AMP's China Fund AGF: Agitating for value

Summary: AMP Capital Growth China (AGF) is the only LIC available for direct exposure to China A shares, but it has faced issues as it has struggled to outperform the index, and has received agitation from shareholders over its underperformance and discount to NTA. With a management fee of 1.65 per cent pa and a stringent investment mandate, it is difficult for the LIC to outperform its benchmark. |

Key take-out: If investors want direct exposure to China, AGF is worth considering, but value investors aren't missing much at this stage. |

Key beneficiaries: General investors. Category: LICs. |

Where to start with a listed investment company like AMP Capital Growth China (AGF)? Is it an opportunity? Yes it is an opportunity. At the time of writing, AGF was trading at a 19.50 per cent discount to its net tangible assets (NTA). It is an opportunity just like any other undervalued stock on the market. What we need to look is if it is value or a value trap.

Before I tackle AGF, I want to state up front this will not be a call on China. The Chinese market and the wider economy have been covered off at length. The issues with the transitioning economy, the question of whether or not we believe the numbers coming out, and the volatility of the market due to liquidity issues and the flow of money, are all reasons why I do not want to make a call on China. This is a view on whether or not AGF is worth your attention as an LIC. (To read more on our view on China-centric stocks see Simon Dumaresq's feature today: on Blackmores.)

The basics

AMP established AGF in late 2006. As part of the initial raising, AMP Life purchased 82 million shares, making it the largest shareholder at the time with just under 30 per cent of the shares on issue. Over the last 9 years, this has increased to approximately 37 per cent.

The opportunity to invest directly in China A shares (shares listed on the Shanghai or Shenzhen stock exchange which are closed off to foreign investors) came from AMP obtaining a Qualified Foreign Institutional Investor Licence. This was one of 52 in the world at the time. AGF remains the only listed fund in Australia to have this access.

Previously, the only access to China came through B shares (Shanghai or Shenzhen listed but used for companies to raise capital from foreign investors), which only had 109 companies to invest in and H (Hong Kong listed) shares, of which there were only 133.

The fund's aim was long-term growth and therefore paying out dividends to investors was not a focus for the management team. In 2010, AGF declared its first dividend. Historically the LIC only paid small single cent dividends, but in the latest dividend came in at $0.33 per share, dwarfing all previous ones.

A quick word on the fee structure, (l come back to this later). The fund has a management fee of 1.65 per cent pa. On top of this, it has a recoverable expense fee of 0.12 per cent pa. There is a performance fee of 20 per cent of the outperformance above the benchmark of the S&P CITIC 300 Total Return Index.

The performance

The long-term performance for AGF has been ok up until January, when it and the CITIC 300 dropped like a stone. What has got up the nose of a handful of shareholders has been the inability for the manager to exceed the benchmark.

Looking at the numbers, what has held the portfolio back from equalling the benchmark has predominantly been fees and taxation. Since inception of the fund the benchmark has returned (up until the December 31 2015) 11 per cent pa. Over the same time period, the AGF portfolio had a gross return of 12.3 per cent pa but the net return after fees and taxes drops to 10.5 per cent pa. This is the cost of doing business with an LIC that has a monopoly on the market.

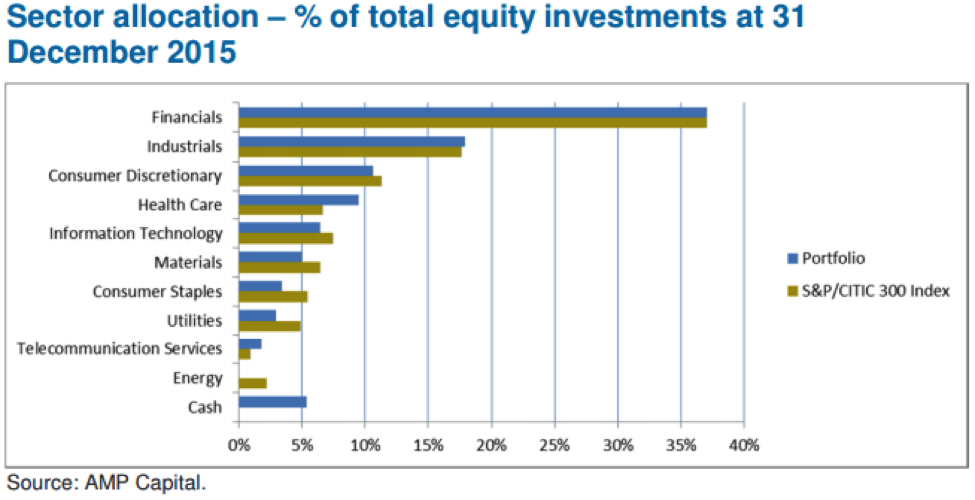

Why does the fund not outperform the benchmark? Fees aside, it comes down to the investment criteria. Here are the restrictions, taken directly from the prospectus:

• A maximum position of 10 per cent of the fund in any individual security

• A maximum share deviation of 5 per cent from the benchmark

• A maximum sector deviation of 10 per cent from the benchmark, and

• An expected annual turnover of approximately 50 per cent, although this will vary depending on market conditions.

