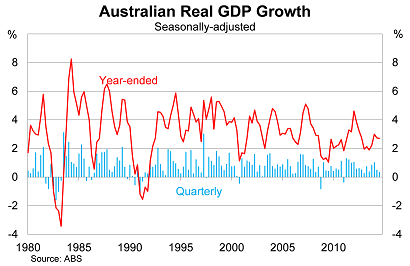

Real gross domestic product rose by 0.3 per cent in the September quarter, well below market expectations, to be 2.7 per cent higher over the year. The dollar fell sharply on the result, pushing below $US0.84.

There are a few important points that are worth emphasising.

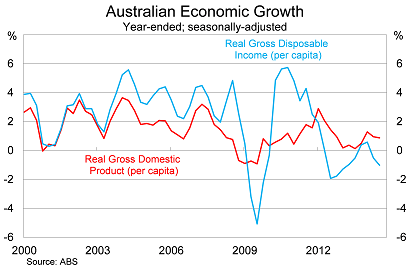

First, we are in an income recession. The following graph compares real GDP per capita against real gross disposable income per capita. The latter measure adjusts real GDP for the change in the terms of trade and provides a better indication of how households and businesses are coping.

Real GDI per capita fell by 0.9 per cent in the September quarter, following a 0.8 per cent decline last quarter, to be 1.0 per cent lower over the year. This is the negative income shock that I have been talking about over the past year: it has considerable implications for everything from household spending to government revenue and house prices.

Second, the federal government's mid-year economic and fiscal outlook, released in December, will be an absolute mess. Not only will the outlook for iron ore prices be revised down considerably (reportedly as low as $US60 a tonne) but the forecast for nominal GDP is also massively overstated.

Nominal GDP fell by 0.1 per cent in the September quarter, to be 2.7 per cent higher over the year. The 2014-15 federal budget assumed that nominal GDP would rise by 3 per cent over the 2014-15 financial year, but now a result closer to 1 to 1.5 per cent would be considered optimistic.

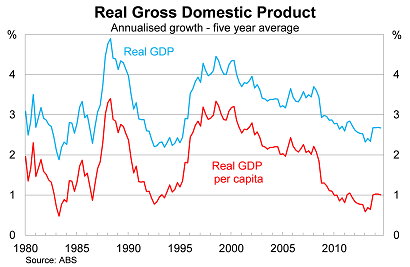

Third, population growth continues to drive the Australian economy. Headline growth has performed reasonably well over the past decade but a look below the surface indicates that it's been population rather than productivity that has created the illusion of strong growth.

It might surprise some readers, but Australia -- despite our mining boom and more favourable demographics -- has actually been outperformed by Japan on a per capita or per working-age person basis.

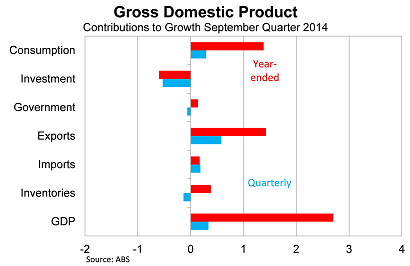

Looking at the disaggregated data, growth was driven by net exports in the September quarter. Net exports contributed 0.8 percentage points to growth in the quarter, reflecting both strong export volumes and a fall in imports.

Export volumes recovered after a poor June quarter but unfortunately the purchasing power of these exports has fallen significantly due to a softer terms-of-trade, weighing on income growth for both businesses and households.

Household spending rose by 0.5 per cent in the September quarter, to by 2.5 per cent higher over the year. Besides the external sector, household spending has been the strongest sector over the past year.

Investment is where the real weakness lies. Business investment fell by 2.5 per cent in the September quarter and is expected to ease further as the mining boom unwinds.

Residential investment fell by 0.9 per cent in the quarter, following a number of strong quarters, to be 6.8 per cent higher over the year. New construction of private buildings has been a bright spot over the past year but also eased somewhat in the September quarter.

Government spending fell by 0.3 per cent in the quarter, falling for the first time since the March quarter last year, to by 0.6 per cent higher over the year. A moderate pick-up in government consumption (mostly federal non-defence spending) was more than offset by a massive 8.4 per cent decline in government investment (mostly at the state and local level).

A lot of economists throughout the country will be revising down their outlook for the Australian economy after today's result. In the near-term, we can expect residential construction to rebound -- consistent with building approvals data -- and government investment will not fall as sharply next quarter.

That's the good news. The bad news is that Australian incomes are falling and that will weigh on domestic demand for the foreseeable future. A softer dollar will also weigh on incomes to some extent, although the hope is that this will be offset by stronger foreign demand and an employment boost as consumers shift their preference towards relatively cheaper Australian products.

The outlook hinges on the Australian dollar and whether the Reserve Bank has got its policy timing correct. Will the non-mining sector pick-up in time to offset the mining investment collapse? Until recently, most economists were pretty confident that it would. After today? I'm guessing they aren't so certain. Expect a lot of discussion about rate cuts between now and the RBA's next meeting in February.