It does not leave a great deal of room for outperformance or underperformance. The below table is taken straight from the AGF December quarterly report. The value add from AMP appears to be access, not stock selection.

AGF portfolio manager Patrick Ho points to the weak sentiment as a main detractor to the performance, but he also pointed towards sentiment as an opportunity. “The local market sentiment will remain weak for a while given it is now the period around Chinese New Year. However, it is believed economic activities will resume with better momentum,” he says.

Ho also highlights the potential inclusion of China's A shares into the MSCI index as a catalyst for the A share market over the next few years.

The agitators

AGF has been in the spotlight less for actual investing and more for the agitation caused by substantial and non-substantial shareholders. Predominantly there has been a lot of activity from Hong Kong based LIM Advisors, with its investment via the LIM Asia Multi-strategy Fund. LIM hold approximately 12 per cent of the shares.

In July last year, AMP commissioned Goldman Sachs to conduct a strategic review of AGF off the back of public statements from LIM Advisors and Metage Capital in a letter it sent to unit holders. The main cause for concern between LIM and Metage was the fund performance and substantial discount to NTA.

Goldman Sachs found the fund was still fit for purpose and should not be wound up, de-listed and have capital returned to shareholders. HOWEVER after the review, measures were put in place to attempt to close the gap to NTA.

These included daily NTA updates, enhanced marketing efforts, adjustment to the dividend reinvestment plan and the implementation of using the Shanghai-Hong Kong Connect Trading platform – this was finalised in December.

On top of this a target discount to NTA of 15 per cent was put in place as a measuring stick. Additionally capital management through the use of buy-backs was put back on the table and will be taken into consideration.

Speaking with the team at AMP, they say a buy-back would be a short term fix, while the other initiatives will not have an immediate impact they will help to close the gap over the long term and keep it narrower for long term investors. There is the thought LIM Advisors are in AGF for the short term and closing the gap to NTA quickly via a buy-back will see LIM profit substantially and then exit the fund. Once this has happened there are fears the discount will reappear again hurting the longer-term shareholders.

The cancelled EGM

After the strategic review, LIM Advisors pushed for an EGM to take place in October 2015. This was eventually cancelled and the EGM has now been pushed to July this year. AMP are also considering bringing forward the vote on the management mandate for the fund to the EGM. AMP had a ten year management mandate put in place when listing and this will be up at the end of 2016.

This puts another cloud over AGF. Will LIM and others push for a change of manager? A change of manager would mean a change of home for the management fees. 1.65 per cent per annum on a $400m mandate is a fairly juicy carrot to dangle out there for prospective managers and may be an incentive for LIM and co – but this is just speculation on my behalf.

Another fund manager has more recently been creeping up the share registry and has now become a substantial shareholder. Gramercy Funds Management LLC is a global manager based in the US with offices around the world who focus on opportunities in emerging markets. The word “distressed” is used in a number of Gramercy's philosophy and strategies.

The above is again speculation on my behalf. I have reached out to Gramercy to discuss the opportunity it sees in AGF but have not received comment back on this subject. Gramercy could just see AGF as a discounted opportunity for direct China exposure with the added benefit for a play on the Aussie dollar as well.

The call

Wait.

Wait for the dust to settle after the EGM in July. We do not know what the agitators are going to do at the EGM or how long the back and forth could play out for.

Also what you are paying AMP for is access.

You are basically getting an ETF and there is nothing wrong with that, and you could get that access before. AMP provided a gateway to an incredibly dynamic economy. But how long until there are actual ETFs with ETF like fees in this space? They could potentially give investors the same results.

There are few (but they do exist) CSI 300 Index ETFs available on global markets but they generally have relatively small amounts in funds under management.

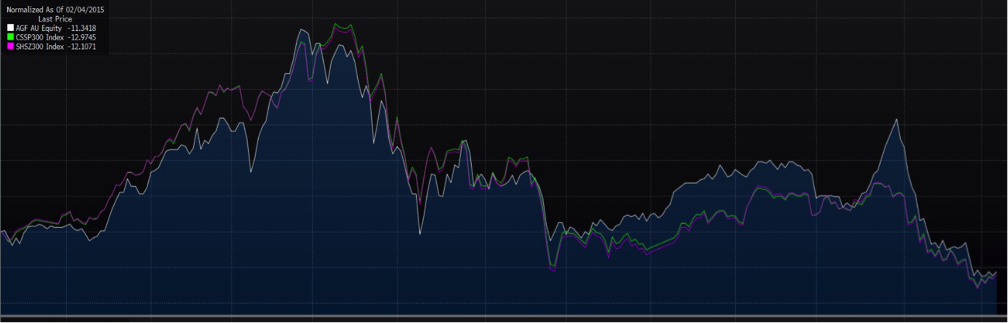

Out of the 300 stocks on the CITIC 300 Index there is a cross over of 215 of them on the CSI 300 in Hong Kong. The below graph shows AGF compared to the CITIC 300 and Hong Kong's CSI 300 Index's over the last 12 months.

The chart below shows the price movement in AGF (solid blue line) compared to the CITIC 300 and CSI 300 Index. The CITIC and CSI are almost inseparable.